- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

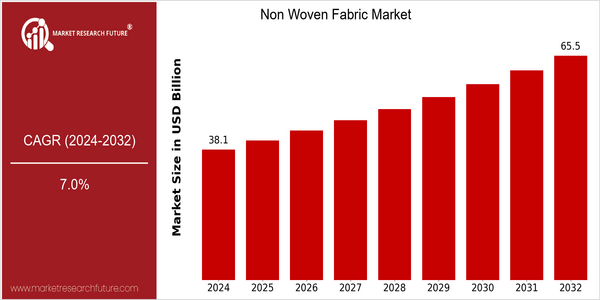

| Year | Value |

|---|---|

| 2024 | USD 38.1 Billion |

| 2032 | USD 65.46 Billion |

| CAGR (2024-2032) | 7.0 % |

Note – Market size depicts the revenue generated over the financial year

The global non-woven fabric market is poised for significant growth, with a current market size of USD 38.1 billion in 2024, projected to reach USD 65.46 billion by 2032. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 7.0% over the forecast period. The increasing demand for non-woven fabrics across various industries, including healthcare, automotive, and construction, is a primary driver of this expansion. Technological advancements in manufacturing processes, such as the adoption of eco-friendly materials and innovative bonding techniques, are further enhancing the market's potential. Key players in the non-woven fabric sector, such as DuPont, Ahlstrom-Munksjö, and Freudenberg, are actively investing in research and development to introduce new products and improve existing ones. Strategic initiatives, including partnerships and collaborations, are also prevalent as companies seek to leverage synergies and expand their market reach. For instance, recent product launches focusing on sustainable and biodegradable non-woven solutions are indicative of the industry's shift towards environmentally responsible practices, aligning with consumer preferences and regulatory trends. This dynamic landscape underscores the non-woven fabric market's resilience and adaptability, positioning it for sustained growth in the coming years.

Regional Market Size

Regional Deep Dive

The Non Woven Fabric Market is experiencing significant growth across various regions, driven by increasing demand in sectors such as hygiene, medical, and automotive. Each region exhibits unique characteristics influenced by local economic conditions, regulatory frameworks, and cultural preferences. The market dynamics are shaped by innovations in production technologies and sustainable practices, which are becoming increasingly important to consumers and manufacturers alike. As environmental concerns rise, the shift towards biodegradable and recyclable non-woven materials is also gaining traction, further enhancing the market's growth potential.

Europe

- Europe is at the forefront of sustainability initiatives, with many manufacturers focusing on eco-friendly non-woven fabrics, spurred by the European Union's stringent regulations on plastic use and waste management.

- Key players like Freudenberg and Ahlstrom-Munksjö are investing in R&D to develop biodegradable non-woven materials, which are expected to reshape the market landscape and cater to the growing consumer demand for sustainable products.

Asia Pacific

- The Asia-Pacific region is experiencing rapid industrialization, leading to increased demand for non-woven fabrics in various applications, particularly in the automotive and construction sectors, with companies like Toray Industries and Asahi Kasei expanding their production capabilities.

- Government initiatives in countries like China and India to promote the use of non-woven fabrics in hygiene products are driving market growth, as these materials are increasingly recognized for their cost-effectiveness and versatility.

Latin America

- Latin America is seeing a growing interest in non-woven fabrics for personal care and hygiene applications, driven by increasing consumer awareness and demand for quality products, with companies like Fitesa and Companhia Providência expanding their market presence.

- Regulatory changes aimed at reducing plastic waste are encouraging manufacturers to explore non-woven alternatives, which are perceived as more environmentally friendly, thus fostering innovation in product development.

North America

- The North American market is witnessing a surge in demand for non-woven fabrics in the healthcare sector, particularly due to the ongoing emphasis on hygiene and infection control, with companies like Kimberly-Clark and DuPont leading the charge in innovation.

- Recent regulatory changes, such as the FDA's updated guidelines on medical textiles, are pushing manufacturers to enhance product safety and performance, thereby driving technological advancements in non-woven fabric production.

Middle East And Africa

- In the Middle East and Africa, the non-woven fabric market is being propelled by the rising demand for hygiene products, particularly in the wake of the COVID-19 pandemic, with local manufacturers ramping up production to meet this need.

- The region's unique climatic conditions are also influencing the development of specialized non-woven fabrics, such as those used in agricultural applications, with companies like Spunbond and SAAF leading innovative projects.

Did You Know?

“Did you know that non-woven fabrics can be produced using a variety of methods, including spunbond, meltblown, and needle-punching, allowing for a wide range of applications from medical supplies to automotive interiors?” — Nonwovens Industry Magazine

Segmental Market Size

The Non Woven Fabric Market is experiencing robust growth, driven by increasing demand across various industries such as healthcare, automotive, and construction. Key factors propelling this segment include the rising need for disposable products, particularly in the medical sector, and stringent regulatory policies promoting the use of sustainable materials. Additionally, technological advancements in manufacturing processes enhance the quality and functionality of non-woven fabrics, further stimulating demand. Currently, the adoption of non-woven fabrics is in a mature stage, with companies like DuPont and Freudenberg leading the way in innovation and production. Primary applications include medical gowns, surgical masks, and geotextiles, showcasing the versatility of non-woven materials. Trends such as the global push for sustainability and the impact of the COVID-19 pandemic have accelerated the shift towards non-woven solutions. Furthermore, advancements in technologies like meltblown and spunbond processes are shaping the segment's evolution, enabling the production of high-performance fabrics that meet diverse industry needs.

Future Outlook

The Non Woven Fabric Market is poised for significant growth from 2024 to 2032, with the market value projected to increase from $38.1 billion to $65.46 billion, reflecting a robust compound annual growth rate (CAGR) of 7.0%. This growth trajectory is driven by the rising demand for non woven fabrics across various sectors, including healthcare, automotive, and construction. The increasing adoption of these materials in personal protective equipment (PPE) and hygiene products, particularly in the wake of the COVID-19 pandemic, has solidified their importance in everyday applications. By 2032, it is anticipated that non woven fabrics will account for over 30% of the total fabric market, underscoring their growing penetration in both consumer and industrial applications. Key technological advancements, such as the development of biodegradable non woven fabrics and innovations in manufacturing processes, are expected to further enhance market growth. Additionally, supportive government policies aimed at promoting sustainable materials and reducing plastic waste will likely drive the adoption of eco-friendly non woven solutions. Emerging trends, including the integration of smart textiles and the increasing focus on circular economy principles, will also shape the future landscape of the non woven fabric market. As industries continue to prioritize sustainability and performance, the non woven fabric market is set to evolve, presenting lucrative opportunities for manufacturers and stakeholders alike.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 33.27 billion |

| Growth Rate | 7.0% (2022-2030) |

Nonwoven Fabrics Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.