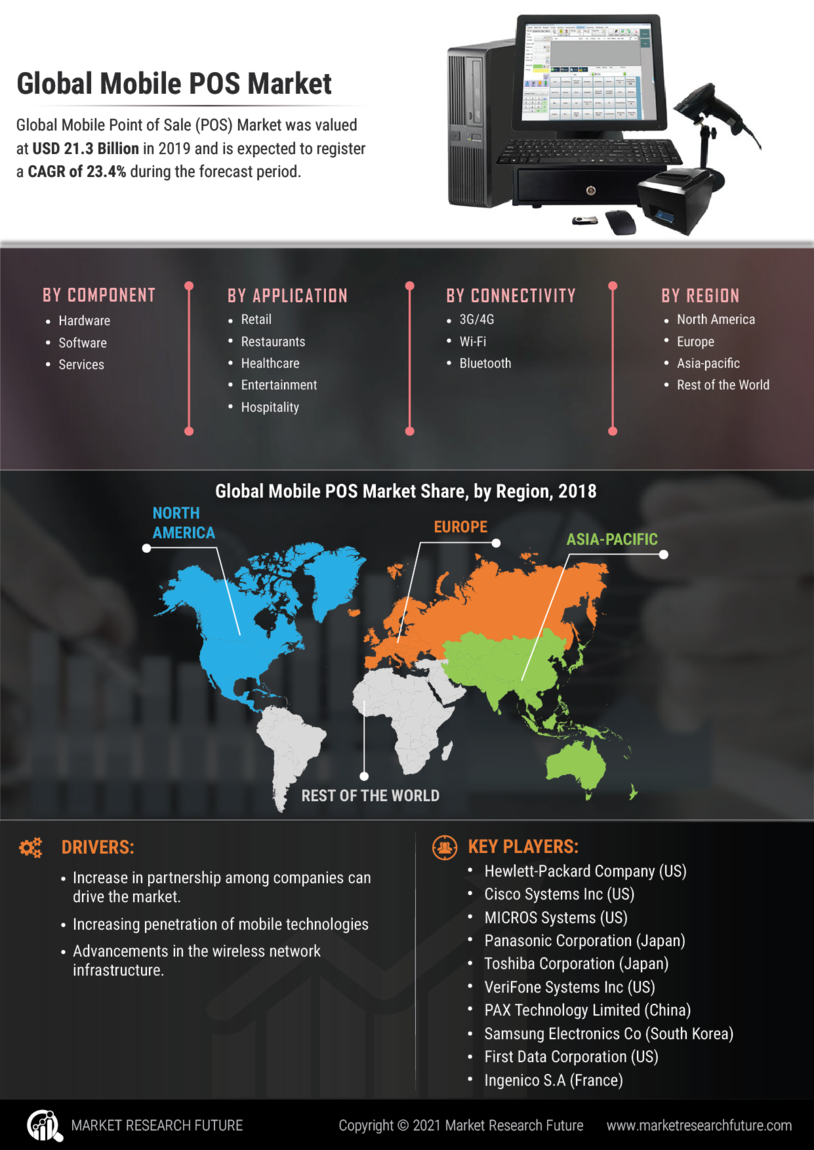

Rising Demand for Mobility in Retail

The Mobile POS Market is experiencing a notable surge in demand for mobility solutions within retail environments. Retailers are increasingly seeking to enhance customer experiences by enabling transactions to occur anywhere on the sales floor. This shift is driven by consumer preferences for convenience and speed, as well as the need for retailers to optimize their operations. According to recent data, the mobile payment segment is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend indicates that businesses are recognizing the potential of mobile POS systems to streamline operations and improve customer satisfaction, thereby solidifying their position in the Mobile POS Market.

Growth of Small and Medium Enterprises (SMEs)

The proliferation of small and medium enterprises (SMEs) is significantly influencing the Mobile POS Market. SMEs are increasingly adopting mobile POS systems to enhance their operational efficiency and customer engagement. These businesses often operate with limited resources, making mobile solutions an attractive option due to their affordability and ease of use. Recent statistics indicate that SMEs account for over 90% of all businesses, highlighting a substantial market opportunity for mobile POS providers. As these enterprises continue to embrace digital transformation, the demand for mobile POS solutions is expected to rise, further propelling the growth of the Mobile POS Market.

Technological Advancements in Payment Solutions

Technological innovations are playing a pivotal role in shaping the Mobile POS Market. The introduction of advanced payment technologies, such as Near Field Communication (NFC) and mobile wallets, is facilitating seamless transactions. These technologies not only enhance the speed of payments but also improve security, which is a critical concern for consumers. As businesses adopt these technologies, they are likely to see an increase in transaction volumes. Data suggests that the integration of such technologies could lead to a 30% increase in transaction efficiency. This evolution in payment solutions is driving the growth of the Mobile POS Market, as businesses strive to stay competitive and meet consumer expectations.

Regulatory Support for Digital Payment Solutions

Regulatory frameworks are increasingly supporting the adoption of digital payment solutions, which is beneficial for the Mobile POS Market. Governments and financial institutions are implementing policies that promote cashless transactions, thereby encouraging businesses to adopt mobile POS systems. This regulatory support is crucial in fostering a conducive environment for innovation and growth within the payment sector. For instance, initiatives aimed at enhancing financial inclusion are likely to drive the adoption of mobile payment technologies among underserved populations. As these regulations evolve, they are expected to create new opportunities for growth in the Mobile POS Market, as businesses align with compliance requirements and consumer preferences.

Consumer Preference for Enhanced Shopping Experiences

Consumer preferences are shifting towards enhanced shopping experiences, which is a key driver for the Mobile POS Market. Shoppers are increasingly looking for personalized and efficient service, prompting retailers to adopt mobile POS systems that facilitate quicker checkouts and tailored promotions. This trend is particularly evident in sectors such as hospitality and retail, where customer interaction is paramount. Data indicates that businesses utilizing mobile POS solutions can improve customer satisfaction scores by up to 25%. As retailers strive to meet these evolving consumer expectations, the adoption of mobile POS technology is likely to accelerate, thereby contributing to the growth of the Mobile POS Market.

Leave a Comment