Mexico Industrial Analytics Market Overview

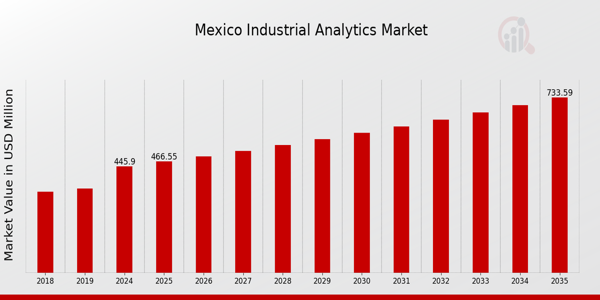

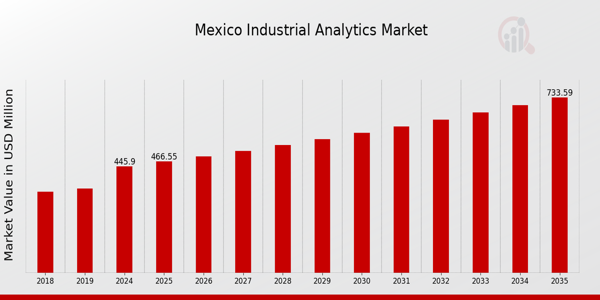

As per MRFR analysis, the Mexico Industrial Analytics Market Size was estimated at 423.85 (USD Million) in 2023.The Mexico Industrial Analytics Market Industry is expected to grow from 445.9(USD Million) in 2024 to 733.6 (USD Million) by 2035. The Mexico Industrial Analytics Market CAGR (growth rate) is expected to be around 4.63% during the forecast period (2025 - 2035)

Key Mexico Industrial Analytics Market Trends Highlighted

There are a number of important reasons why the Mexico Industrial Analytics Market is growing quickly. As more and more manufacturing companies implement Industry 4.0 techniques, there is a greater focus on making decisions based on data. The government's efforts to modernize the industrial landscape, which stress the use of advanced analytics technologies to improve operational efficiencies, support this trend. Mexican enterprises also want to improve their production processes and save costs so they can compete with companies across the world. This makes the demand for industrial analytics solutions even higher. There are several opportunities to explore in the Mexico Industrial Analytics Market, especially in areas like food processing, aerospace, and automotive.

The government's backing for these businesses and efforts to bring in more foreign investment make it easier for companies that offer analytics services to do business. Additionally, more and more local businesses are realizing how important predictive maintenance and real-time data analytics are for avoiding downtime and boosting productivity. This gives service providers a chance to enter this growing industry. Recent trends reveal that Mexican organizations are using more cloud-based analytics tools because they want their operations to be flexible and able to grow. More data can be collected and analysed since more people are using the internet and mobile devices.

Also, more and more people are realizing how important data security and privacy are, which is changing how businesses use analytics. In short, the Mexico Industrial Analytics Market is affected by a mix of government programs, competition in the sector, more people using technology, and a greater focus on data-driven insights.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Mexico Industrial Analytics Market Drivers

Expansion of Manufacturing Sector in Mexico

The manufacturing sector in Mexico has experienced significant growth, contributing approximately 18% to the country's Gross Domestic Product (GDP) as of 2022. This expansion is driven by Foreign Direct Investment (FDI), particularly from established organizations like General Electric and Toyota, which are increasingly using data analytics to streamline operations and enhance decision-making processes. The Mexican government has actively promoted this sector through policies aimed at improving infrastructure and providing financial incentives for advanced technologies, including analytics.

The strong emphasis on data-driven manufacturing is leading to increased adoption of analytics tools, which are vital for optimizing production efficiency, quality control, and supply chain management. Consequently, this trend is a key driver in the Mexico Industrial Analytics Market Industry, with expectations that more companies will invest in analytics solutions to maintain their competitive advantage and meet growing demand.

Rise in Smart Factory Initiatives

The adoption of smart factory initiatives is becoming a pivotal trend in Mexico Industrial Analytics Market Industry. Approximately 63% of manufacturers in Mexico are investing in technological innovations aimed at creating smart factories that utilize IoT (Internet of Things) and big data analytics to improve operational efficiency. Large companies like Siemens and IBM are at the forefront, offering advanced industrial analytics solutions that facilitate real-time monitoring and predictive maintenance.

