Membrane Chromatography Market Summary

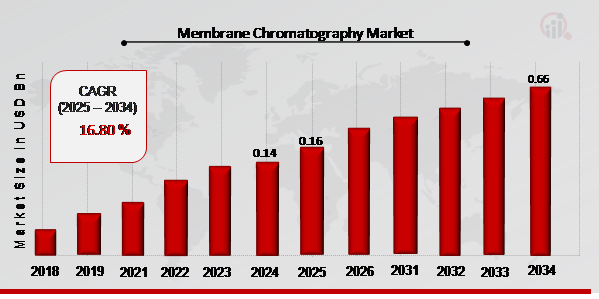

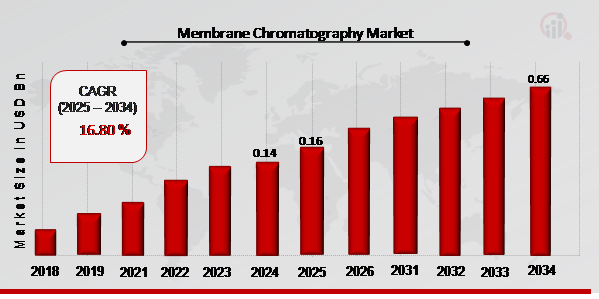

As per Market Research Future Analysis, the Membrane Chromatography Market was valued at 0.14 USD Billion in 2024 and is projected to grow to 0.66 USD Billion by 2034, with a CAGR of 16.80% from 2025 to 2034. The market is driven by rising biopharmaceutical R&D and increased regulatory scrutiny of cleaning validation procedures. The adoption of advanced membrane chromatography techniques over conventional methods is also a significant factor. The consumables segment leads the market, primarily due to the demand for virus purification applications. North America is expected to dominate the market, supported by a robust biopharmaceutical industry and strong research infrastructure.

Key Market Trends & Highlights

The Membrane Chromatography Market is witnessing significant growth driven by technological advancements and increasing demand in biopharmaceuticals.

- Market Size in 2024: USD 0.14 Billion

- Projected Market Size by 2034: USD 0.66 Billion

- CAGR from 2025 to 2034: 16.80%

- Dominant Segment: Consumables due to rising demand for virus purification applications

Market Size & Forecast

2024 Market Size: USD 0.14 Billion

2025 Market Size: USD 0.16 Billion

2034 Market Size: USD 0.66 Billion

Largest Regional Market Share in 2024: North America

Major Players

Key players include Sartorius AG (Germany), Danaher Corporation (US), Merck Millipore (US), Thermo Fisher Scientific (US), 3M (US), Asahi Kasei Corporation (Japan), Cole-Parmer Instrument Company, LLC (US), Restek Corporation (US), Purilogics (US), and GVS Group (Italy).

Rising biopharmaceutical R&D is a significant market driver influencing the market and will support its expansion throughout the forecast period. It is also projected that increased regulatory scrutiny of cleaning validation procedures used in downstream purification processes will support market growth in the upcoming years.

Source Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Increasing benefits provided by cutting-edge membrane chromatography methods over conventional methods are driving the market's CAGR. Flow-through mode removal of diluted pollutants like viruses, endotoxins, and DNA is one of the few situations when membrane chromatography is necessary.

In the last decade, this procedure has become widely used as the capstone to a variety of commercial strategies for producing monoclonal antibody treatments. Chromatography is an important part of biopharmaceutical downstream processing.

Increases in both R&D spending and technological progress in the biological products sector will have a positive effect on the membrane chromatography market by stimulating the introduction of innovative products from leading manufacturers. There are now a number of research projects underway, each of which has the potential to provide producers a leg up in the market by resulting in the creation of novel and revolutionary membrane chromatography products.

July 2023: McMaster University researchers in Canada have used CFD simulations to improve fluid flow homogeneity in membrane chromatography devices, which is essential for effective separations. They found that CFD has the potential to be a useful and inexpensive technique for preliminary optimization and performance prediction in membrane chromatography, and they published their findings in the Journal of Chromatography A.

It is the practice of simulating and analyzing fluid dynamics in complicated systems using mathematical models and computational techniques. To determine the velocity, pressure, and temperature distribution of a flow inside a particular region, CFD employs the Navier-Stokes equations and other fundamental equations of fluid dynamics.

