Mexico Smart TV Market Overview:

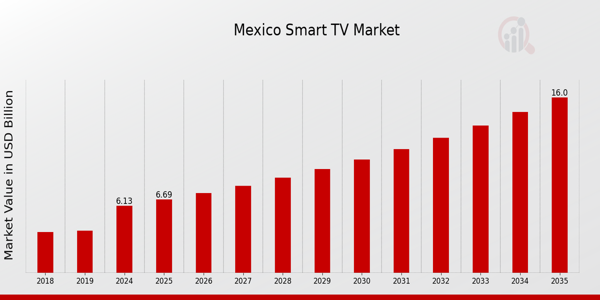

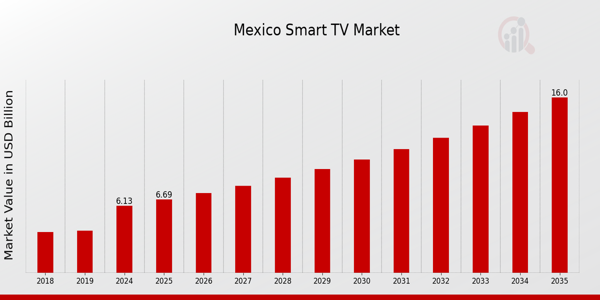

As per MRFR analysis, the Mexico Smart TV Market Size was estimated at 5.22 (USD Billion) in 2023. The Mexico Smart TV Market Industry is expected to grow from 6.13(USD Billion) in 2024 to 16 (USD Billion) by 2035. The Mexico Smart TV Market CAGR (growth rate) is expected to be around 9.113% during the forecast period (2025 - 2035).

Key Mexico Smart TV Market Trends Highlighted

The Japan Smart TV Market is currently experiencing substantial changes as a consequence of the increasing prevalence of streaming services among households. Japanese consumers are increasingly turning to smart TVs that provide seamless access to popular platforms such as Netflix Hulu, and local services like FOD (Fuji TV On Demand). The proliferation of high-speed internet connectivity has facilitated this transition, enabling consumers to effortlessly ingest high-definition content. The demand for enhanced user experiences is another critical market driver, which has led to the integration of advanced technologies into Smart TVs, such as artificial intelligence (AI) capabilities and voice recognition technologies. Japanese manufacturers are prioritizing the creation of models that are designed to accommodate users' customization preferences, allowing them to personalize interfaces and content recommendations based on their viewing habits.

Furthermore, the prevalence of 8K resolution televisions is on the rise in Japan. The country is establishing the infrastructure for 8K broadcasting, which presents an increasing opportunity for consumers to invest in high-resolution televisions that can yield superior image quality. Additionally, the increasing prominence of gaming has resulted in a high demand for Smart TVs with minimal latency and high refresh rates, which is appealing to gamers who are seeking a superior playing experience. Japanese consumers are also becoming more environmentally conscious, which presents an opportunity for eco-friendly Smart TVs that are built from sustainable materials and have energy-efficient features.

By responding to this demand with innovative models, manufacturers have the opportunity to capture a segment of conscious consumers in the market. In general, the Japanese Smart TV market is enduring a rapid transformation, which is facilitating the introduction of new technologies, improved consumer experiences, and environmentally responsible products.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Mexico Smart TV Market Drivers

Growing Demand for Streaming Services

The increasing popularity of streaming services is driving the expansion of the Mexico Smart TV Market Industry. According to the Mexican Association of Internet, as of 2022, over 70% of Mexican households had access to at least one streaming platform, demonstrating a significant consumer shift towards on-demand content consumption. The proliferation of affordable internet services supports this trend as the Mexican government continues to invest in expanding broadband access throughout the country.

With over 80% internet penetration in urban areas, more consumers are adopting Smart TVs to take advantage of services like Netflix, Disney+, and local platforms, contributing to robust growth in the market. Established companies such as Televisa and TV Azteca are also pivoting to leverage these platforms, indicating a broader industry transition towards digital streaming. Consequently, this increasing demand underscores the anticipated growth trajectory of the Mexico Smart TV Market.

Rising Disposable Income

The growth of disposable income among Mexican consumers serves as a fundamental driver for the Mexico Smart TV Market Industry. Recent reports indicate that average household disposable income in Mexico has increased by around 24% from 2015 to 2020, according to Mexico’s National Institute of Statistics and Geography. As citizens experience an increase in their financial resources, they are more inclined to invest in premium electronics such as Smart TVs that offer enhanced features like high-definition displays and internet connectivity. Established brands like Samsung and LG are making significant inroads in this market by catering to diverse consumer preferences and offering affordable options, thus solidifying their position. This trend indicates a continued willingness to spend on quality entertainment solutions, further propelling market growth through to 2035.

