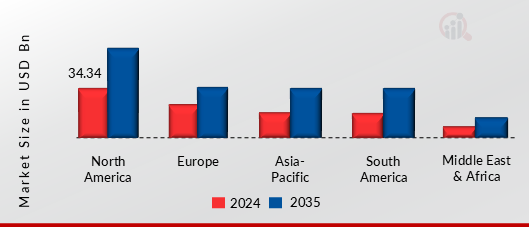

Market Growth Projections

The Global Microbial Fermentation Technology Market Industry is projected to experience substantial growth, with estimates indicating a market value of 156.8 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 6.1% from 2025 to 2035, reflecting the increasing adoption of microbial fermentation across various sectors. The anticipated expansion is driven by factors such as rising consumer demand for natural products, advancements in fermentation technology, and the growing emphasis on sustainability. These projections underscore the market's potential and the critical role of microbial fermentation in shaping future industrial practices.

Rising Demand for Biopharmaceuticals

The Global Microbial Fermentation Technology Market Industry experiences a notable surge in demand for biopharmaceuticals, driven by the increasing prevalence of chronic diseases and the need for innovative therapies. Microbial fermentation serves as a critical process in the production of antibiotics, vaccines, and monoclonal antibodies. For instance, the global biopharmaceutical market is projected to reach 81.7 USD Billion in 2024, highlighting the essential role of microbial fermentation in meeting healthcare needs. This trend suggests that as the biopharmaceutical sector expands, the reliance on microbial fermentation technology will likely increase, thereby propelling market growth.

Expanding Applications Across Industries

The Global Microbial Fermentation Technology Market Industry is characterized by expanding applications across diverse sectors, including food and beverage, pharmaceuticals, and agriculture. In the food industry, fermentation is utilized for producing probiotics, fermented dairy products, and plant-based alternatives, catering to the growing consumer preference for health-oriented products. Similarly, in agriculture, microbial fermentation plays a crucial role in developing biofertilizers and biopesticides, promoting sustainable farming practices. This diversification of applications not only broadens the market's scope but also indicates a robust growth potential, as industries increasingly recognize the benefits of microbial fermentation.

Sustainability and Eco-Friendly Practices

Sustainability emerges as a pivotal driver within the Global Microbial Fermentation Technology Market Industry, as industries seek eco-friendly alternatives to traditional chemical processes. Microbial fermentation offers a sustainable method for producing various chemicals, biofuels, and food ingredients, which aligns with global efforts to reduce carbon footprints. The shift towards greener production methods is evident in sectors such as food and beverage, where fermentation processes are utilized to create natural flavors and preservatives. This growing emphasis on sustainability not only enhances the market's appeal but also positions microbial fermentation as a key player in the transition towards environmentally responsible manufacturing.

Regulatory Support and Funding Initiatives

Regulatory support and funding initiatives significantly bolster the Global Microbial Fermentation Technology Market Industry, as governments and organizations promote research and development in fermentation technologies. Various funding programs aim to encourage innovation and commercialization of microbial fermentation processes, particularly in biopharmaceuticals and sustainable agriculture. This support is crucial for fostering advancements that enhance product quality and safety. As regulatory frameworks evolve to accommodate new fermentation technologies, the market is likely to benefit from increased investment and collaboration between public and private sectors, further driving growth.

Technological Advancements in Fermentation Processes

Technological advancements significantly influence the Global Microbial Fermentation Technology Market Industry, enhancing efficiency and productivity in fermentation processes. Innovations such as automated fermentation systems, advanced bioreactor designs, and improved strain development techniques contribute to higher yields and reduced production costs. For example, the integration of artificial intelligence and machine learning in fermentation monitoring allows for real-time adjustments, optimizing conditions for microbial growth. These advancements are expected to drive the market's growth trajectory, as companies increasingly adopt cutting-edge technologies to remain competitive and meet the rising demand for fermented products.

Leave a Comment