Impact of Social Media Trends

Social media platforms are significantly influencing consumer behavior within the fragrance market in North America. The rise of platforms like Instagram and TikTok has created new avenues for brands to engage with consumers, showcasing products through visually appealing content. Data indicates that fragrances promoted through social media campaigns can experience sales increases of up to 20% within a short period. This trend highlights the importance of digital presence in the fragrance market, as brands leverage user-generated content and influencer partnerships to enhance brand awareness and drive sales. As social media continues to evolve, its impact on consumer preferences and purchasing decisions is likely to grow.

Influence of Celebrity Endorsements

Celebrity endorsements play a pivotal role in shaping consumer preferences within the fragrance market in North America. High-profile figures often launch their own fragrance lines, which can lead to substantial sales boosts. For instance, fragrances associated with celebrities have been known to capture significant market shares, with some products achieving sales exceeding $100 million within their first year. This trend suggests that the fragrance market is heavily influenced by the allure of celebrity culture, as consumers are drawn to products that promise a connection to their favorite stars. Consequently, brands are increasingly collaborating with influencers and celebrities to enhance their visibility and appeal, thereby driving growth in the industry.

Growing Interest in Niche Fragrances

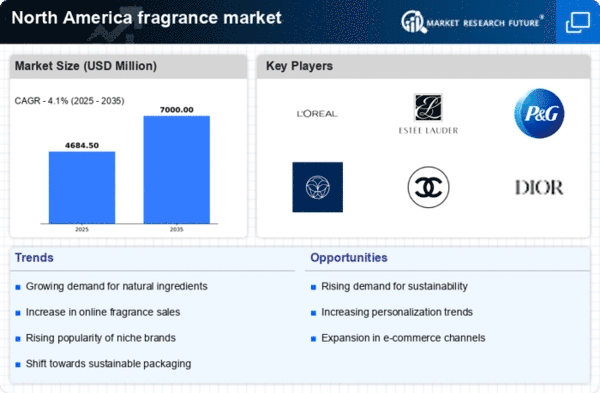

The fragrance market in North America is experiencing a burgeoning interest in niche and artisanal fragrances. Consumers are increasingly seeking unique and personalized scent experiences, moving away from mass-market offerings. This trend is reflected in the growth of niche brands, which have seen sales increase by approximately 15% annually. The fragrance market is responding by diversifying product lines to include more exclusive and limited-edition fragrances, catering to the desires of discerning consumers. This shift towards niche products suggests a potential for higher profit margins, as consumers are often willing to pay a premium for distinctive and high-quality scents.

Rising Demand for Natural Ingredients

The fragrance market in North America is experiencing a notable shift towards natural and organic ingredients. Consumers are increasingly concerned about the safety and environmental impact of synthetic chemicals, leading to a growing preference for products that utilize botanical extracts and essential oils. This trend is reflected in market data, indicating that the segment of natural fragrances is projected to grow at a CAGR of approximately 8% over the next five years. Brands that prioritize transparency in sourcing and production are likely to gain a competitive edge. As a result, the fragrance market is adapting by reformulating existing products and launching new lines that emphasize natural compositions, thereby appealing to health-conscious consumers.

E-commerce Growth and Digital Marketing

The fragrance market in North America is witnessing a significant transformation due to the rise of e-commerce and digital marketing strategies. Online sales channels have become increasingly important, with data indicating that e-commerce sales in the fragrance sector have surged by over 30% in recent years. This shift is largely attributed to the convenience of online shopping and the ability to access a wider range of products. Brands are investing in targeted digital marketing campaigns to reach consumers effectively, utilizing social media platforms and influencer partnerships. As a result, the fragrance market is evolving to meet the demands of a digitally-savvy consumer base, which is likely to continue shaping purchasing behaviors in the future.