Mexican Personal Loans Market Overview:

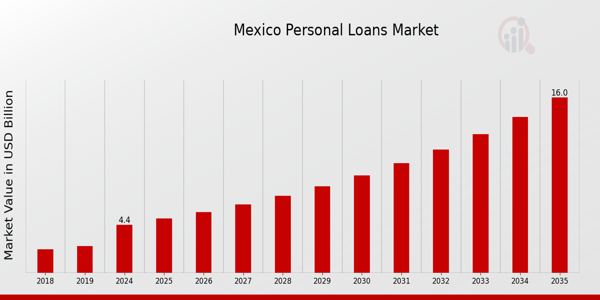

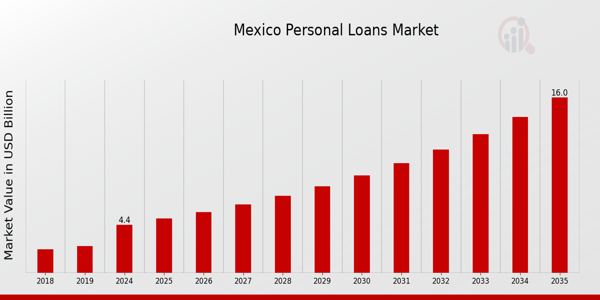

Mexican Personal Loans Market Size was estimated at 2.94 (USD Billion) in 2023. The Mexican Personal Loans Market is expected to grow from 4.4 (USD Billion) in 2024 to 16.0 (USD Billion) by 2035. The Mexican Personal Loans Market CAGR (growth rate) is expected to be around 12.453% during the forecast period (2025 - 2035).

Key Mexican Personal Loans Market Trends Highlighted

Numerous market variables have been driving notable developments in the Mexican personal loan sector. The growing availability of digital financial services, which has made it easier for more customers to apply for personal loans online, is a significant market driver.

Given that Mexico's young, tech-savvy population is growing more at ease with online purchases, this shift towards digitization is particularly significant.

In response to this trend, financial institutions are providing individualized loan solutions that are designed to satisfy particular client requirements, which has increased consumer interest. The increased need for fast personal loans, especially from millennials and the expanding middle class, presents opportunities to enter this sector.

Many of these people favor quick and adaptable finance options to handle unforeseen or regular needs. Peer-to-peer lending is another alternative lending model that local financial institutions are investigating since it may be appealing to borrowers who might find it difficult to get loans from conventional banks.

Recent trends indicate that consumers are becoming more financially literate. Government agencies and nonprofit groups are assisting customers in making well-informed borrowing decisions through awareness campaigns and educational initiatives.

Lenders are also improving their risk assessment techniques as a result of the growing emphasis on credit ratings and responsible borrowing.

Transparency and ethical lending practices are becoming increasingly important as legislative frameworks change to protect consumer rights in lending. When taken as a whole, these patterns create a dynamic personal loan environment in Mexico and open up new opportunities for the financial industry.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Mexican Personal Loans Market Drivers

Increasing Demand for Personal Loans Among the Middle Classes

The Mexican Personal Loans Market is experiencing a significant increase in demand for personal loans, particularly among the expanding middle-class population. According to government statistics, the middle class in Mexico saw a growth of approximately 15% over the last decade, reaching nearly 50% of the total population.

This demographic shift is driven by rising incomes and greater access to credit facilities. Institutions such as BANXICO, the central bank of Mexico, have reported a consistent increase in consumer credit, which includes personal loans.

The latest datasets indicate that consumer lending has grown at an annual rate of around 10% recently, demonstrating a robust appetite for personal loans within this booming segment of the economy. As more individuals seek financial support for necessities like home improvement, education, and health expenses, the Mexican Personal Loans Market will continue to benefit significantly from this trend.

Expansion of Digital Lending Platforms

The rise of digital lending platforms is transforming the way personal loans are distributed in Mexico. Digital finance institutions and fintech companies have emerged as key players in the Mexican Personal Loans Market, leveraging technology to provide quick and convenient access to personal loans.

