- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

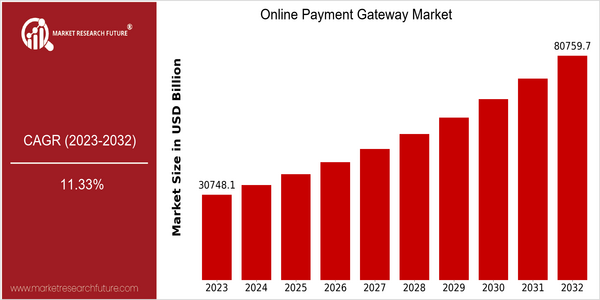

Online Payment Gateway Market Size Snapshot

| Year | Value |

|---|---|

| 2023 | USD 30748.1 Billion |

| 2032 | USD 80759.7 Billion |

| CAGR (2024-2032) | 11.33 % |

Note – Market size depicts the revenue generated over the financial year

The market for online payment systems is expected to grow at a rapid pace, and the current market size is estimated to reach $29,771.4 billion by 2023. By 2032, it is expected to reach $80,759.7 billion. This represents a strong compound annual growth rate (CAGR) of 11.33% from 2024 to 2032, which indicates a strong upward trend in the use of digital payment solutions. Combined with the growing shift towards e-commerce, accelerated by the COVID-19 pandemic, the demand for safe and reliable digital payment systems is driving market growth. There are many factors that are contributing to this growth, including the increasing use of smartphones and the Internet, which make it easier to conduct online transactions. Also, the development of new payment methods such as contactless and block-chain, which enhance the security and speed of digital payments, is a major factor driving market growth. The major players, such as PayPal, Stripe and Square, are investing heavily in new developments and strategic alliances to enhance their offerings. The recent acquisition of Honey by PayPal and the company’s foray into the world of cryptocurrencies are good examples of these strategic moves to maintain their market dominance.

Regional Deep Dive

The online payment gateway market is expected to grow significantly across different regions, owing to the rising adoption of e-commerce, mobile wallets, and digital wallets. North America has the most advanced technology and the highest penetration of the Internet. Europe has a strong regulatory framework, which promotes safe and secure online transactions. The Asia-Pacific region is expected to grow rapidly, owing to the growing middle class and the penetration of smart phones. The Middle East and Africa (MEA) region is expected to grow significantly, owing to the rising penetration of the Internet and the young population. Latin America is expected to grow rapidly, owing to the growing need for financial inclusion and the emergence of fintech companies.

North America

- After the COVID-19 epidemic, contactless payment systems had taken off. Companies like PayPal and Square were leading the way.

- Regulations such as the Payment Services Directive 2 (PSD2), which will be implemented in January 2018, enhance the protection of consumers and stimulate competition among payment service providers.

- The collaboration between the traditional banks and the fintechs has created a more integrated payment system, as demonstrated by the JP Morgan-FinTech alliance.

Europe

- The European Union’s strong regulatory stance on data protection, in particular the General Data Protection Regulation (GDPR), has had a profound effect on the way payment service providers handle data.

- Revolut and Transferwise have been at the forefront of this revolution.

- The rise of Buy Now Pay Later (BNPL) services, which have been growing steadily in popularity of late, is changing the behavior of consumers and influencing payment gateways.

Asia-Pacific

- The growth of e-commerce in China and India is boosting the growth of the payment system. In China, Alibaba and Paytm are the big players.

- The digitalization of payments is supported by the governments, like the digital India programme.

- In Southeast Asia, the rising use of smart phones and the increasing use of mobile wallets is changing the payment landscape. Gojek and Grab are at the forefront of the new wave.

MEA

- “The young people of the MEA region are more and more accepting of digital payment solutions, and companies like PayFort and Fawry are gaining in popularity.

- The Egyptian Central Bank is putting in place a legal framework to encourage the use of digital currencies.

- The growth of e-commerce platforms in the region is driving the need for secure payment gateways, and local players like Souq.com and Jumia are expanding their payment options.

Latin America

- The rise of fintech companies in Latin America, such as Nubank and MercadoPago, is transforming the digital payment landscape and increasing financial inclusion.

- In Brazil, the central bank launched the PIX system for instant payments.

- The rise in mobile phone penetration and Internet access has pushed up the number of consumers who are buying things through the Internet and the number of people who are paying for things through payment gateways.

Did You Know?

“By 2023, sixty per cent of all transactions in the world will be done on mobile devices. This will be the main factor in the shift towards mobile payment solutions.” — Statista

Segmental Market Size

The payment gateway is the backbone of the digital transaction system. The gateway is experiencing tremendous growth. The growth is mainly due to the growing preference of the consumers for the virtual shopping, and it has been further accelerated by the CovID-19 pandemic, which has pushed many of the businesses to the digital platform. The regulatory initiatives to promote cashless transactions and the growth of e-commerce have also increased the demand for the secure and efficient payment solutions.

In the United States, the use of the payment gateway is at a mature stage. The leaders are PayPal, Stripe and Square. These companies have set up a presence in many countries, especially in North America and Europe, where the digital payment system is well developed. The main applications are e-commerce platforms, mobile applications and subscription services where the ease of payment is essential. The evolution of the sector is marked by the increasing importance of cybersecurity, the integration of artificial intelligence into fraud detection, and the growing acceptance of cryptocurrencies.

Future Outlook

The market for online payment gateways is set to experience a significant growth from 2023 to 2032, with a CAGR of 11.33%. According to eMarketer, e-commerce will account for over 70% of retail sales by 2032. The shift to digital transactions, accelerated by the COVID pandemic, has fundamentally changed consumers’ behavior, resulting in a sustained demand for safe and convenient payment solutions across industries, including retail, travel, and services.

The ensuing years will see a growing use of artificial intelligence in fraud detection and risk management. The rise of mobile wallets and contactless payments will also spur the market, as consumers prefer a simpler and more convenient payment experience. The regulatory framework, such as the European Union’s new Payment Services Directive (PSD2), will also have an impact on the payment services industry. And that will bring about new players and new solutions, a dynamic industry which will meet the changing needs of both consumers and businesses.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 25,715.6 Billion |

| Market Size Value In 2023 | USD 30,748.1 Billion |

| Growth Rate | 11.3% (2023-2032) |

Online Payment Gateway Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.