Membrane Chromatography Market Trends

Advantages offered by novel membrane chromatography techniques is driving the market growth

The market CAGR is being driven by the growing advantages offered by novel membrane chromatography techniques over established ones. Only a very small number of applications, such as the flow-through mode removal of diluted contaminants including viruses, endotoxins, and DNA, call for the employment of membrane chromatography.

The technique has gained acceptance during the past ten years as the final stage in a number of industrial methods for creating monoclonal antibody therapies. Chromatography is absolutely necessary for downstream processing in the biopharmaceutical sector. It offers significant benefits for applications that do not need for high-resolution separation, such as flow-through process steps, according to the article published in Wiley Online Library in 2016. These benefits include a much cheaper cost in addition to ease of use.

The foundation of chromatography is the idea that when molecules from a mixture are placed to a surface or a solid, they are separated from one another by the stationary fluid phase. To simplify without sacrificing crucial quality traits, the purifying process needs a more powerful separation technology.

One of the best separation methods is affinity chromatography, which works because of the interactions between the target molecules and the immobilized ligand. It might enable a platform-capable purification strategy that allows for the purification of each molecule using a different affinity media, followed by one or more polishing processes.

The rising trend of manufacturers engaging in joint ventures and the launch of new products in the membrane chromatography market. Membrane chromatography market participants participate in mergers and acquisitions, product launches, and strategic alliances between well-established and up-and-coming firms.

For instance, the Biopharma division of General Electric Company's Life Sciences division was acquired by Danaher Corporation in 2020, and it was renamed Cytiva once the transaction was finished. Thus, driving the membrane chromatography market revenue.

Membrane Chromatography Market Segment Insights

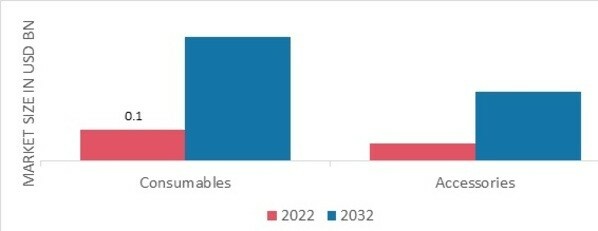

Membrane Chromatography Product Insights

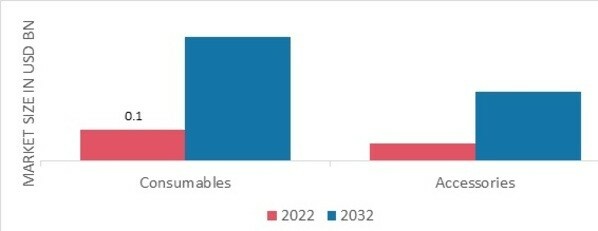

The membrane chromatography market segmentation, based on product includes Consumables, Accessories. The consumable segment dominated the market due to the growing use of capsules and cartridges for virus purification applications in lab-scale production, biomanufacturing, and process development. Along with other things, it has a filter and a capsule storage.

The market sector is expanding as a result of rising demand from biopharmaceutical and pharmaceutical businesses for these membrane chromatography accessories.

Figure 1 Membrane Chromatography Market, by Product, 2022 & 2032 (USD Billion)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Membrane Chromatography End User Insights

The membrane chromatography market segmentation, based on end user, includes CROs, Pharmaceutical and Biopharmaceutical Companies, Others. The pharmaceutical and biopharmaceutical companies category generated the most income because the biopharmaceutical business is expanding quickly and there has been a growth in R&D activity and rapid biologics output.

Membrane Chromatography Technique Insights

The membrane chromatography market segmentation, based on technique, includes Ion Exchange Membrane Chromatography, Affinity Membrane Chromatography, Hydrophobic Interaction Membrane Chromatography. The ion exchange membrane chromatography category generated the most income. One of the methods for separating proteins and complex bio-structures, such as viruses, such as rotavirus-like particles (RLPs), is called ion-exchange chromatography.

Ion exchange technology will advance only with the creation of extremely effective monolithic ion exchange columns and the resolution of related challenges. In ion-exchange chromatography, molecules are divided based on their respective charged groups. Analyte molecules are kept on the column via ion-exchange chromatography due to columbic (ionic) interactions.

February 2023: Biotage expanded its chromatography business into the bioprocessing market for biologics and advanced therapeutic clients in February 2023 when it purchased Astrea Bioseparations from Gamma Biosciences, a chromatography solutions supplier.

