Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Mexico Ethanol Market Drivers

Government Initiatives Supporting Ethanol Production

The Mexican authorities have carried out several projects to encourage the manufacturing and use of ethanol as a cleaner fuel alternative. Driven by the Secretara de Energa (SENER), Mexico's energy policy, for example, supports the inclusion of biofuels into the energy mix with particular targets for renewable energy consumption. SENER noted in recent years a rising mix of ethanol with gasoline, averaging 10% in several areas.

Apart from offering a better substitute for fossil fuels, this mix helps local farmers grow maize and sugarcane, therefore improving the agricultural industry. Following worldwide trends in sustainable energy would help the Mexico Ethanol Market gain from government backing as well as more customer awareness of the need to lower carbon emissions.

Growing Demand for Renewable Energy

The growing worldwide focus on renewable energy sources is driving faster demand for ethanol in Mexico. The International Energy Agency (IEA) estimates that demand for renewable fuels has grown by 20% over the previous five years, with significant contributions made to the transportation industry. Cleaner, more efficient fuel sources become critical as urbanization and car ownership keep rising in Mexico. The Mexico Ethanol Market is therefore positioned to satisfy this need as the government encourages a change to reduce carbon footprints in line with international climate accords.

Investment in Infrastructure for Ethanol Production

Infrastructure investments meant to assist ethanol generation in Mexico have been growing. According to a 2021 study by the Mexican Association of Renewable Energy (AMER), 15% more money is being invested in ethanol distillery and blending operations than in past years. This increase in investment shows a dedication to improving manufacturing capacity and satisfying customer demand. The Mexico Ethanol Market is predicted to grow quickly as facilities are renovated and introduced, giving a competitive advantage over conventional fuels while also generating employment and, therefore, boosting the local economy.

Increased R in Ethanol Technologies

Driven by alliances between universities, businesses, and government agencies, research and development (R) in ethanol production technologies is gathering steam in Mexico. For instance, the National Autonomous University of Mexico (UNAM) has been leading in creating creative ideas to raise ethanol output efficiency. Recent research has shown that advanced fermentation methods have shown a possible 30% increase in yields.

This concentration on R not only helps the Mexico Ethanol Market but also establishes Mexico as a pioneer in sustainable biofuel innovation, drawing both local and foreign capital.

Mexico Ethanol Market Segment Insights

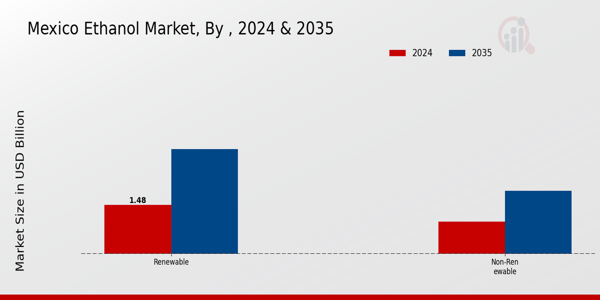

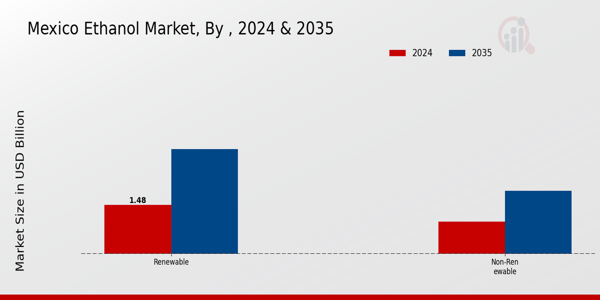

Ethanol Market Insights

The Mexico Ethanol Market reflects considerable growth potential driven by a rising focus on renewable energy sources aimed at reducing greenhouse gas emissions. The renewable segment of the ethanol market is gaining traction as the nation strives to meet its energy goals and environmental regulations, bolstered by governmental initiatives aimed at boosting biofuel production. This shift towards renewable resources marks a significant trend in Mexico’s energy landscape, encouraging investments and innovations in sustainable agricultural practices alongside technological advancements in ethanol production systems. The development of renewable ethanol sources generated from agricultural waste and other biomass materials is not just a response to environmental pressures but also aligns with Mexico’s ambition to enhance energy independence and diversify its energy mix, making it a strategic focus area in the national agenda.

In contrast, the non-renewable segment continues to play a substantial role in the ethanol landscape, primarily due to existing infrastructure and the established systems of production that benefit from traditional raw materials. Non-renewable ethanol production often utilizes first-generation feedstock derived from food crops, a practice that raises sustainability concerns but meets immediate energy demands. The balance between renewable and non-renewable sources of ethanol reflects broader market dynamics, where growth in the renewable segment is countered by the longstanding reliance on non-renewable resources.

