Innovations in Flavor Profiles

The juice concentrate market in North America is witnessing a wave of innovation in flavor profiles, driven by consumer curiosity and the desire for unique taste experiences. Manufacturers are increasingly experimenting with exotic fruits and blends, creating new flavor combinations that appeal to adventurous consumers. This trend is supported by Market Research Future indicating that flavor innovation can lead to a 15% increase in sales for new product launches. As a result, the juice concentrate market is focusing on research and development to introduce novel flavors that not only satisfy consumer preferences but also differentiate products in a competitive landscape. This emphasis on flavor innovation is likely to enhance market growth and attract a broader consumer base.

Expansion of Distribution Channels

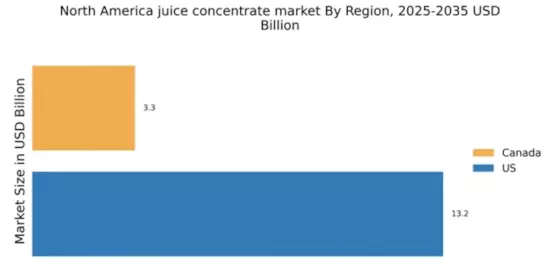

The juice concentrate market in North America is benefiting from the expansion of distribution channels, which enhances product accessibility for consumers. Retailers are increasingly diversifying their offerings by including juice concentrates in various formats, such as online platforms and specialty stores. This trend is supported by data indicating that e-commerce sales of juice products have grown by over 20% in the past year. As a result, the juice concentrate market is adapting to these changes by strengthening partnerships with distributors and exploring new sales avenues. This expansion not only increases market reach but also allows manufacturers to cater to a wider audience, ultimately driving growth in the juice concentrate market.

Convenience and On-the-Go Consumption

The juice concentrate market in North America is significantly influenced by the increasing demand for convenience and on-the-go consumption. Busy lifestyles and the need for quick, nutritious options drive consumers towards ready-to-drink beverages and concentrated juice products. The market has seen a rise in single-serve packaging and portable formats, catering to the needs of health-conscious consumers seeking quick refreshment. Recent data indicates that the ready-to-drink segment is expected to account for over 30% of the total juice concentrate market by 2026. This trend highlights the importance of convenience in the juice concentrate market, prompting manufacturers to innovate in packaging and product offerings to capture this growing consumer segment.

Rising Demand for Natural Ingredients

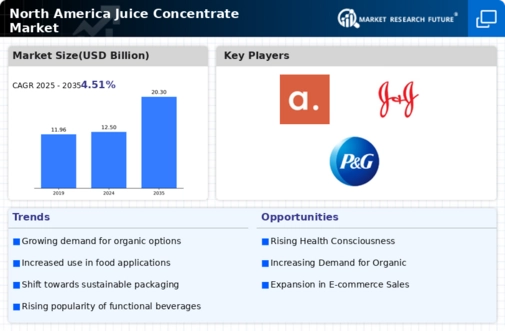

The juice concentrate market in North America experiences a notable surge in demand for natural ingredients. Consumers increasingly prefer products that are free from artificial additives and preservatives. This trend is driven by a growing awareness of health and wellness, leading to a shift towards organic and natural juice concentrates. According to industry reports, the market for organic juice concentrates is projected to grow at a CAGR of approximately 8% over the next five years. This shift not only influences consumer purchasing behavior but also compels manufacturers to innovate and reformulate their products to meet these evolving preferences. As a result, the juice concentrate market is adapting to these demands by sourcing high-quality, natural ingredients, thereby enhancing product appeal and market competitiveness.

Increased Focus on Nutritional Benefits

The juice concentrate market in North America is experiencing a heightened focus on the nutritional benefits of juice products. Consumers are increasingly seeking beverages that offer functional health benefits, such as enhanced immunity and improved digestion. This trend is reflected in the growing popularity of juice concentrates fortified with vitamins, minerals, and probiotics. Market analysis suggests that products highlighting these nutritional advantages are likely to capture a larger share of the market, with an expected growth rate of 6% annually. Consequently, the juice concentrate market is responding by reformulating existing products and developing new offerings that emphasize health benefits, thereby aligning with consumer demands for functional beverages.