- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

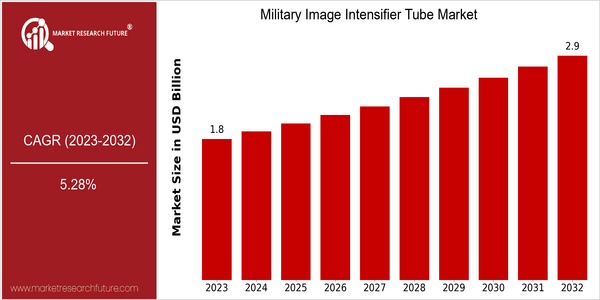

| Year | Value |

|---|---|

| 2023 | USD 1.81 Billion |

| 2032 | USD 2.87 Billion |

| CAGR (2024-2032) | 5.28 % |

Note – Market size depicts the revenue generated over the financial year

The military intensifier tube market is expected to reach about $1.81 billion in 2023 and is expected to grow to about $2.87 billion in 2032. This growth rate represents a CAGR of 5.28% from 2024 to 2032, which reflects the high demand for advanced night vision equipment in military applications. The intensifier tube market is expected to grow mainly because of the growing need for greater situational awareness and the effectiveness of military operations. Several factors are expected to contribute to the growth of the military intensifier tube market. The technological progress in intensifier tubes, such as the development of lighter and more efficient tubes with higher resolution and sensitivity, has improved the military's low-light vision capabilities. Secondly, the increasing defense budgets of different countries, coupled with the need to modernize and improve military equipment, are also expected to drive the growth of the market. The major intensifier tube manufacturers, such as L3-Harris, Thales and Elbit, are also actively pursuing strategic cooperation and product innovation. , in order to enhance their market positions and meet the changing needs of military applications.

Regional Market Size

Regional Deep Dive

The Military Image Intensifier Tube Market is characterized by a high demand in different regions. The demand is driven by an increase in defense budgets, the modernization of military equipment and the need for improved night vision capabilities. Each region has its own characteristics, which are influenced by geopolitical factors, technological advancements and regulations. North America leads in terms of technological development and defense spending. Europe is more focused on joint defense initiatives. The Asia-Pacific region is experiencing strong growth due to increasing military expenditure and rising regional tensions. The Middle East and Africa are also investing heavily in the modernization of their armed forces. Latin America, which is a smaller market, is gradually increasing its focus on improving its military capabilities.

Europe

- The European Union has initiated collaborative defense projects, such as the European Defence Fund, which aims to enhance military capabilities, including night vision technologies, across member states.

- Companies like Thales Group and Rheinmetall are actively developing innovative image intensifier solutions, responding to the growing demand for enhanced situational awareness in military operations.

Asia Pacific

- Countries like India and China are significantly increasing their defense budgets, with a focus on acquiring advanced night vision technologies, including image intensifier tubes, to strengthen their military capabilities.

- The rise of regional tensions has prompted nations in the Asia-Pacific to prioritize military modernization, leading to increased procurement of advanced imaging technologies from companies like NEC Corporation and Samsung Techwin.

Latin America

- Countries such as Brazil and Colombia are beginning to modernize their military forces, with a growing interest in acquiring advanced night vision systems, including image intensifier tubes, to improve operational effectiveness.

- Regional defense cooperation initiatives are emerging, encouraging joint procurement and development of military technologies, which may include image intensifier solutions.

North America

- The U.S. Department of Defense has recently increased its budget allocation for advanced night vision technologies, including image intensifier tubes, to enhance operational capabilities in low-light conditions.

- Key players like L3Harris Technologies and Elbit Systems of America are investing in R&D to develop next-generation image intensifier tubes, focusing on improved performance and reduced size.

Middle East And Africa

- The Middle East is experiencing a surge in defense spending, with countries like Saudi Arabia and the UAE investing heavily in advanced military technologies, including image intensifier tubes, to enhance their defense systems.

- Local defense manufacturers are collaborating with international firms to produce advanced night vision technologies, reflecting a trend towards self-sufficiency in military capabilities.

Did You Know?

“Did you know that the first image intensifier tube was developed during World War II, significantly enhancing soldiers' night vision capabilities and changing the dynamics of nighttime warfare?” — Military History Journal

Segmental Market Size

The military infrared light intensifier tube market is a vital segment of the military and security industry and is currently experiencing a stable growth rate, mainly due to the rising demand for enhanced night vision. In addition, the modernization of armed forces around the world is driving the market. The need to improve the safety of soldiers and the efficiency of military operations is also driving the market. The military infrared light intensifier tube is currently in its deployment stage. For example, the US Army uses the AN/PVS-14 night vision device, and many NATO forces have incorporated advanced image intensification systems into their equipment. Generally, the infrared light intensifier tube is used in military operations, such as in combat, reconnaissance and border patrols, where visibility is limited. The trend of increasing defense budgets and rising geopolitical tensions has led to an increase in the demand for image intensifiers, and the development of photonics and nanotechnology has led to the development of image intensifiers with lighter and more efficient devices.

Future Outlook

From 2023 to 2032, the Military Image Intensifier Tube Market is expected to grow at a CAGR of 5.28%. The growth will be driven by the need for advanced night vision equipment for military forces. The need for improved situational awareness in different operating conditions is increasing. As military budgets continue to increase, especially in North America and Asia-Pacific, the adoption of advanced imaging technology will increase, which will further drive the market. In addition, technological developments, such as the development of lightweight and high-performance image intensifier tubes, will also play an important role in shaping the market. Materials and manufacturing processes will continue to improve, and they will be more efficient and effective, which will make them more attractive to defense contractors and military end users. The integration of image intensifier technology with other systems, such as unmanned aerial vehicles and surveillance equipment, will also increase the penetration rate. As a result, the military image intensifier tube market will continue to evolve, driven by the strong demand for cutting-edge solutions to meet the operational needs of modern armed forces.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 6.90% (2022-2032) |

Military Image Intensifier Tube Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.