Rising Demand for Animal Protein

The increasing consumer preference for animal protein in North America is a pivotal driver for the feed premix market. As health-conscious consumers seek high-quality protein sources, livestock production is expected to rise. According to recent data, the demand for poultry and beef is projected to grow by approximately 3.5% annually. This surge in demand necessitates the use of specialized feed premixes to enhance growth rates and feed efficiency in livestock. Consequently, feed premix formulations that optimize nutrient absorption and promote animal health are becoming increasingly vital. The feed premix market must adapt to these changing consumer preferences by developing innovative products that cater to the nutritional needs of livestock, thereby ensuring sustainable production practices and meeting market demands.

Increased Focus on Animal Welfare

The growing emphasis on animal welfare in North America is reshaping the feed premix market. Consumers are becoming more aware of the ethical implications of livestock production, leading to a demand for products that ensure humane treatment of animals. This shift is prompting producers to adopt practices that prioritize animal health and well-being, which in turn influences their choice of feed. Feed premixes that support stress reduction, enhance immune function, and promote overall health are increasingly sought after. As a result, the feed premix market is likely to see a rise in demand for formulations that align with animal welfare standards. This trend not only reflects changing consumer values but also encourages producers to invest in high-quality feed premixes that contribute to better animal care.

Advancements in Nutritional Science

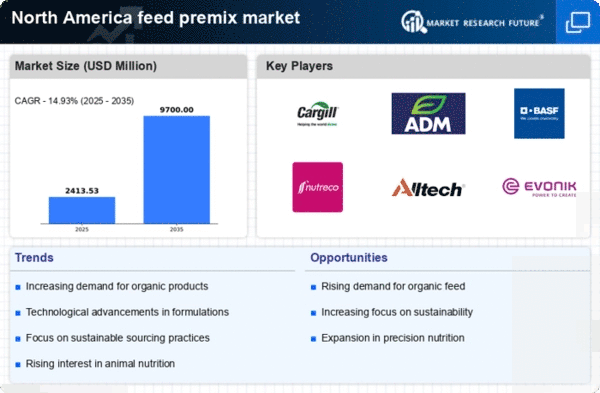

The feed premix market is significantly influenced by advancements in nutritional science. Research into animal nutrition has led to the development of specialized feed premixes that enhance growth performance and overall health in livestock. Innovations such as probiotics, prebiotics, and amino acid supplementation are gaining traction, as they are shown to improve feed conversion ratios and reduce disease incidence. The North American feed premix market is projected to reach approximately $1.5 billion by 2026, driven by these scientific advancements. As producers increasingly recognize the benefits of tailored nutritional solutions, the demand for high-quality feed premixes is likely to rise. This trend underscores the importance of continuous research and development in the feed premix market to meet the evolving needs of livestock producers.

Growth of Organic and Non-GMO Products

The rising consumer preference for organic and non-GMO products is a significant driver for the feed premix market in North America. As more consumers seek transparency in food production, livestock producers are responding by incorporating organic feed ingredients and non-GMO formulations into their practices. This shift is expected to propel the feed premix market, as organic livestock production is projected to grow at a rate of 5% annually. Producers are increasingly looking for feed premixes that comply with organic standards while still providing optimal nutrition. This trend not only reflects consumer demand but also encourages innovation within the feed premix market, as manufacturers develop products that meet these stringent requirements while ensuring livestock health and productivity.

Technological Integration in Feed Production

The integration of technology in feed production processes is transforming the feed premix market. Innovations such as precision feeding, data analytics, and automated mixing systems are enhancing the efficiency and accuracy of feed formulation. These technologies allow producers to tailor feed premixes to the specific nutritional needs of their livestock, optimizing growth and reducing waste. The North American feed premix market is expected to benefit from these advancements, with a projected growth rate of 4% annually. As producers increasingly adopt technology-driven solutions, the feed premix market is likely to see a shift towards more efficient and sustainable production practices. This trend highlights the importance of embracing technological advancements to meet the demands of a rapidly evolving agricultural landscape.