The arrangement places a valuation of around $190m on Cambridge, UK-based Astrea, which also has manufacturing operations in the United Kingdom and the United States. Columns, resins, and nanofiber purification technologies are all products that Astrea Bioseparations offers its clients in the life sciences and related fields.

June 2022, Donaldson Co. Inc. said that it had paid $20 million to buy Purilogics, a biotechnology firm situated in Greenville, South Carolina. Donaldson, a filtration device manufacturer located in Bloomington, claims the acquisition would provide its life sciences portfolio a major competitive edge because to Purilogics' technology, which allows for the faster and cheaper synthesis of complicated pharmaceuticals. Purilogics is a cutting-edge biotech startup that has pioneered several innovative membrane chromatography solutions. The firm provides a wide variety of purification technologies for various biologics.

These include messenger RNA (mRNA), plasmid DNA (pDNA), viral particles (viral particles), monoclonal antibodies (mAbs), and proteins. In order to facilitate the rapid and cost-effective manufacture of increasingly complicated biologic pharmaceuticals, Purilogics has developed patented formulations and techniques that produce membranes with substantial competitive advantages.

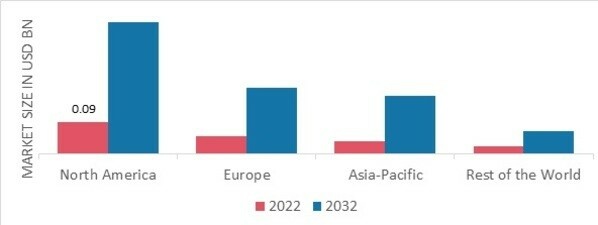

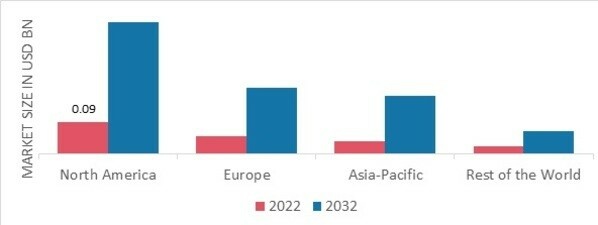

Membrane Chromatography Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American membrane chromatography market area will dominate this market due to the existence of a well-established biopharmaceutical industry, strong research infrastructure, and supportive government programmes for biopharmaceutical research and development.

The market expansion is being driven by the early adoption of membrane chromatography technologies in the region, which is home to numerous significant industry participants.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2 MEMBRANE CHROMATOGRAPHY MARKET SHARE BY REGION 2022 (USD Billion)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe membrane chromatography market accounts for the second-largest market share driven by the increased R&D expenditure by biopharmaceutical companies, rising investment in the R&D industry, and market participants playing a vital role in contributing to the expansion.

For instance, Sartorius, a renowned partner of life science research and the biopharmaceutical sector, purchased a subset of Danaher Corporation's life science assets in April 2020. Innovative tools, biosensors, and reagents for protein analysis that are employed in drug discovery will be promoted by the acquisition. Further, the German membrane chromatography market held the largest market share, and the UK membrane chromatography market was the fastest growing market in the European region

The Asia-Pacific Membrane chromatography Market is expected to grow at the fastest CAGR from 2023 to 2032 fueled by rising healthcare infrastructure investments, expanding pharmaceutical industry outsourcing, and expanding biopharmaceutical industry. With the help of domestic and foreign investments, the area has become a significant centre for contract manufacturing and research organisations.

In addition, a sizable patient population, rising healthcare costs, and encouraging government measures are fostering the development of membrane chromatography in the Asia Pacific region. Moreover, China’s membrane chromatography market held the largest market share, and the Indian membrane chromatography market was the fastest growing market in the Asia-Pacific region.

Membrane Chromatography Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the membrane chromatography market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, membrane chromatography industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the membrane chromatography industry to benefit clients and increase the market sector. In recent years, the membrane chromatography industry has offered some of the most significant advantages to market.

Major players in the membrane chromatography market attempting to increase market demand by investing in research and development operations include Sartorius AG (Germany), Danaher Corporation (US), Merck Millipore (US), Thermo Fisher Scientific (US), 3M (US), Asahi Kasei Corporation (Japan), Cole-Parmer Instrument Company, LLC (US), Restek Corporation (US), Purilogics (US), and GVS Group (Italy).