The Mexican government’s policies increasingly favor renewable ethanol as the country aims to reduce its carbon footprint and enhance energy security, positioning the renewable segment as a vital component of future energy strategies. These evolving dynamics suggest that while both segments currently coexist, the future of the Mexico Ethanol Market may tilt towards sustainability practices, driven by legislative support and consumer preferences for eco-friendly energy options. Overall, market segmentation in the Mexico Ethanol Market illustrates a critical transition in energy production and consumption, influenced by sustainability goals, technological advancements, and the need for a diversified energy portfolio.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Ethanol Market Feedstock Insights

The Mexico Ethanol Market is crucially influenced by the Feedstock segment, which encompasses both Renewable and Non-Renewable sources. The Renewable feedstock is gaining traction due to its sustainability and alignment with Mexico's commitment to reducing carbon emissions and promoting green energy initiatives. This aligns with national policies aiming for energy independence and lower greenhouse gas emissions. On the other hand, Non-Renewable feedstock remains an important player due to established infrastructure and its ability to provide a stable supply, despite its environmental implications.

The demand for ethanol in Mexico is bolstered by the country's growing transportation sector and increasing adoption of biofuels. The market is experiencing significant momentum driven by governmental support for renewable energy sources and technology innovations. However, challenges such as fluctuating raw material costs and competition from other renewable energy sources may impact growth. Overall, the segmentation within the Feedstock category shows a dynamic landscape reflecting Mexico's evolving energy policies and market preferences driven by both environmental considerations and economic needs.

Ethanol Market Type Insights

The Mexico Ethanol Market is characterized by a diverse range of types, including Extra Neutral Ethanol (EN), Neutral Ethanol, Bioethanol, and Others, each serving distinct applications within the industry. Extra Neutral Ethanol, renowned for its high purity, is frequently utilized in beverage production and as a solvent in pharmaceuticals, showcasing its importance in high-value sectors. Neutral Ethanol plays a crucial role in diverse applications, particularly in industrial and agricultural uses, where its versatility is favored. Bioethanol, produced from renewable resources, has gained traction as a sustainable alternative to fossil fuels, aligning with Mexico's initiatives to enhance energy independence and environmental sustainability.

The segment of Others encompasses a variety of ethanol types that cater to niche markets, further enriching the dynamics of the Mexico Ethanol Market. Factors such as the increasing demand for eco-friendly fuels, government support for renewable energy, and the growth of the beverage industry are driving the market forward. However, challenges remain, including the need for technological advancements and competition from alternative energy sources. Overall, the market segmentation reflects a robust and evolving landscape in which Mexico is positioning itself to be a key player in the global ethanol arena.

Ethanol Market Grade Insights

The Mexico Ethanol Market, with a diverse range of grades, demonstrates significant potential for growth and development. The Grade segmentation includes categories such as Fuel Grade, Pharmaceutical Grade, Industrial Grade, and Others. Fuel Grade ethanol is particularly important, as it plays a critical role in the country’s energy transition, promoting renewable energy sources and reducing dependency on fossil fuels. The Pharmaceutical Grade segment is essential for the production of various medical formulations, driven by an increasing demand for health and wellness products in Mexico.

Industrial Grade ethanol serves a vital function in manufacturing, catering to sectors such as chemicals and cosmetics, reflecting the nation’s industrial growth. Additionally, the Others category encompasses a variety of niche applications, further enhancing the market's diversity. These segments together contribute to the broader Mexico Ethanol Market revenue stream, showcasing the versatile applications and growing demand driven by both local consumption and export opportunities. As the industry progresses, it faces challenges such as regulatory considerations and competition but also enjoys numerous opportunities presented by technological advancements and the rise of bio-based products.

Overall, this dynamic landscape is poised for ongoing evolution, highlighting the importance of each grade within the Mexico Ethanol Market segmentation.

Ethanol Market Application Insights

The Mexico Ethanol Market, with its growing applications, particularly emphasizes the role of ethanol in diverse sectors. The fuel blending segment plays a pivotal role, as Mexico continues to enhance its renewable energy initiatives, integrating ethanol into gasoline to reduce greenhouse gas emissions and improve air quality. Alcoholic beverages production also represents a significant part of the market, with tequila and mezcal being traditional exports, utilizing ethanol's role as both a fermenting agent and a purifying element. Additionally, the solvents and chemical intermediates segment showcases the versatility of ethanol in manufacturing processes, serving as a crucial ingredient in pharmaceuticals and personal care products.