According to the National Banking and Securities Commission (CNBV), the fintech sector has witnessed an impressive growth rate of 30% annually, reflecting a surge in consumer preferences for online loan services.

This shift not only enhances accessibility for consumers but also streamlines the application and approval processes, making personal loans more attainable than ever. With a reported 70% of Mexicans owning smartphones, the penetration of mobile banking further boosts the reach of digital lenders, solidifying the growth prospects of the Mexican Personal Loans Market.

Growing Financial Literacy Initiatives

As financial literacy initiatives gain traction in Mexico, the understanding of personal loans and their benefits is improving among the population. Government bodies, such as the Ministry of Finance, alongside various nonprofit organizations, are actively promoting educational programs aimed at enhancing financial awareness.

Recent surveys suggest that over 60% of Mexicans are now more informed about personal loans compared to five years ago, thanks to these initiatives.

This surge in knowledge is encouraging more individuals to consider personal loans as viable financial solutions. As financial literacy improves, the Mexican Personal Loans Market is likely to witness increased engagement, leading to higher borrowing rates and a stronger demand for personal loans.

Supportive Regulatory Framework

The Mexican Personal Loans Market benefits from a supportive regulatory framework that fosters growth and protects consumers. Recent reforms implemented by the National Commission for the Protection and Defense of Users of Financial Services (CONDUSEF) aim to create a more transparent lending environment.

These regulations include measures to ensure fair interest rates and prevent predatory lending practices. Enhancing consumer protection encourages more individuals to pursue personal loans.

Statistics show that since the implementation of these regulations, consumer trust in financial institutions has increased by 20%, leading to a notable uptick in personal loan applications. As the regulatory landscape continues to evolve in favor of consumer rights, the Mexican Personal Loans Market is expected to thrive.

Mexican Personal Loans Market Segment Insights:

Personal Loans Market Type Insights

The Mexican Personal Loans Market is characterized by a diverse Type segmentation, which primarily includes P2P Marketplace Lending and Balance Sheet Lending. Within this expansive market, P2P Marketplace Lending has emerged as a popular alternative for borrowers looking for more flexible financing options compared to traditional banking channels.

This type of lending connects borrowers directly with individual lenders through online platforms, facilitating faster loan approval processes and competitive interest rates.

The growing digitization in Mexico, coupled with an increasing number of tech-savvy individuals, has driven the acceptance and adoption of P2P platforms, ultimately leading to substantial growth in the number of participants in this lending space.

On the other hand, Balance Sheet Lending, where financial institutions utilize their own funds to offer personal loans, has maintained a significant foothold in the Mexican Personal Loans Market. This type tends to cater to a diverse range of consumers, providing quick access to credit, especially for those who may not qualify for P2P options.

This model allows lenders to have better control over the credit evaluation process, fostering a stable relationship with clients and leading to sustained market presence. The balance between innovative lending solutions and traditional banking principles offers a dynamic approach that addresses the varying needs of Mexican consumers, enhancing the overall financial inclusion in the region.

As the country continues to modernize its financial services, both P2P Marketplace Lending and Balance Sheet Lending will remain integral to the Mexican Personal Loans Market, shaping the way individuals access credit and manage their financial well-being in the future.

Overall, the diverse Type segmentation showcases the evolving landscape of personal financing in Mexico, highlighting the ongoing trends of digital transformation and a shift toward more consumer-centric lending practices.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Personal Loans Market Age Insights

The Mexican Personal Loans Market exhibits diverse dynamics across different age groups, presenting distinctive insights into consumer behavior and needs. Individuals aged Less Than 30 are increasingly engaging with personal loans, often driven by educational expenses and early financial independence, creating substantial demand within this segment.

Those in the 30-50 age range tend to dominate the market, utilizing personal loans for a variety of purposes including home improvement, debt consolidation, and family-related expenditures, thus representing a substantial portion of the market activity.

