- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

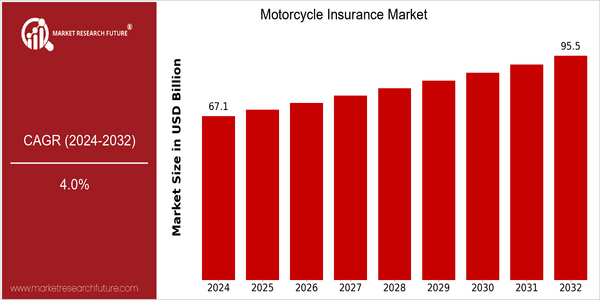

| Year | Value |

|---|---|

| 2024 | USD 67.09 Billion |

| 2032 | USD 95.48 Billion |

| CAGR (2024-2032) | 4.0 % |

Note – Market size depicts the revenue generated over the financial year

The global motorcycle insurance market is expected to grow at a CAGR of 4.1% from 2024 to 2032. This growth is expected to be at a CAGR of 4.0% from 2024 to 2032. This is attributed to the rising number of motorcycle registrations and the rising awareness about the importance of insurance. The growing popularity of motorcycles as a cost-effective and convenient mode of transport in urban areas is also expected to drive market growth. Technological advancements, such as the integration of telematics and usage-based insurance, are also expected to drive the market. These innovations enable insurers to offer individualized premiums based on individual driving behavior, thereby increasing customer engagement and satisfaction. The leading players in the motorcycle insurance industry, such as Allstate, Allianz, and Progressive, are investing in digital platforms and strategic collaborations to enhance their service offerings and reach a larger customer base. These efforts are expected to increase operational efficiency and meet the evolving needs of consumers seeking more flexible and individualized insurance solutions.

Regional Market Size

Regional Deep Dive

The global motorcycle insurance market is growing rapidly across the world. The reasons for this growth are increasing ownership of motorcycles, growing awareness of insurance benefits, and changing regulatory frameworks. North America is characterized by a strong preference for customized insurance policies, whereas in Europe, the trend towards environment-friendly motorcycles is influencing insurance products. Asia-Pacific is characterized by a rising demand due to the urbanization and growth of the middle class, whereas in the Middle East and Africa, the need for motorcycle insurance is gradually being recognized as a necessity. Latin America, with its unique cultural orientation towards motorcycles, is also experiencing an increase in insurance, although at a lower rate than the others due to the economic crisis. The market will continue to evolve with the changing preferences of consumers and the regulatory framework.

Europe

- The European Union's push for greener transportation has led to an increase in electric motorcycle sales, prompting insurers to develop specialized policies that cater to this emerging market segment.

- The implementation of the EU's Insurance Distribution Directive (IDD) has enhanced transparency in insurance offerings, encouraging competition and innovation among providers.

Asia Pacific

- In countries like India and Indonesia, government initiatives promoting two-wheeler safety and insurance awareness are significantly increasing the penetration of motorcycle insurance.

- The rise of digital insurance platforms, such as Policybazaar in India, is making it easier for consumers to compare and purchase motorcycle insurance, driving market growth.

Latin America

- In Brazil, the government has launched initiatives to promote motorcycle safety, which includes encouraging riders to obtain insurance, thus increasing market awareness.

- Economic challenges in countries like Argentina have led to a slower adoption of motorcycle insurance, but local companies are innovating with micro-insurance products to cater to budget-conscious consumers.

North America

- The introduction of usage-based insurance (UBI) models by companies like Progressive and Geico is reshaping how motorcycle insurance is priced, allowing for more personalized premiums based on actual riding behavior.

- Regulatory changes in states like California, which now require motorcycle insurance to cover uninsured motorists, are pushing riders to seek more comprehensive coverage options.

Middle East And Africa

- In South Africa, the introduction of mandatory motorcycle insurance has led to a surge in policy uptake, with local insurers like Old Mutual developing tailored products for riders.

- Cultural factors, such as the growing popularity of motorcycle clubs and events, are fostering a community that values insurance as a means of protection and support.

Did You Know?

“In some countries, motorcycle insurance can be as low as 1% of the motorcycle's value, making it an affordable option for many riders.” — Insurance Information Institute

Segmental Market Size

The motorcycle insurance market is growing steadily, due to the increasing number of motorcycles and the growing awareness of the importance of insurance. In some regions, insurance for riders is strictly required. In addition, technological developments in telematics are enabling the assessment of risks and the calculation of premiums to be improved, making insurance more accessible and more tailored to the individual. The current situation is that the market has matured, with the leading companies such as Progressive and Geico, especially in the U.S., offering the most advanced insurance solutions. The main applications of motorcycle insurance are liability insurance, collision insurance and comprehensive insurance, which covers both riders who ride occasionally and daily riders. In addition, the growing popularity of electric motorcycles and the increasing emphasis on sustainability are driving the market further, as consumers seek more environmentally friendly solutions. Artificial intelligence-based underwriting and mobile applications for policy management are influencing the development of the market, making it more convenient for consumers and simplifying the business process.

Future Outlook

The world motorcycle insurance market is expected to grow at a CAGR of 4.0% from 2024 to 2032, with the market value increasing from $ 67 billion to $ 94 billion. The growth is driven by an increase in motorcycle registrations, which is in turn driven by the growing urban population and the growing popularity of two-wheelers as a convenient and cost-effective means of transport. Increasing demand for motorcycles is expected to increase the demand for comprehensive insurance, and the penetration rate is expected to reach about 30% of all motorcycle owners by 2032, compared to the current estimate of about 20%. The development of telematics and usage-based insurance is expected to change the motorcycle insurance landscape. The new technology not only allows the insurer to assess the risk in real time, but also offers a more individualized premium based on the rider's behavior. Also, government policies to improve road safety and reduce the accident rate will further drive the market. The popularity of electric motorcycles and the emphasis on the environment will also play an important role in shaping the future demand for insurance and customer preferences. The insurers that adapt to these changes and take advantage of the opportunities will be able to grab a larger market share in the future.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 67.09 Billion |

| Growth Rate | 4% (2024-2032) |

Motorcycle Insurance Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.