The Mexican government has also established guidelines and incentives promoting Industry 4.0, which emphasizes automation and data exchange in manufacturing technologies. This governmental support, coupled with the increasing need for digital transformation in the manufacturing sector, propels the growth of the Mexico Industrial Analytics Market.

Government Initiatives and Financial Support

The Mexican government has recognized the importance of industrial analytics in enhancing productivity and has initiated several programs to support the technology's adoption. For instance, the Ministry of Economy is encouraging local companies to embrace digitalization through grants and subsidies, with an estimated funding of up to 5 billion pesos earmarked for technology advancements in the manufacturing sector over the next five years.

Organizations such as the National Institute of Entrepreneurs are collaborating with businesses to provide training on the use of analytics tools.This focus on fostering a technology-friendly environment directly stimulates growth in the Mexico Industrial Analytics Market Industry as firms seek to leverage these resources to adopt advanced analytics.

Mexico Industrial Analytics Market Segment Insights

Industrial Analytics Market Deployment Type Insights

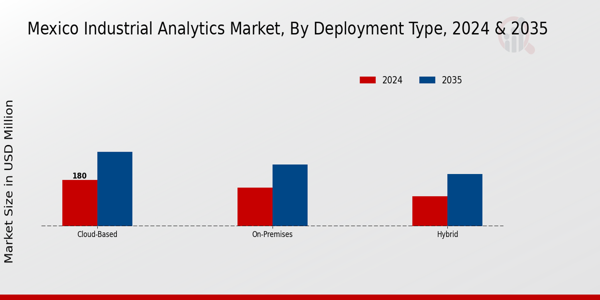

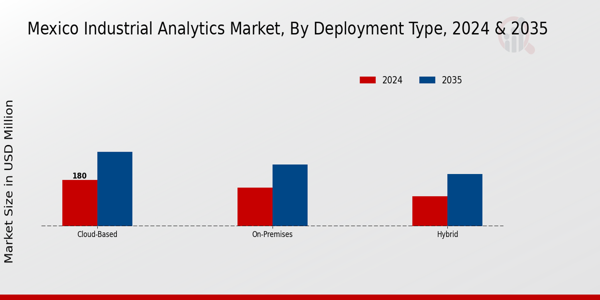

The Deployment Type segment of the Mexico Industrial Analytics Market showcases significant diversity, as it encompasses On-Premises, Cloud-Based, and Hybrid strategies, catering to various industrial needs within the region. On-Premises solutions have traditionally been favored by large enterprises seeking stringent control over their data and analytics processes, particularly within manufacturing sectors that require compliance with local regulations and data sovereignty. These organizations often invest heavily in infrastructure and security to mitigate risks associated with data breaches, making On-Premises a preferred choice for critical operations.Conversely, Cloud-Based deployment has gained traction due to its scalability and cost-effectiveness, allowing companies to leverage advanced analytics tools without the burden of substantial upfront investments in hardware.

This option is particularly attractive for small and medium-sized enterprises (SMEs) engaging in digital transformation, enabling them to unlock insights from their data efficiently. The flexibility of Cloud-Based solutions fosters collaboration and accelerates decision-making, as users can access analytics tools and data from anywhere with internet connectivity.The Hybrid model, effectively combining the best aspects of both On-Premises and Cloud-Based strategies, is increasingly favored by organizations aiming for a balanced approach that addresses specific operational needs while still harnessing the scalability of the cloud. This model allows for sensitive data to be stored on-premises, while utilizing cloud resources for less critical operations, thereby optimizing overall performance and compliance.

As industries in Mexico increasingly adopt advanced analytics to drive innovation, the Deployment Type segment plays a crucial role in determining how organizations manage and analyze their data assets in a dynamically evolving market landscape.The trends point towards a steady adoption of these deployment strategies, influenced by the growing demand for real-time analytics, the need for enhanced operational efficiency, and a push towards Industry 4.0 principles. There remains potential for growth and investment in the Mexico Industrial Analytics Market, as companies evaluate their analytics strategies, aiming to strike the perfect balance between control, cost optimization, and agility as they navigate through their digital transformation journeys.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Industrial Analytics Market Application Insights

The Mexico Industrial Analytics Market, particularly in the Application segment, showcases a strong commitment to optimizing industrial processes through various innovative practices. Predictive Maintenance plays a crucial role as it reduces downtime and enhances equipment lifespan by utilizing data analytics to anticipate failures. Supply Chain Management is another vital area, as it streamlines operations, reduces costs, and improves service levels amidst a complex logistics landscape. Quality Control, aided by advanced analytics, ensures adherence to standards and reduces defects, which is essential for maintaining competitiveness in global markets.

