Rising Demand for Packaging Solutions

The printing inks market in North America is significantly influenced by the rising demand for packaging solutions across various industries. With the growth of e-commerce and retail sectors, there is an increasing need for attractive and functional packaging that enhances product visibility. This trend is particularly evident in the food and beverage industry, where packaging plays a crucial role in consumer choice. The market for flexible packaging is expected to grow at a CAGR of around 5% over the next few years, driving the demand for specialized inks that can withstand various environmental conditions. Consequently, manufacturers in the printing inks market are likely to focus on developing inks that meet these specific requirements, thereby contributing to the overall growth of the industry.

Consumer Preferences for Customization

The printing inks market in North America is witnessing a shift in consumer preferences towards customization and personalization. As brands strive to differentiate themselves in a competitive landscape, there is an increasing demand for unique and tailored printing solutions. This trend is particularly prominent in sectors such as cosmetics and fashion, where packaging design plays a pivotal role in brand identity. The ability to offer customized inks that cater to specific design requirements is becoming a key competitive advantage for manufacturers. This demand for customization is expected to drive innovation in ink formulations, potentially leading to a market growth rate of around 3.5% annually. As a result, companies are likely to invest in research and development to create inks that meet these evolving consumer needs.

Regulatory Compliance and Safety Standards

The printing inks market in North America is subject to stringent regulatory compliance and safety standards, which are shaping the industry landscape. Government regulations regarding the use of hazardous materials in ink formulations are becoming increasingly rigorous. This has prompted manufacturers to reformulate their products to comply with safety standards, such as those set by the Environmental Protection Agency (EPA). As a result, there is a growing emphasis on the development of non-toxic and environmentally friendly inks. This shift not only addresses regulatory requirements but also aligns with consumer preferences for safer products. The market is likely to see a rise in the adoption of compliant inks, which could account for a substantial portion of the overall market share in the coming years.

Technological Advancements in Ink Production

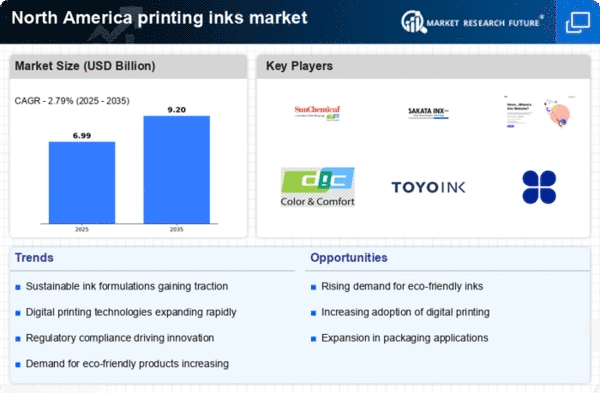

The printing inks market in North America is experiencing a notable transformation due to rapid technological advancements in ink production. Innovations such as the development of high-performance inks and eco-friendly formulations are becoming increasingly prevalent. These advancements not only enhance print quality but also improve the efficiency of the printing process. For instance, the introduction of UV-curable inks has gained traction, allowing for faster drying times and reduced energy consumption. As a result, manufacturers are likely to invest in these technologies, which could lead to a projected growth rate of approximately 4.5% annually in the printing inks market. This trend indicates a shift towards more sustainable and efficient production methods, aligning with the evolving demands of consumers and regulatory standards in North America.

Expansion of E-commerce and Digital Marketing

The printing inks market in North America is being propelled by the expansion of e-commerce and digital marketing strategies. As businesses increasingly shift towards online platforms, the need for high-quality printed materials, such as labels and promotional materials, is on the rise. This trend is particularly relevant for small and medium-sized enterprises (SMEs) that rely on effective branding to attract customers. The demand for short-run printing and quick turnaround times is driving the adoption of digital printing technologies, which require specialized inks. The market for digital inks is projected to grow at a CAGR of approximately 6% over the next few years, indicating a robust opportunity for manufacturers to cater to this evolving landscape. This expansion is likely to reshape the printing inks market, emphasizing the importance of adaptability and innovation.