The increasing demand for disinfectants and sanitizers, especially highlighted during health crises, demonstrates the importance of ethanol due to its effectiveness as an antimicrobial agent. The "Others" category captures various miscellaneous applications, further reflecting the expansive use of ethanol across multiple industries in Mexico. Overall, the Mexico Ethanol Market segmentation illustrates a dynamic industry landscape driven by innovation and sustainability goals.

Ethanol Market End-Use Industry Insights

The End-Use Industry segment of the Mexico Ethanol Market is diverse and encompasses various applications that are crucial for consumers and industries alike. The market sees significant participation from the Cosmetics sector, where ethanol is widely utilized as a key ingredient in perfumes and sanitizers, driven by increasing health consciousness among consumers. In Pharmaceuticals, ethanol serves as an important solvent in drug formulations, contributing greatly to its effectiveness, while the Chemicals industry relies heavily on ethanol as both a feedstock and a solvent, showcasing its versatility.

The Food Beverages sector utilizes ethanol in food preservation and as a flavoring agent, capitalizing on growing demand for organic and natural products. In the Automotive industry, ethanol is increasingly recognized as a sustainable fuel alternative, aligning with Mexico's energy policies aimed at reducing carbon emissions. The Others category includes various applications that leverage ethanol's properties, signifying its broad utility across industrial and consumer markets. With evolving consumer preferences and regulatory support for sustainable practices, the Mexico Ethanol Market revenue anticipates notable growth driven by these end-use applications.

Mexico Ethanol Market Key Players and Competitive Insights

The Mexico Ethanol Market is characterized by a combination of domestic production and imports, which serve to meet the growing demand for renewable fuel sources. Ethanol in Mexico plays a critical role in the energy sector, driven by governmental policies aimed at reducing greenhouse gas emissions and promoting cleaner fuels. This market has been influenced by several factors, including the evolving regulatory landscape, shifts in consumer preferences, and the strategic maneuvers of key players within the industry. Competitive insights reveal that companies operating in this space must navigate regulatory challenges, fluctuations in feedstock prices, and competition from alternative fuels to maintain market share and enhance sustainability efforts. The importance of strategic collaborations and technological advancements cannot be understated, as these elements are pivotal in propelling companies within the sector to higher performance levels.

Alco Biofuel has established a notable presence in the Mexico Ethanol Market, leveraging its expertise in biofuel production to meet local demand effectively. The company has strengths rooted in its comprehensive understanding of ethanol production processes, which include the utilization of advanced technologies for better yield and sustainability. Alco Biofuel has focused on forging partnerships with local agricultural providers, securing a steady supply of feedstock and minimizing production costs. This strategic alignment not only enhances their operational efficiency but also reinforces their commitment to boosting local economies. Moreover, Alco Biofuel's dedication to eco-friendly practices resonates with consumers, giving them a competitive edge in a market where sustainability is increasingly prioritized.

Bunge Limited operates as a consequential player in the Mexico Ethanol Market, focusing on the production of ethanol derived primarily from sugarcane and corn. The company's key products and services encompass the provision of high-quality ethanol, which is pivotal for both fuel and industrial applications. Bunge Limited has a robust market presence, given its extensive supply chain and distribution network, facilitating efficient access to markets throughout Mexico. Its strengths are buttressed by a significant investment in technology and innovation, enabling the company to maintain production efficiency and adapt to changing market dynamics. In addition, Bunge Limited has pursued strategic mergers and acquisitions, allowing for an expanded footprint in Mexico and enhanced capabilities within the ethanol sector, solidifying its position as a leader in renewable energy solutions. This proactive approach not only boosts productivity but also aligns with the broader trends of sustainability and responsible sourcing.

Key Companies in the Mexico Ethanol Market Include

- Alco Biofuel

- Bunge Limited

- Grupo Granjas Carroll

- Petrobras

- Sabia

- Agroindustrias Unidas de México

- Biosolutions

- AES Ethanol

- BioUrja Group

- Mexican Sugarcane Union

- Green Plains Inc.

- Cargill

Mexico Ethanol Market Industry Developments

In recent news developments within the Mexico Ethanol Market, there has been a significant focus on regulatory reforms aimed at increasing the country’s biofuel production. Companies like Alco Biofuel and Bunge Limited are reportedly exploring expansion opportunities to enhance their production capabilities. The Mexican government has made efforts to strengthen the biofuels sector, particularly through initiatives that support the integration of greener fuel alternatives. In the context of mergers and acquisitions, Grupo Granjas Carroll was noted for its acquisition of certain assets in July 2023 to bolster its footprint in the bioethanol space, aligning with broader industry consolidations. Meanwhile, Agroindustrias Unidas de México and Biosolutions have been engaged in partnerships to innovate ethanol production processes, contributing positively to market growth. In the last couple of years, specifically between 2021 and 2023, the Mexican Sugarcane Union has advocated for policy changes that promote sustainable ethanol production, reflecting a growing trend towards sustainability in the sector. The valuation of companies such as Cargill and Green Plains Inc. has seen noticeable growth, reinforcing investor confidence in the Mexican ethanol market as it positions itself for a more significant role in renewable energy production.