Production Optimization leverages real-time data to boost efficiency and minimize waste, responding to the demand for leaner manufacturing practices. The increasing adoption of Industry 4.0 technologies in Mexico is driving the growth of these applications, with businesses recognizing the need to harness Mexico Industrial Analytics Market data for informed decision-making. Additionally, the support from governmental initiatives aimed at fostering digital transformation in industries contributes to the robustness of this segment, reflecting a promising landscape for stakeholders involved in the Mexico Industrial Analytics Market.

Industrial Analytics Market Component Insights

The Component segment of the Mexico Industrial Analytics Market encompasses vital elements such as Software, Hardware, and Services, each playing a crucial role in shaping the landscape of industrial analytics in the region. Demand for advanced Software solutions has surged, driven by the increasing need for real-time data processing and predictive analytics, empowering organizations to optimize their operations and enhance decision-making. Meanwhile, Hardware components remain essential, given the necessity for robust infrastructure to support expansive data collection and processing activities in Mexican industries.

Services, including consulting and integration, are fundamental as they facilitate the effective implementation of analytics solutions, providing businesses with the expertise to navigate the complexities of digital transformation. The integration of these components supports the overall economic development in Mexico, positioning the country as a competitive player in the industrial analytics sector, while allowing enterprises to leverage insights for improved operational efficiency. This synergy among Software, Hardware, and Services underscores the importance of the Component segment in driving the future growth of the Mexico Industrial Analytics Market..

Industrial Analytics Market End Use Industry Insights

The Mexico Industrial Analytics Market, particularly within the End Use Industry framework, showcases a robust and diverse landscape. Manufacturing stands as a cornerstone, leveraging analytics to streamline operations, reduce costs, and enhance product quality. This sector significantly benefits from data-driven insights, enabling real-time decision-making and predictive maintenance measures. The Energy and Utilities segment is also vital, as it utilizes analytics for optimizing power generation, distribution, and renewable energy integration, aligning with Mexico's commitment to sustainable energy practices.In Healthcare, industrial analytics plays a crucial role in improving patient outcomes through efficient resource management and predictive analytics for patient care.

Meanwhile, Transportation is increasingly adopting analytics to enhance logistics, traffic management, and supply chain efficiency, driving operational excellence. Lastly, Retail utilizes data analytics to understand consumer behavior and optimize inventory management, ensuring customer satisfaction while minimizing waste. This blend of sectors within the Mexico Industrial Analytics Market underscores a comprehensive approach to harnessing data for strategic advantage and operational improvements across various industries.

Mexico Industrial Analytics Market Key Players and Competitive Insights

The Mexico Industrial Analytics Market is characterized by a dynamic competitive landscape that reflects the increasing importance of data-driven decision-making in the industrial sector. As companies in Mexico prioritize the optimization of operations and enhancements in efficiency, the demand for sophisticated analytics solutions has surged. Key players in this market are developing advanced technologies that enable businesses to harness data, streamline processes, and achieve better outcomes. This shift is supported by the growth of internet connectivity, the proliferation of IoT devices, and the rise of cloud computing, fostering a robust environment for industrial analytics. Companies are not only focusing on traditional data analytics but also incorporating artificial intelligence and machine learning capabilities, leading to a competitive race to provide cutting-edge solutions tailored to the unique needs of the Mexican market.Oracle has established a significant presence in the Mexico Industrial Analytics Market, showcasing a robust portfolio of integrated software solutions designed to cater to industrial operations.

The company's strengths lie in its comprehensive suite of analytics tools that offer real-time data insights, predictive analytics, and scalability. Oracle's commitment to continuous innovation allows it to maintain a competitive edge, as it frequently updates its offerings to adapt to the evolving market demands. Furthermore, Oracle benefits from its extensive partnerships with local businesses and educational institutions, which enhance its visibility and credibility in the region. This collaborative approach not only strengthens its market position but also opens avenues for tailored solutions that address specific challenges faced by industries in Mexico, solidifying its role as a leader in the industrial analytics domain.PTC is another key player in the Mexico Industrial Analytics Market, recognized for its innovative solutions that intersect industrial operations and digital transformation.

