Global Offshore Black Sea service providers Market Overview

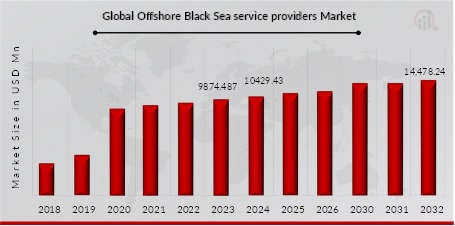

Offshore Black Sea service providers Market Size was valued at USD 9874.48 Million in 2023. The Offshore Black Sea service providers Market industry is projected to grow from USD 10429.43 Million in 2024 to USD 14,478.24 Million by 2030, exhibiting a compound annual growth rate (CAGR) of 5.62% during the forecast period (2024 - 2030).

The four main categories of offshore work are management, operations, construction, and exploration. A variety of tasks are possible for offshore oil workers, including drilling, surveying, diving, and conducting health and safety checks.

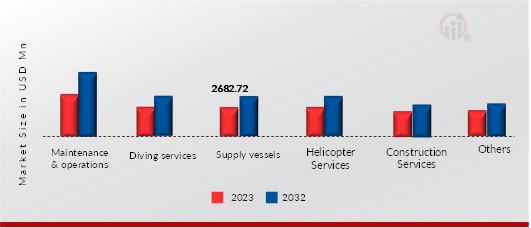

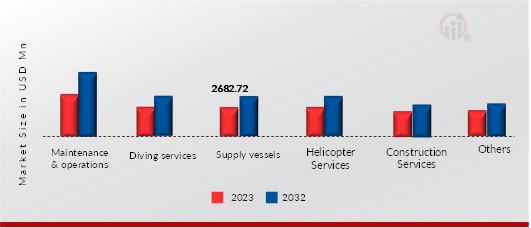

The Offshore Black Sea service providers market is segmented based services and port type. By services, the market is segmented into maintenance & operations, diving services, supply vessels, helicopter services, construction services and others. Of them, supply vessels services held the largest share in the market in 2023. Further, the segment is expected to continue its dominance over the forecast duration. By port type, the market is segmented into government running port and private running port with former dominating the market in 2023. However, private ports are expected to witness the highest CAGR over the forecast duration.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Offshore Black Sea service providers Market Trends

Revitalization Of Oil & Gas Industry

From 85 million barrels per day in 2006 to 118 million barrels per day in 2030, the world is projected to consume more oil. Emerging Asia (including China and India), which accounts for 45% of the global increase in oil consumption, is the main cause of the surge.

Between now and 2030, oil prices are predicted to stay within a range of US$ 50 and US$ 60 (based on business as normal; any disruption from war, terrorism, or weather will have a negative effect). This rate is significantly greater (on average) than what was observed over the previous 30 years. Oil corporations are prepared to invest more now that oil is more expensive in order to increase production. Due to a decline in investment between 1980 and 2000, offshore vessels have a poor spare capacity.

Large investments were made in offshore vessels during the beginning of the 1980s as a result of the high price of oil. But as the price of oil did not rise, these investments shrank in the years that followed. Because of this, utilization rates (of these older arteries) are exceedingly high as demand reaches a new level. All these factors collectively expected to drive the offshore black sea services over the forecast duration.

Rise In Number of Rigs/Offshore Leases

The percentage of active rigs is at an all-time high. A high drilling utilization rate is a sign that there will be a large demand for construction vessels because the exploration of oilfields is a risky and expensive operation. Demand for construction services typically lags exploratory drilling by six to eighteen months since it takes time to drill a well and construct a production platform.

A significant portion of the fleet of offshore vessels is currently older than 20 years old as a result of a lack of vessel investments over the previous 20 years. A large number of vessels will need to be replaced in the upcoming years because their average use-life is around 30 years. So even though there are a lot of ships ordered, many of them are likely to replace older ships already in service and so won't increase the number of ships that are available for usage.

In addition, evolving extraction conditions like greater depth result in a greater need for specialized equipment.

Overall Rise in Offshore Activity in Black Sea

Turkish Petroleum (TPAO) has found 540 bcm of gas in the western Black Sea over the past two years. The ultra-deep-water Sakarya and Amasra discovery wells were drilled by the drillship Fatih. Sakarya is thought to be the largest hydrocarbon discovery in the Black Sea and for the nation, with in-place quantities of 405 bcm. Estimates of Turkey's Black Sea resources would increase as a result of further evaluation of the massive Sakarya discovery, and fresh exploratory wells drilled by Turkish drill ships.

Turkey's negotiation stance over its gas imports from Azerbaijan, Iran, and Russia has been boosted by TPAO's exploration results, allowing it more clout to demand lower prices, lower volumes, and increased contract flexibility.

In addition, the pipelines will be transported and installed by Saipem, with the pipelay vessel Castorone doing the majority of the work. Beginning next spring, offshore operations are anticipated.