Meanwhile, the More Than 50 demographic is gaining traction as they seek loans for retirement planning, healthcare needs, or supporting adult children, highlighting the growing complexity in financial requirements as people age.

The interplay between these age groups reflects broader economic trends in Mexico, influenced by rising living costs, urbanization, and an evolving financial landscape.

Notably, favorable regulatory changes and increased awareness of financial products are also paving the way for enhanced participation across these age segments in the Mexican Personal Loans Market, which underscores the potential for targeted marketing strategies tailored to the distinct needs of each group.

Personal Loans Market Marital Status Insights

The Mexican Personal Loans Market, segmented by Marital Status, reveals significant insights into consumer borrowing behavior across different relationship statuses. Typically, the Married demographic is often viewed as a stable lending group, as dual incomes may provide greater repayment capabilities and enhance creditworthiness.

On the other hand, the Single category represents a rising segment driven by young professionals seeking financial independence and personal investments. Additionally, the Others category, encompassing divorced and widowed individuals, shows unique borrowing patterns where loans may serve as crucial support during transitional life stages.

This segment has progressively garnered attention due to influential shifts in lifestyle dynamics, prompting institutions to tailor financial products accordingly. In recent years, there has been a noticeable trend toward personalized lending solutions that cater to the varying needs within these categories, reflecting an increasingly sophisticated understanding of consumer preferences.

The overall growth of the Mexican Personal Loans Market is buoyed by factors such as increased digitalization, economic stability, and evolving social norms, all of which contribute to a complex landscape where marital status plays a pivotal role in shaping lending strategies.

Furthermore, with above-average penetration of technology in personal finance, consumers across all marital statuses are accessing loan options with ease, enhancing overall financial engagement in the region.

Personal Loans Market Employment Status Insights

The Employment Status segment within the Mexican Personal Loans Market exhibits significant dynamics as it comprises key categories such as Salaried and Business individuals. The Salaried segment tends to dominate the market, primarily due to the stability of regular income, which makes it easier for financial institutions to lend.

This segment's borrowers often seek personal loans for various purposes, including home improvements, education, and debt consolidation, leading to a robust demand for personal lending solutions. Meanwhile, the Business segment plays an equally crucial role, as entrepreneurs and small business owners look for personal loans to support ventures, manage cash flow, or expand operations.

The growing entrepreneur-driven economy in Mexico, supported by government initiatives, fuels opportunities for business loans, highlighting the importance of this category in addressing the unique financial needs of this demographic.

In essence, the Employment Status segment serves as a fundamental pillar of the Mexican Personal Loans Market, influenced by employment trends, economic conditions, and consumer behavior within the region, shaping the overall maturity and growth of the market.

Mexican Personal Loans Market Key Players and Competitive Insights:

The Mexican Personal Loans Market is a dynamic and rapidly evolving sector characterized by intense competition among financial institutions and lending platforms. This market has seen significant growth due to an increasing demand for personal loans driven by various factors such as consumer financing, unexpected expenses, and the need for cash flow management.

As digital transformation shapes the landscape, players leverage technology to enhance their offerings, streamline customer acquisition, and improve the overall borrowing experience.

Competitive insights reveal the strategies employed by various entities to capture market share, foster customer loyalty, and differentiate themselves from peers, thus creating a complex environment where innovation and customer-centricity play pivotal roles.

Aserta has emerged as a prominent player within the Mexican Personal Loans Market, recognized for its focus on providing tailored financial solutions to meet the diverse needs of consumers. With a range of loan offerings, Aserta has strategically positioned itself to cater to both traditional and novel customer segments, enhancing its market presence.

The company's strengths lie in its ability to leverage digital technology for efficient loan processing, ensuring quick approvals and disbursements. Aserta has also established strong brand equity by prioritizing customer service and transparency, fostering trust among its borrowers.

The continuous assessment of market trends enables Aserta to adapt its offerings and services, thereby maintaining its competitive edge in the fast-paced lending environment. HSBC Mexico is a significant player in the personal loans market, bringing a wealth of expertise and an extensive network to consumers in Mexico.