Technological Advancements in Display Quality

Innovative technological developments in display quality are a pivotal driver in the Mexico Smart TV Market Industry. With advancements such as 4K resolution, OLED technology, and enhanced HDR capabilities, consumer interest in high-quality viewing experiences is increasing. As per the Mexican Electronics Industry Association, sales of 4K Ultra HD televisions in Mexico grew by nearly 50% in the last year alone, reflecting customers' thirst for superior entertainment technologies. Companies like Sony and Panasonic are at the forefront of offering cutting-edge display technologies that attract early adopters and tech-savvy consumers. The continuous evolution of product offerings based on consumer demand and technological innovation reassures the future growth of the Smart TV market in Mexico, with expectations of a shift towards more advanced display systems.

Increased Advertising Budget Allocations

The upward trend in advertising budgets by major firms in Mexico is significantly boosting the Mexico Smart TV Market Industry. As brands acknowledge the effectiveness of connected TV ads in reaching a targeted audience, advertising expenditures aimed at Digital Media have surged by approximately 30% over the past few years, according to the Mexican Advertising Association. Companies like Grupo Bimbo and FEMSA are leading this trend, allocating more resources to reach consumers through Smart TV platforms. The effective reach and engagement resulting from targeted advertising not only fosters competition but also incentivizes manufacturers to develop smarter and more feature-rich televisions, ultimately accelerating market growth.

Mexico Smart TV Market Segment Insights:

Smart TV Market Resolution Insights

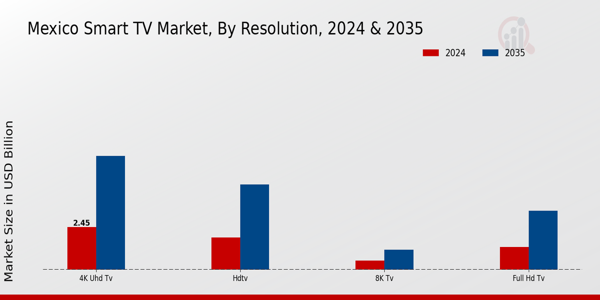

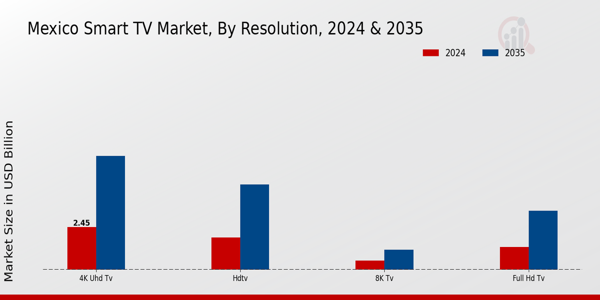

The Resolution segment within the Mexico Smart TV Market has been gaining significant traction, driven by the diverse viewing preferences of consumers and the rapid advancement of technology. This segment includes various categories such as 4K UHD TV, HDTV, Full HD TV, and the emerging 8K TV, each catering to unique consumer demands. The growing popularity of high-definition content fuels the shift towards 4K UHD TVs, which offer superior picture quality, enhancing the overall viewing experience. Consumers are increasingly drawn to the immersive visuals and detail that 4K resolution provides, making it a vital contributor to market growth. HDTV remains a prominent choice due to its balance between quality and affordability, appealing to a broader audience. Meanwhile, Full HD TV maintains a strong position in the market as many households continue to transition from older models to more advanced displays.

As technology progresses, 8K TVs are starting to enter the market, signaling the industry's push for even higher resolutions. This segment is important because it signifies the evolution of viewing standards, with the demand for higher resolutions reflecting consumers' desire for enhanced image clarity and viewing experiences. Additionally, the market is influenced by trends such as increased streaming opportunities, where high-resolution content is becoming increasingly accessible. As a result, the Resolution segment is expected to play a crucial role in shaping the future of the Mexico Smart TV Market, with the potential for innovation and adaptation as consumer preferences evolve. Factors like product differentiation, pricing strategies, and the availability of content are critical in supporting growth in this segment within the dynamic landscape of the Mexico Smart TV Market. The ongoing developments in display technology also present opportunities for manufacturers to tap into emerging consumer needs, making the Resolution segment a focal point for stakeholders and investors within the industry. Overall, consumer behavior toward resolution preferences will continue to define the direction of the Mexico Smart TV Market, shaping the competitive landscape as manufacturers strive to meet changing demands and enhance user experiences.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Smart TV Market Operating System Insights

