- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

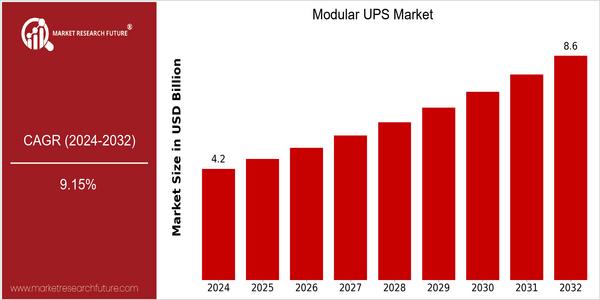

| Year | Value |

|---|---|

| 2024 | USD 4.2 Billion |

| 2032 | USD 8.61 Billion |

| CAGR (2024-2032) | 9.15 % |

Note – Market size depicts the revenue generated over the financial year

Modular UPS market is expected to grow at a CAGR of 9.15% from 2024 to 2032. This growth is mainly driven by the increasing demand for reliable power solutions in various industrial sectors, including data centers, hospitals, and industrial operations. There are many factors that will drive the growth of this market, such as the development of modular UPS technology, which enhances scalability, efficiency, and redundancy. Also, the shift to the use of alternative energy sources and the increasing demand for energy efficiency are driving the demand for modular systems, which offer flexibility and lower operating costs. In this market, the leading companies, such as Schneider Electric, Eaton, and Vertiv, are actively investing in research and development, establishing strategic alliances, and launching new products to increase their market share. The recent product launches, which have integrated the Internet of Things (IoT) technology into UPS systems, are expected to set new standards for performance and monitoring, thereby driving the market growth.

Regional Market Size

Regional Deep Dive

Modular UPS Market is experiencing a considerable growth in various regions, driven by the growing demand for reliable power solutions in data centers, hospitals, and industrial applications. North America is characterized by the presence of an advanced technological framework and a high emphasis on energy efficiency, while Europe is characterized by the presence of government initiatives aimed at reducing the carbon footprint. Asia-Pacific is growing rapidly, due to increasing urbanization and industrialization, while the Middle East and Africa region is focusing on improving power reliability in emerging economies. Latin America is also growing, albeit at a lower rate, mainly due to the growing importance of infrastructure and alternative energy sources. In conclusion, the Modular UPS Market is expected to develop at a high rate, influenced by the economic and technological environment of each region.

Europe

- The European Union's Green Deal is driving investments in sustainable energy solutions, leading to a growing interest in modular UPS systems that support renewable energy integration.

- Companies like Schneider Electric are launching initiatives to promote energy-efficient UPS systems, aligning with the region's commitment to reducing greenhouse gas emissions and enhancing energy security.

Asia Pacific

- Rapid urbanization in countries like India and China is fueling the demand for modular UPS systems, with companies such as Huawei and Delta Electronics expanding their product lines to cater to this growing market.

- Government initiatives aimed at improving power reliability and reducing outages are encouraging investments in modular UPS technology, particularly in sectors like telecommunications and manufacturing.

Latin America

- The increasing frequency of power outages in countries like Brazil and Argentina is driving demand for modular UPS systems, with local manufacturers beginning to innovate to meet this need.

- Government programs aimed at improving energy access and reliability are encouraging investments in modular UPS technology, particularly in rural and underserved areas.

North America

- The rise of edge computing has led to increased demand for modular UPS systems, as companies like Vertiv and Eaton are innovating to provide scalable solutions that meet the needs of distributed IT environments.

- Regulatory changes, such as California's energy efficiency standards, are pushing organizations to adopt more energy-efficient UPS systems, prompting manufacturers to enhance their product offerings with advanced features.

Middle East And Africa

- The UAE's Vision 2021 is promoting the adoption of advanced power solutions, including modular UPS systems, to support the country's infrastructure development and smart city initiatives.

- Companies like APC by Schneider Electric are actively participating in projects aimed at enhancing power reliability in critical sectors such as healthcare and data centers across the region.

Did You Know?

“Did you know that modular UPS systems can be scaled up or down based on demand, allowing businesses to optimize their energy usage and reduce costs?” — Energy Management Journal

Segmental Market Size

Modular UPS Market is expected to grow at a CAGR of around 6%, as a result of the growing demand for reliable power solutions across various industries. The major factors driving this market are the rising need for uninterrupted power supply in critical applications, such as data centers and hospitals, and the increasing need for energy conservation and sustainability. Also, the demand for UPS systems that are able to support the integration of renewable sources of energy is expected to grow at a CAGR of 6% during the forecast period. The adoption of modular UPS systems is in the process of mass deployment, with Schneider Electric and Eaton leading the way with their innovative solutions. North America and Europe are the most advanced regions, with telecommunications and IT as the key industries. The main applications are for data centers, industrial automation, and renewable energy systems. The trends of digital transformation and the drive toward energy conservation and sustainability are also contributing to the market’s growth. In terms of technology, IoT-based remote monitoring and advanced batteries are shaping the market’s future.

Future Outlook

The Modular UPS Market is set to experience significant growth between 2024 and 2032, when the market is estimated to grow from $ 4.21 billion to $8.61 billion at a CAGR of 9.15%. The main reason for this growth is the increasing demand for reliable power solutions in various industries, such as data centers, hospitals, and telecommunications. The increasing need for businesses to ensure continuity of operations and energy efficiency will lead to an increase in the use of scalable and flexible modular UPS systems. In 2032, the penetration rate of modular UPS systems in critical applications is expected to reach about 30% from about 15% in 2024. This shows a strong shift towards advanced power management solutions. Also, technological developments, such as the integration of IoT and artificial intelligence into UPS systems, will enhance monitoring and forecasting capabilities, which will also boost market growth. Government initiatives to encourage energy efficiency and sustainability will also help to drive market growth. The increasing focus on renewable energy sources and the growing need for back-up power solutions due to climate change will also play a crucial role in shaping the market. The Modular UPS Market is expected to thrive as a result of the growing need for reliable and sustainable power solutions to protect against the risk of power outages.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 3.8 billion |

| Growth Rate | 9.15% (2024-2032) |

Modular UPS Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.