Further, ExxonMobil and Romgaz concluded their exclusive discussions and came to an agreement on the acquisition's terms and circumstances in October. Upon closing of the deal, OMV Petrom will take over as operator. The purchase is anticipated to be finalised in the first quarter of 2022, pending approval. The deepwater Domino gas discovery is located in the Neptun Deep block, which Romgaz and OMV Petrom hope to jointly exploit. All these ongoing activities are expected to provide a lucrative opportunity for the market players over the forecast duration.

Offshore Black Sea service providers Market Segment Insights

Offshore Black Sea service providers by Services Insights

The Offshore Black Sea service providers Market segmentation, based on Services has been segmented as maintenance & operations, diving services, supply vessels, helicopter services, construction services and others. Among these, the supply vessels segment is projected to dominate the Offshore Black Sea service providers Market revenue through the projected period. A range of technical problems and limitations that hinder offshore infrastructure from operating effectively and achieving sustainability are eliminated and minimized through operations and maintenance activities.

It's crucial for owners and operators to maintain dependable day-to-day operation and respond safely to scheduled and unanticipated events and interruptions if they want a project to be financially successful. Without regular inspections, repairs, and maintenance throughout its service life, even the most durable offshore infrastructure cannot function effectively.

The term "commercial offshore diving," frequently abbreviated to "offshore diving," primarily refers to the area of commercial diving where divers help the oil and gas industry's exploration and production sector. Maintenance of oil platforms and the construction of underwater structures are among the tasks performed in this sector of the industry. "Offshore" in this context denotes that the diving work is performed outside of national borders. Surface-supplied equipment is typically utilized for commercial offshore diving, though this depends on the task and location.

Offshore Supply Vessels, another name for Offshore Support Vessels, are specialized ships built for ocean operations and have several uses. They are capable of supporting platforms, handling anchors, building, maintaining, and other tasks. Offshore support vessels (OSVs) offer assistance with everything from fixing offshore wind turbines to carrying equipment to rigs. They are essential to developing and maintaining offshore machinery as well as moving supplies and materials where they are needed. Because of their adaptability, they may be created for almost any project.

The activity of monitoring and inspecting oil rigs as well as the delivery of cargo and people are referred to as offshore helicopter services. Some of the helicopter types that are frequently employed in these services are medium, heavy, and light.

Installing buildings and infrastructure in a sea environment is known as offshore construction. This is typically done to produce and transmit resources like power, oil, and gas.

The majority of construction and pre-commissioning is normally done onshore. Various building procedures have been devised in order to minimize the costs and dangers associated with the installation of massive offshore platforms.

Offshore Black Sea service providers by Services, 2023, 2030 (USD Million)

Offshore Black Sea service providers by Port type Insights

Based on Port type, the Offshore Black Sea service providers Market is segmented into private ports and government ports. The Government port dominated base year market and is also projected to dominate the Offshore Black Sea service providers Market revenue through the projected period. Government running port has dominated the market in offshore black sea services. One of the biggest ports in the Black Sea basin and the biggest in Krasnodar Krai is Novorossiysk Sea Port, or NSP in Russian. The NSP berthing line is the longest in all of Russia's ports at 8.3 kilometers.

Russia has the significant number of ports at Black Sea.

On the other hand, the private running ports are expected to witness the highest growth rate over the forecast duration. As it can result in improved marine and hinterland connectivity, efficient trade processes, and competitive port costs, effective port governance has a significant impact on freight transport costs. Increasing private sector participation is one strategy to cut costs and inefficiencies at ports. If the proper legislative framework is in place, private port operations often result in more effective and reasonably priced port services.

Since private businesses now run the majority of the terminals, the "port authority's" institutional status and responsibilities are currently the biggest obstacles to port reform.

Offshore Black Sea service providers by Port type, 2023, 2030 (USD Million)

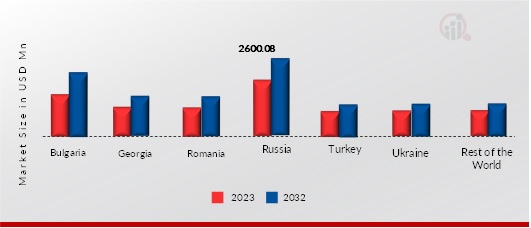

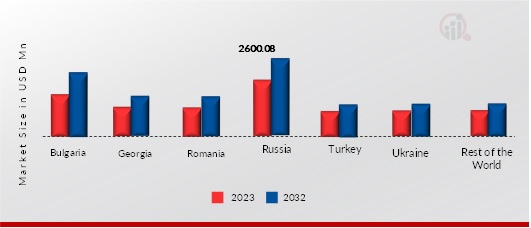

Offshore Black Sea service providers Country Insights

Based on Country, the Offshore Black Sea service providers market is segmented into Bulgaria, Georgia, Romania, Russia, Turkey, Ukraine and Rest of the World. The Russia Offshore Black Sea service providers market held the maximum market share and is also expected to account for the significant revenue share during the forecast period. The technical potential for offshore wind in the Black Sea was projected by the World Bank to be 435 MW last year, of which 269 GW would be fixed-bottom turbines and the remaining 166 GW would be floating turbines.