The institution offers various personal loan products aimed at different customer needs, including unsecured personal loans and lines of credit that cater to individual borrowers, facilitating purposes such as home improvement and debt consolidation.

HSBC Mexico's strengths are evident in its solid reputation and the integration of advanced banking technology, which enhances the customer experience through streamlined applications and personalized service options.

The bank's ongoing commitment to uphold superior customer service is complemented by its focus on innovation and broad market understanding.

Additionally, any strategic mergers and partnerships within the region enhance HSBC Mexico's capacity to offer competitive financial products, further solidifying its position in the growing personal loans market and appealing to a wide array of borrowers seeking reliable lending solutions.

Key Companies in the Mexican Personal Loans Market Include:

Mexican Personal Loans Market Developments

The Mexican Personal Loans Market has seen notable developments recently, with companies like HSBC Mexico and Santander Mexico expanding their digital offerings to adapt to changing consumer behavior.

For instance, in October 2023, HSBC Mexico launched a new app feature enabling quicker loan approvals, reflecting a growing trend towards digitalization in financial services. Meanwhile, Kueski continues to lead in online personal loans, responding to the demand for immediate financing solutions, particularly among younger demographics.

In terms of mergers and acquisitions, January 2023 marked a significant milestone when Banorte acquired a stake in a fintech startup, enhancing its digital capabilities and expanding its service offerings. Similarly, Citibanamex has been actively exploring partnerships to strengthen its position in the personal loan segment.

Over the last few years, the market has witnessed growth, with an increase in the overall valuation of key players such as BBVA Mexico and Banco Azteca, which has positively impacted lending rates and consumer accessibility. According to government statistics, the personal loans sector is projected to continue growing, driven by rising demand as households increasingly seek financial support amidst economic challenges.

Mexican Personal Loans Market Segmentation Insights

Personal Loans Market Type Outlook

Personal Loans Market Age Outlook

Personal Loans Market Marital Status Outlook

Personal Loans Market Employment Status Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2018 |

2.94 (USD Billion) |

| MARKET SIZE 2024 |

4.4 (USD Billion) |

| MARKET SIZE 2035 |

16.0 (USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

12.453% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Aserta, HSBC Mexico, Kueski, Unifin, Banorte, Santander Mexico, Scotiabank Mexico, Finsus, Citibanamex, Progreso, Banco Azteca, BBVA Mexico, Creditea, Lendico |

| SEGMENTS COVERED |

Type, Age, Marital Status, Employment Status |

| KEY MARKET OPPORTUNITIES |

Increasing digital lending platforms, Expanding financial inclusion initiatives, Rising demand for debt consolidation, Growing consumer awareness of credit options, Enhanced risk assessment technologies |

| KEY MARKET DYNAMICS |

Increasing consumer debt levels, Rising interest rates, Growing digital lending platforms, Increasing financial literacy, Strong competition among lenders |

| COUNTRIES COVERED |

Mexico |

Frequently Asked Questions (FAQ):

The Mexico Personal Loans Market is expected to be valued at 4.4 billion USD in 2024.

By 2035, the Mexico Personal Loans Market is projected to reach a value of 16.0 billion USD.

The expected CAGR for the Mexico Personal Loans Market from 2025 to 2035 is 12.453%.

Major players in the Mexico Personal Loans Market include HSBC Mexico, Banorte, Santander Mexico, and BBVA Mexico among others.

In 2024, P2P Marketplace Lending in the Mexico Personal Loans Market is valued at 1.5 billion USD.

The Balance Sheet Lending segment in 2024 is expected to be valued at 2.9 billion USD.

P2P Marketplace Lending is projected to reach 5.5 billion USD by 2035.

Emerging trends include an increase in digital lending and personalized loan offerings.

Challenges include regulatory changes and competition from alternative lending sources.

Both P2P Marketplace Lending and Balance Sheet Lending are expected to grow significantly, contributing to the overall market expansion.