The Operating System segment within the Mexico Smart TV Market is characterized by diverse platforms catering to varying consumer preferences. Android TV holds a significant position in the market due to its flexibility and extensive app ecosystem, appealing to tech-savvy users who seek customization and variety. Tizen and WebOS also play essential roles, primarily through their integration with popular TV brands, promoting user-friendly interfaces and seamless experiences. Roku, recognized for its simplicity and broad content availability, captures a considerable audience that values straightforward navigation.

Additionally, Other operating systems encompass emerging platforms that could cater to niche segments, highlighting the dynamic nature of the market. With the rise of streaming services and smart home integrations, the demand for diverse operating systems remains strong, driving innovation and competition among providers. The increasing penetration of fiber-optic broadband in Mexico bolsters these operating systems, enabling smoother streaming experiences and enhancing the overall appeal of Smart TVs in households. As the market evolves, understanding these platforms' unique strengths will be crucial for stakeholders aiming to navigate this rapidly changing landscape.

Smart TV Market Screen Size Insights

The Screen Size segment of the Mexico Smart TV Market plays a pivotal role in shaping consumer preferences and purchasing decisions. As more households in Mexico embrace Smart TVs, the demand for larger screen sizes has surged, driven by factors such as the growing popularity of streaming services and a desire for enhanced viewing experiences. Larger screens, particularly the 46 to 65 inches category, show significant appeal for family and entertainment use, reflecting a trend towards immersive viewing. Meanwhile, smaller sizes, such as Below 32 inches, cater to value-conscious consumers and those with limited space, often appealing to young professionals and students.

The 32 to 45-inch segment serves as a robust middle ground for consumers seeking a balance between size and affordability. The market dynamics indicate that as technology advances, consumer preference is gradually shifting towards higher resolution displays, making screen size an essential consideration in the evolution of the Mexico Smart TV Market. Additionally, the expanding availability of varied content and gaming options is expected to further bolster demand across all sizes while home entertainment trends gain momentum in the region. Understanding these diverse preferences is crucial for manufacturers aiming to tailor their offerings and capture market share effectively in this evolving landscape.

Smart TV Market Screen Shape Insights

The Mexico Smart TV Market is experiencing notable growth, particularly in the Screen Shape segment, which is pivotal in enhancing consumer viewing experiences. Flat and Curved screens are the primary formats within this segment, each catering to distinct consumer preferences. Flat-screen televisions are widely popular due to their versatile installation capabilities and affordability, making them accessible to a broad audience. Meanwhile, Curved screens are gaining traction for their immersive viewing perspective, appealing to consumers seeking enhanced depth and realism in their viewing experience.

With the ongoing advancements in display technology and the growing trend of content consumption through smart TVs, these screen shapes are becoming increasingly significant. As consumers in Mexico look for enhanced entertainment options, the demand for various screen shapes is likely to influence market dynamics. Additionally, evolving design preferences and the push for modern aesthetics in home entertainment solutions further bolster the importance of the Screen Shape segment in the Mexico Smart TV Market. This segment not only reflects consumer trends but also drives innovations in technology and design to meet the diverse needs of the Mexican population.

Mexico Smart TV Market Key Players and Competitive Insights:

The competitive landscape of the Mexico Smart TV Market is characterized by rapid advancements in technology and increasing consumer preferences for high-definition viewing experiences. As the demand for smart TV functionalities rises, including integration with streaming services and easier user interfaces, manufacturers are continuously innovating to maintain market relevance. In this dynamic environment, companies are investing heavily in research and development to enhance their offerings while navigating significant competitive pressures from both local and international brands. Price competitiveness remains a crucial factor, as consumers seek the best value for their investment while being drawn to features that enhance their viewing experience.

In the Mexico Smart TV Market, Sharp holds a robust position, distinguished by its commitment to quality and technological innovation. The brand is well-regarded for its high-definition displays and energy-efficient models, which appeal to eco-conscious consumers. Sharp’s presence in the Mexican market is fortified by its strong distribution network and effective marketing strategies that resonate with local preferences. Furthermore, the company emphasizes customer service and support, ensuring a positive consumer experience. The brand's ability to adapt its product offerings to meet regional demands, combined with its reputation for reliability, solidifies its standing in a competitive market where user satisfaction is paramount.

