- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

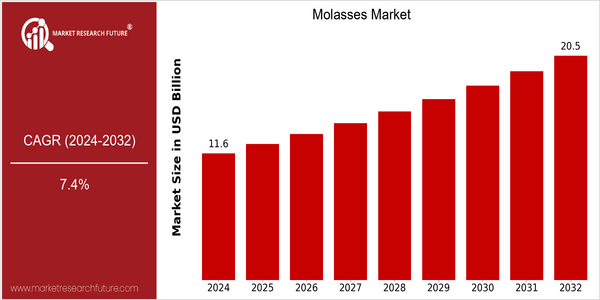

| Year | Value |

|---|---|

| 2024 | USD 11.59 Billion |

| 2032 | USD 20.533 Billion |

| CAGR (2024-2032) | 7.4 % |

Note – Market size depicts the revenue generated over the financial year

The Molasses market is expected to grow at a CAGR of 6.9 percent from 2017 to 2032, reaching a market size of $20.5 billion by 2032. The growth of the molasses market is expected to reach a CAGR of 7.2 percent in the forecast period. The increasing demand for natural sweeteners and the increasing popularity of molasses in food and beverage applications will drive the growth of the market. The expansion of the biofuel industry, which uses molasses as a raw material for ethanol production, will also promote the development of the market. The development of molasses production and processing technology will also play a major role in the quality and efficiency of molasses. Cargill Inc. and AB InBev PLC are investing in the development of new molasses extraction and processing technology, and establishing long-term strategic cooperation and partnership to further enhance their market position. The recent collaborations are an example of this. As consumers become more aware of the health and safety of their food choices, the molasses market is expected to benefit from this trend and continue to grow in the future.

Regional Market Size

Regional Deep Dive

The molasses market is characterized by the diverse applications of molasses in various industries such as food & beverage, animal feed, and biofuels. In North America, the molasses market is driven by the growing demand for natural sweeteners and the increasing use of molasses in fermentation processes. The region also benefits from a strong agricultural sector that supports molasses production, and a rising trend toward organic and sustainable products. Regulations in support of biofuels will further boost market growth in the coming years.

Europe

- The European Union's Green Deal has spurred interest in sustainable agricultural practices, leading to increased molasses usage in organic farming and animal feed, with companies like Südzucker AG adapting their production strategies accordingly.

- Innovations in fermentation technology are being adopted by European firms, such as Novozymes, to enhance the efficiency of molasses in bioethanol production, which is expected to drive market growth.

Asia Pacific

- In countries like India, the growing demand for traditional sweets and fermented beverages has led to a rise in molasses production, with local producers focusing on quality improvements to meet consumer preferences.

- The increasing awareness of health benefits associated with molasses is driving its use in functional foods, with companies like Bunge India expanding their product lines to cater to this trend.

Latin America

- Brazil, as a leading sugar producer, is leveraging its molasses by-products for bioethanol production, with companies like Raízen investing in advanced fermentation technologies.

- The cultural significance of molasses in traditional Latin American beverages is driving local consumption, with artisanal producers gaining popularity among health-conscious consumers.

North America

- The U.S. has seen a surge in the use of molasses as a natural sweetener in health-conscious food products, with companies like Domino Foods investing in innovative processing techniques to enhance product quality.

- Recent regulatory changes in the biofuel sector, particularly the Renewable Fuel Standard (RFS), have encouraged the use of molasses in ethanol production, leading to increased investments from firms such as Archer Daniels Midland Company.

Middle East And Africa

- In the Middle East, the rising popularity of molasses-based products in traditional cuisines is boosting local production, with companies like Al Watania Agriculture investing in modern processing facilities.

- Regulatory support for biofuel initiatives in several African nations is encouraging the use of molasses as a feedstock, with governments promoting sustainable energy solutions to address energy shortages.

Did You Know?

“Molasses is not only a sweetener but also a rich source of vitamins and minerals, including calcium, potassium, and iron, making it a popular choice in health foods.” — USDA National Nutrient Database

Segmental Market Size

Molasses plays an important role in many industries, mainly in food and beverage, animal feed, and biofuels. These industries are currently experiencing steady growth, driven by the rising demand for natural sweeteners and sustainable feed alternatives. The increasing demand for organic and non-GMO products, as well as the promotion of biofuels, are key drivers of the molasses industry. The use of molasses in the production of biofuels is currently in the commercialization stage, with Green Plains and ADM leading the way in the U.S. and Brazil, respectively. The main uses of molasses are as a sweetener in food and beverages, a fermentation agent in alcoholic beverages, and a nutritional supplement in animal feed. In the food and beverage industry, the growing demand for natural sweeteners and the trend toward plant-based diets are driving the demand for molasses. The fermentation and processing of molasses are undergoing continuous development to ensure that molasses remains a relevant product in a rapidly changing market.

Future Outlook

The Molasses Market is estimated to grow from $11.59 billion in 2024 to $20.53 billion in 2032, at a robust CAGR of 7.4 per cent. The rising demand for molasses in various sectors, such as food and beverage, animal feed, and biofuels, is the key growth driver for the molasses market. As consumers are moving towards natural sweeteners and sustainable ingredients, molasses is gaining momentum as a versatile and eco-friendly alternative in both developed and emerging economies. Further, the molasses market is anticipated to be shaped by several policy and technological developments. The advancements in extraction and processing techniques are expected to enhance the quality and yield of molasses, thereby enhancing its marketability. Supportive government policies that promote bio-based products and sustainable agriculture are also anticipated to drive market growth. As a result of the rising popularity of plant-based diets and the growing awareness of molasses’ health benefits, the molasses consumption is projected to increase by up to 20 per cent in the food and beverage sector by 2032. Hence, the molasses market is expected to grow in the near future, driven by a combination of changing consumer preferences, technological advancements, and favorable government policies.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 10.8 Billion |

| Growth Rate | 7.40% (2024-2032) |

Molasses Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.