Ethanol Market Segmentation Insights

Ethanol Market Outlook

Ethanol Market Feedstock Outlook

Ethanol Market Type Outlook

- Extra Neutral Ethanol (EN)

- Neutral Ethanol

- Bioethanol

- Others

Ethanol Market Grade Outlook

- Fuel Grade

- Pharmaceutical Grade

- Industrial Grade

- Others

Ethanol Market Application Outlook

- Fuel Blending

- Alcoholic Beverages Production

- Solvents and Chemical Intermediates

- Disinfectants and Sanitizers

- Others

Ethanol Market End-Use Industry Outlook

- Cosmetics

- Pharmaceuticals

- Chemicals

- Food Beverages

- Automotive

- Others

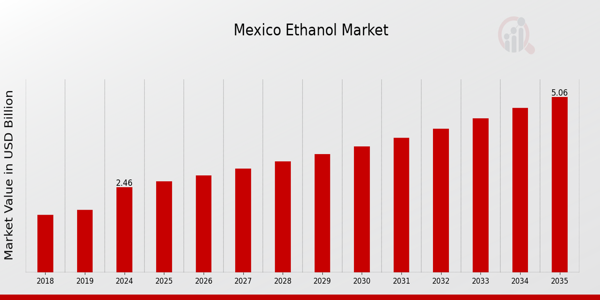

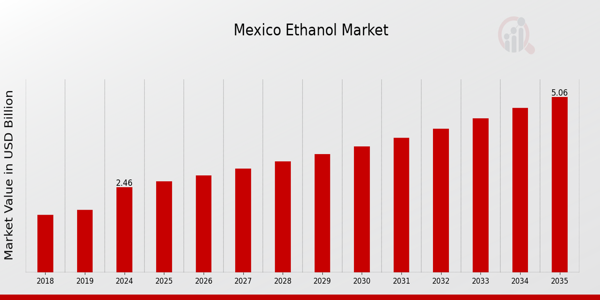

| Report Attribute/Metric |

Details |

| Market Size 2018 |

2.34(USD Billion) |

| Market Size 2024 |

2.46(USD Billion) |

| Market Size 2035 |

5.06(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

6.768% (2025 - 2035) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2035 |

| Historical Data |

2019 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Alco Biofuel, Bunge Limited, Grupo Granjas Carroll, Petrobras, Sabia, Agroindustrias Unidas de México, Biosolutions, AES Ethanol, BioUrja Group, Mexican Sugarcane Union, Green Plains Inc., Cargill |

| Segments Covered |

, Feedstock, Type, Grade, Application, End-Use Industry |

| Key Market Opportunities |

Increasing biofuel demand, Government policy support, Sustainable production technologies, Export potential to U.S., Growing passenger vehicle sector |

| Key Market Dynamics |

Regulatory policies, Demand for renewable energy, Sugarcane production, Fuel blending mandates, Price volatility |

| Countries Covered |

Mexico |

Frequently Asked Questions (FAQ) :

The projected market size of the Mexico Ethanol Market in 2024 is expected to be valued at 2.46 USD billion.

The estimated compound annual growth rate (CAGR) for the Mexico Ethanol Market from 2025 to 2035 is 6.768.

The Mexico Ethanol Market is expected to be valued at 5.06 USD billion by the year 2035.

In 2024, the Renewable segment is valued at 1.48 USD billion, while the Non-Renewable segment is valued at 0.98 USD billion.

The Renewable segment of the Mexico Ethanol Market is expected to reach 3.16 USD billion by 2035.

Key players in the Mexico Ethanol Market include Alco Biofuel, Bunge Limited, Grupo Granjas Carroll, Petrobras, and Cargill among others.

The Non-Renewable segment of the Mexico Ethanol Market is expected to increase to 1.9 USD billion by 2035.

Emerging trends in the Mexico Ethanol Market include a growing focus on renewable energy sources and advancements in production technologies.

The growth rate for the Mexico Ethanol Market shows significant potential, driven by local demand and global market dynamics.

The primary growth drivers include increasing biofuel regulations and a rising demand for sustainable energy solutions.