Philips also plays a significant role in the Smart TV landscape in Mexico, offering a variety of products that cater to different segments of the market. Known for its innovative designs and features, Philips Smart TVs often showcase advanced picture quality, smart connectivity, and a user-friendly interface, which are essential in capturing the attention of tech-savvy consumers. The company has effectively positioned itself through strategic partnerships and collaborations aimed at enhancing its service offerings. Philips continues to invest in marketing initiatives that highlight its latest technologies, particularly in areas such as image processing and artificial intelligence. As part of its growth strategy, Philips has explored mergers and acquisitions to bolster its market presence and technological capabilities in the region. This approach not only enhances its product lineup but also reinforces its commitment to delivering high-quality entertainment solutions tailored to the Mexican audience.

Key Companies in the Mexico Smart TV Market Include:

- Sharp

- Philips

- Google

- LG Electronics

- Vizio

- Xiaomi

- Panasonic

- Amazon

- Roku

- Apple

- Nvidia

- Sony

- TCL

- Hisense

- Samsung

Mexico Smart TV Market Industry Developments

The Mexico Smart TV Market has witnessed significant developments, particularly with the growing demand for advanced technology and premium features. In September 2023, LG Electronics announced the launch of its new OLED Smart TV line, designed specifically for the Mexican audience, emphasizing local content and affordability. Samsung has also expanded its portfolio, introducing models equipped with artificial intelligence capabilities that enhance user experience. Additionally, in recent months, TCL has secured a substantial market share by offering budget-friendly options that cater to younger consumers. In terms of mergers and acquisitions, a noteworthy event occurred in July 2023 when Hisense announced the acquisition of a local electronics distributor to enhance its market penetration in Mexico. This strategic move supports their expansion efforts amid increased competition. Furthermore, there is a trend of growth in market valuations for established companies such as Sony and Panasonic, driven by innovation and content partnerships. Google's ongoing collaboration with local streaming services to promote its smart devices has generated significant consumer interest. With rising Internet penetration in Mexico, the Smart TV market anticipates sustained growth, reinforcing the importance of localized content and competitive pricing strategies.

Mexico Smart TV Market Segmentation Insights

Smart TV Market Resolution Outlook

- 4K UHD TV

- HDTV

- Full HD TV

- 8K TV

Smart TV Market Operating System Outlook

- Android TV

- Tizen

- WebOS

- Roku

- Other

Smart TV Market Screen Size Outlook

- Light

- Below 32 inches

- 32 to 45 inches

- 46 to 55 inches

- 56 to 65 inches

- Above 65 inches

Smart TV Market Screen Shape Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

5.22(USD Billion) |

| MARKET SIZE 2024 |

6.13(USD Billion) |

| MARKET SIZE 2035 |

16.0(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

9.113% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Sharp, Philips, Google, LG Electronics, Vizio, Xiaomi, Panasonic, Amazon, Roku, Apple, Nvidia, Sony, TCL, Hisense, Samsung |

| SEGMENTS COVERED |

Resolution, Operating System, Screen Size, Screen Shape |

| KEY MARKET OPPORTUNITIES |

Rising internet penetration, Growing demand for streaming services, Increasing disposable income, Expansion of local content production, Adoption of smart home integration |

| KEY MARKET DYNAMICS |

increasing internet penetration, growing demand for streaming, competitive pricing strategies, enhanced user experience, brand loyalty influences |

| COUNTRIES COVERED |

Mexico |

Frequently Asked Questions (FAQ) :

The Mexico Smart TV Market is expected to be valued at 6.13 billion USD in 2024.

By 2035, the Mexico Smart TV Market is anticipated to reach a value of 16.0 billion USD.

The expected CAGR for the Mexico Smart TV Market from 2025 to 2035 is 9.113%.

The 4K UHD TV segment is projected to be the largest in the Mexico Smart TV Market, valued at 6.55 billion USD by 2035.

The HDTV segment is expected to be valued at 4.9 billion USD in 2035.

Key players in the Mexico Smart TV Market include Sharp, LG Electronics, Samsung, Sony, and Xiaomi.

The Full HD TV segment is anticipated to reach 3.4 billion USD by 2035 in the Mexico Smart TV Market.

The 8K TV segment is expected to reach a value of 1.15 billion USD by 2035.

The Mexico Smart TV Market faces challenges such as price competition and the need for continuous technological advancements.

Key trends influencing growth include increasing consumer demand for high-resolution TVs and advancements in smart technology features.