Danaher Corp creates, produces, and sells industrial, commercial, professional, and medical goods and services. A wide range of testing equipment, communications solutions, water quality systems, sustainable packaging design solutions, medical diagnostic solutions, professional microscopes, life science research tools, product identification solutions, automation solutions, and sensors and controls solutions are all available.

In Europe, Australia, Asia, and the Americas, the corporation has facilities for manufacturing, sales, distribution, service, and administration. In 2020, the life sciences branch of General Electric Company's Biopharma business was fully acquired by Danaher Corporation and rebranded as Cytiva.

Chemical items are produced and sold by Asahi Kasei Corp. The company's product line consists of acrylonitrile, diagnostic reagents, foam insulation panels, styrene, foundation systems, methyl methacrylate, polystyrene, polyethylene, polymers, functional additives, ion-exchange membranes, membrane filtration systems, medical devices and sensors.

Additionally, prescription medicines are available. Products from Asahi Kasei are used in industries like electronics, building, healthcare, and chemicals and fibres. It sells these goods under the Duranol, Sepacell, Polydurex, Ceolus, Aciplex, and Hipore names.

Key Companies in the membrane chromatography market include

- Sartorius AG (Germany)

- Danaher Corporation (US)

- Merck Millipore (US)

- Thermo Fisher Scientific (US)

- 3M (US)

- Asahi Kasei Corporation (Japan)

- Cole-Parmer Instrument Company, LLC (US)

- Restek Corporation (US)

- Purilogics (US)

- GVS Group (Italy)

Membrane Chromatography Market Industry Developments

-

Q2 2024: Boehringer Ingelheim Biopharmaceuticals China successfully passes pre-approval inspections by EMA and FDA Boehringer Ingelheim announced that its biopharmaceutical manufacturing facility in China passed pre-approval inspections by both the European Medicines Agency and the U.S. Food and Drug Administration, supporting the company's expansion in advanced purification technologies including membrane chromatography.

Membrane Chromatography Market Segmentation

Membrane Chromatography Product Outlook (USD Billion, 2018-2032)

Membrane Chromatography End User Outlook (USD Billion, 2018-2032)

- CROs

- Pharmaceutical and Biopharmaceutical Companies

- Others

Membrane Chromatography Technique Outlook (USD Billion, 2018-2032)

- Ion Exchange Membrane Chromatography

- Affinity Membrane Chromatography

- Hydrophobic Interaction Membrane Chromatography

- Others

Membrane Chromatography Regional Outlook (USD Billion, 2018-2032)

| Report Attribute/Metric |

Details |

| Market Size 2024 |

0.14 (USD Billion) |

| Market Size 2025 |

0.16 (USD Billion) |

| Market Size 2034 |

0.66 (USD Billion) |

| Compound Annual Growth Rate (CAGR) |

16.80 % (2025 - 2034) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2034 |

| Historical Data |

2020 - 2024 |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product, End User, Technique, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Sartorius AG (Germany), Danaher Corporation (US), Merck Millipore (US), Thermo Fisher Scientific (US), 3M (US), Asahi Kasei Corporation (Japan), Cole-Parmer Instrument Company, LLC (US), Restek Corporation (US), Purilogics (US), and GVS Group (Italy) |

| Key Market Opportunities |

Increasing number of manufacturers involved in new product launch and strategic collaborations |

| Key Market Dynamics |

Growing regulatory scrutiny on the cleaning validation of downstream purification processes Rising demand for membrane chromatography in the biopharmaceutical industry and R&D |

Membrane Chromatography Market Highlights:

Frequently Asked Questions (FAQ):

The membrane chromatography market size was valued at USD 0.1 Billion in 2022.

The market is projected to grow at a CAGR of 16.80% during the forecast period, 2023-2032.

North America had the largest share in the market

The key players in the market are Sartorius AG (Germany), Danaher Corporation (US), Merck Millipore (US), Thermo Fisher Scientific (US), 3M (US), Asahi Kasei Corporation (Japan), Cole-Parmer Instrument Company, LLC (US), Restek Corporation (US), Purilogics (US), and GVS Group (Italy).

The consumable category dominated the market in 2022.

The ion exchange membrane chromatography category had the largest share in the market.