- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

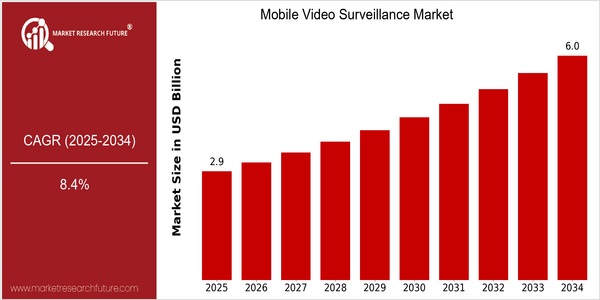

| Year | Value |

|---|---|

| 2025 | USD 2.9 Billion |

| 2034 | USD 5.99 Billion |

| CAGR (2025-2034) | 8.4 % |

Note – Market size depicts the revenue generated over the financial year

The Mobile Video Surveillance Market is poised for substantial growth, with the current market size of $ 2,914 million in 2025, it is expected to nearly double to $ 5,995 million by 2034, at a CAGR of 8.4 % over the forecast period. This growth is primarily driven by the growing security concerns and the need for real-time monitoring in various sectors such as transportation, public safety, and private security. The mobile video surveillance market is also driven by the advancements in technology, such as the integration of artificial intelligence (AI) and the Internet of Things (IoT) in surveillance systems. These developments are expected to enhance the functionality and efficiency of mobile surveillance systems, thereby improving the analysis and response times. The major players in the market, such as Hikvision, Dahua Technology, and Axis Communications, are continuously investing in research and development and launching new products to meet the growing demand. Recent collaborations between technology companies and security companies have resulted in the development of more sophisticated mobile surveillance solutions, thereby accelerating the growth of the market.

Regional Market Size

Regional Deep Dive

The mobile surveillance market is experiencing a high growth rate across various regions, mainly driven by the rise in security concerns, technological advancements, and smart city initiatives. In North America, the market is characterized by a high penetration of advanced surveillance technologies and the strong presence of key players. Europe is characterized by a strong regulatory framework, which supports the integration of mobile surveillance solutions. In Asia-Pacific, the market is characterized by rapid urbanization and the development of the economy, which has led to the increased demand for mobile surveillance systems. The Middle East and Africa are mainly focused on improving security measures due to the rise in geopolitical tensions, while Latin America is gradually deploying mobile surveillance solutions as a part of its public safety initiatives.

Europe

- The European Union's General Data Protection Regulation (GDPR) has prompted organizations to adopt more secure and compliant mobile video surveillance solutions, driving innovation in data protection technologies.

- Key players such as Axis Communications and Bosch Security Systems are collaborating with local governments to implement mobile surveillance in urban areas, enhancing public safety and crime prevention.

Asia Pacific

- Rapid urbanization in countries like India and China is leading to increased investments in smart infrastructure, which includes mobile video surveillance systems for traffic management and public safety.

- The rise of 5G technology is enabling faster data transmission for mobile surveillance systems, with companies like Hikvision and Dahua Technology at the forefront of this innovation.

Latin America

- Countries like Brazil and Mexico are increasingly adopting mobile video surveillance as part of their public safety strategies, driven by rising crime rates and urban violence.

- Local governments are partnering with technology providers to implement mobile surveillance systems in high-crime areas, aiming to improve community safety and law enforcement response.

North America

- The U.S. government has been investing heavily in smart city projects, which include the integration of mobile video surveillance systems to enhance public safety and traffic management.

- Companies like Motorola Solutions and Genetec are leading the charge in developing innovative mobile surveillance technologies, including AI-driven analytics that improve threat detection and response times.

Middle East And Africa

- Governments in the Middle East are prioritizing security enhancements, with initiatives like the UAE's Vision 2021 promoting the use of advanced surveillance technologies in public spaces.

- Companies such as Avigilon and Hanwha Techwin are expanding their presence in the region, providing mobile video surveillance solutions tailored to local security needs.

Did You Know?

“Mobile video surveillance systems can reduce response times to incidents by up to 50%, significantly enhancing public safety and security.” — Security Industry Association (SIA)

Segmental Market Size

The Mobile Surveillance Market is expected to witness a high growth rate, owing to the increasing security concerns and the need for real-time monitoring solutions. The factors driving the growth of the mobile surveillance market include the rising criminal activities, the stringent regulations pertaining to the security of the nation, and the advancements in the mobile technology that enable easy streaming and storage of the surveillance videos. The use of mobile surveillance systems is increasing in the private and public sector. The mobile surveillance systems are moving from the testing stage to the implementation stage. The law enforcement agencies in the United States and the smart city initiatives in Europe are the major adopters of the mobile surveillance systems. The major applications of mobile surveillance include public safety monitoring, fleet management, and event security. The major solutions include those from Hikvision and Axis Communications. The public safety concerns, the government mandates, and the global events that are boosting the market growth. The cloud-based solutions and the machine learning are expected to enhance the performance and efficiency of the mobile surveillance systems.

Future Outlook

The Mobile Video Surveillance Market is expected to grow from $2.9 billion to $ 5.9 billion by 2025, at a CAGR of 8.4 percent. The growth will be driven by the increasing demand for security solutions in the transportation, retail, and public safety sectors. As a result, the penetration of mobile video surveillance is expected to grow and could reach a penetration rate of 30 percent in urban areas by 2025, from the current 15 percent. Further driving the growth is the integration of artificial intelligence (AI) and machine learning (ML) into mobile surveillance systems. These enable real-time analytics, enhanced threat detection, and automatic responses, thereby making mobile surveillance more effective and appealing to end users. Also driving the market is the implementation of supportive government policies and regulations to enhance public safety. Also, the emergence of 5G technology and the shift to cloud-based solutions will ensure that mobile surveillance remains a critical part of the security architecture.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 2.1 Billion |

| Market Size Value In 2023 | USD 2.2764 Billion |

| Growth Rate | 8.40 % (2023-2030) |

Mobile Video Surveillance Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.