The company offers a range of products and services, including advanced analytics platforms, IoT solutions, and augmented reality applications, designed to enhance productivity and efficiency in manufacturing processes. PTC’s strengths are rooted in its expertise in product lifecycle management and its ability to integrate with existing systems, which is crucial for companies looking to optimize their workflows. The company has made strategic investments in the Mexican market through mergers and acquisitions that allow it to enhance its offerings and expand its customer base. PTC’s focus on industry best practices and its commitment to providing tailored support to local enterprises further amplify its competitive positioning in Mexico's industrial analytics sector, catering to a diverse range of manufacturing and industrial clients seeking to harness the power of data.

Key Companies in the Mexico Industrial Analytics Market Include

- Oracle

- PTC

- Ansys

- Siemens

- General Electric

- Cisco

- SAP

- Rockwell Automation

- Salesforce

- Tableau

- IBM

- Infosys

- Microsoft

- Honeywell

Mexico Industrial Analytics Market Industry Developments

In the Mexico Industrial Analytics Market, recent developments highlight a growing interest in advanced analytics solutions to enhance operational efficiencies and drive data-driven decisions across various sectors. Companies like Oracle and Siemens are actively expanding their offerings, focusing on the integration of Artificial Intelligence and Machine Learning into their analytics platforms. A notable acquisition was made by Cisco in March 2023, purchasing a local analytics firm to enhance their data analytics capabilities in the region. This aligns with the Mexican government’s initiative to modernize the manufacturing sector through smart technologies, and it is expected to elevate the market's valuation significantly, with reports of a projected growth rate of 25% by 2025.

Additionally, the collaboration between Rockwell Automation and Honeywell announced in June 2022 aims to streamline supply chain processes, reflecting an ongoing trend towards partnerships in the market. With rising investments in digital transformation initiatives, major industry players like SAP and Microsoft are also reinforcing their presence in Mexico, further driving the adoption of industrial analytics tools and solutions. The market has seen increased commitment from industry leaders to invest in research and development, paving the way for innovative analytics solutions tailored for the Mexican industrial landscape.

Mexico Industrial Analytics Market Segmentation Insights

Industrial Analytics Market Deployment Type Outlook

-

- On-Premises

- Cloud-Based

- Hybrid

Industrial Analytics Market Application Outlook

-

- Predictive Maintenance

- Supply Chain Management

- Quality Control

- Production Optimization

Industrial Analytics Market Component Outlook

-

- Software

- Hardware

- Services

Industrial Analytics Market End Use Industry Outlook

-

- Manufacturing

- Energy and Utilities

- Healthcare

- Transportation

- Retail

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

423.85(USD Million) |

| MARKET SIZE 2024 |

445.9(USD Million) |

| MARKET SIZE 2035 |

733.6(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

4.63% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

Oracle, PTC, Ansys, Siemens, General Electric, Cisco, SAP, Rockwell Automation, Salesforce, Tableau, IBM, Infosys, Microsoft, Honeywell |

| SEGMENTS COVERED |

Deployment Type, Application, Component, End Use Industry |

| KEY MARKET OPPORTUNITIES |

Predictive maintenance solutions, Supply chain optimization tools, Smart manufacturing integration, Data-driven decision-making platforms, Regulatory compliance analytics |

| KEY MARKET DYNAMICS |

increased adoption of IoT technologies, demand for real-time data analytics, focus on predictive maintenance solutions, rising need for operational efficiency, growth of manufacturing sector in Mexico |

| COUNTRIES COVERED |

Mexico |

Frequently Asked Questions (FAQ):

The Mexico Industrial Analytics Market is expected to be valued at 445.9 million USD in 2024.

By 2035, the Mexico Industrial Analytics Market is anticipated to reach a value of 733.6 million USD.

The Mexico Industrial Analytics Market is projected to have a CAGR of 4.63% during the forecast period from 2025 to 2035.

In 2024, the largest deployment type is expected to be Cloud-Based, valued at 180.0 million USD.

The On-Premises deployment type is expected to be valued at 240.0 million USD by 2035.

Major players in the Mexico Industrial Analytics Market include Oracle, Siemens, General Electric, IBM, and Microsoft.

The Hybrid deployment type is projected to be valued at 203.6 million USD by 2035.

The Cloud-Based deployment type is expected to reach a market value of 290.0 million USD by 2035.

Opportunities in the Mexico Industrial Analytics Market are driven by increasing demand for data-driven decision-making and automation solutions.

Challenges may include data security concerns and the need for skilled analytics professionals to manage advanced technologies.