The neighboring Black Sea nation of Romania has declared it will pass an offshore wind law by the end of the year. By 2050, the European Union intends to have 300 GW of offshore wind installed.

According to a recent study by the Bulgarian Center for the Study of Democracy (CSD), the Black Sea territorial seas of Bulgaria provide 116 GW of technical wind potential, of which 26 GW can be harnessed in accessible areas with the present technological solutions.

Bulgaria could gain from the growth of offshore energy through job creation, new technology clusters, and Country supply chains for equipment. The offshore wind business has the potential to turn the two biggest ports in Bulgaria, Burgas and Varna, into centers for the reduction of carbon emissions, which would help the Black Sea Country's offshore wind industry grow.

However, the potential of Bulgarian maritime Countrys for the decarbonization of the energy sector is not taken into account by the existing national strategic document roadmaps. As a result, the roadmaps for the growth of the energy grid and maritime spatial planning are affected by the lack of strategic direction towards offshore wind energy development.

Offshore Black Sea service providers Country Insights, 2023 (USD Million)

Offshore Black Sea service providers Key Market Players & Competitive Insights

The Offshore Black Sea service providers Market is characterized by the presence of many global, Country, and local vendors. The market is highly competitive, with all the players competing to gain maximum market share. Intense competition, frequent changes in government policies, and regulations are key factors that impact market growth. The vendors compete based on cost, product quality, reliability, and aftermarket services. The vendors must provide cost-efficient and high-quality offshore black sea services to sustain their presence in an intensely competitive market environment.

The market is benefiting from the development of new technologies. The key players in the Offshore Black Sea service providers Market include Able UK, Aker Solutions ASA, AF GRUPPEN ASA, John Wood Group PLC, DNV GL, Heerema Marine Contractors (HMC), Allseas Group, TECHNIPFMC PLC, DeepOcean Group Holding B.V., Equinor ASA. These companies compete based on product quality, innovation, price, customer service, and market share. Companies also engage in various strategic initiatives, such as mergers and acquisitions, new product launches, partnerships, joint ventures, and expansions, to enhance their market position and expand their product portfolio.

Companies are also focusing on developing new and innovative products that meet the specific needs of their customers. Companies will need to continue to innovate and expand their product offerings to remain competitive. For instance, on April 2022, Heerema Marine Contractors awarded He Dreiht XL monopiles project. The work includes the transport and installation of 64 monopiles and transition pieces. During operations, Heerema will use the IHC IQIP double-walled noise mitigation system NMS-10,000 amongst other systems to reduce noise pollution.

Offshore Black Sea service providers Industry Developments

July 2022: Heerema Marine Contractors (HMC) has been awarded a contract by Norway’s Aibel to transport and install two offshore converter stations for Ørsted’s Hornsea 3 offshore wind farm in the UK.

November 2021: John Wood Group PLC, Inc. has been appointed by Turkish Petroleum (TP) as the integrated project management partner for the Sakarya Gas Field Development Project, located 150km off the coast of Turkey in the Black Sea.

Key Companies in the Offshore Black Sea service providers Market includes.

- Heerema Marine Contractors (HMC)

- DeepOcean Group Holding B.V.

Offshore Black Sea service providers Market Segmentation

Offshore Black Sea service providers Services Outlook

Offshore Black Sea service providers Port type Outlook

Offshore Black Sea service providers Country Outlook

- Rest of the World Rest of the World

| Report Attribute/Metric |

Details |

| Market Size 2023 |

USD 9874.48 Million |

| Market Size 2024 |

USD 10429.43 Million |

| Market Size 2030 |

USD 14,478.24 Million |

| Compound Annual Growth Rate (CAGR) |

5.62% (2024-2030) |

| Base Year |

2023 |

| Forecast Period |

2024-2030 |

| Historical Data |

2019 & 2022 |

| Forecast Units |

Value (USD Million) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Services, Port type, End-Users, and Country |

| Geographies Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

| Countries Covered |

US, Canada, Germany, UK, France, Russia, Italy, Spain, China, India, Japan, South Korea, Brazil, Mexico, Argentina, GCC Countries, South Africa |

| Key Companies Profiled |

Able UK, Aker Solutions ASA, AF GRUPPEN ASA, John Wood Group PLC, DNV GL, Heerema Marine Contractors (HMC), Allseas Group, TECHNIPFMC PLC, DeepOcean Group Holding B.V., Equinor ASA |

| Key Market Opportunities |

· Overall rise in offshore activity in black sea |

| Key Market Dynamics |

· Revitalization of Oil & Gas Industry · Rise in number of rigs/offshore leases |

Frequently Asked Questions (FAQ):

Able UK, Aker Solutions ASA, AF GRUPPEN ASA, John Wood Group PLC, DNV GL, Heerema Marine Contractors (HMC), Allseas Group, TECHNIPFMC PLC, DeepOcean Group Holding B.V., Equinor ASA