- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

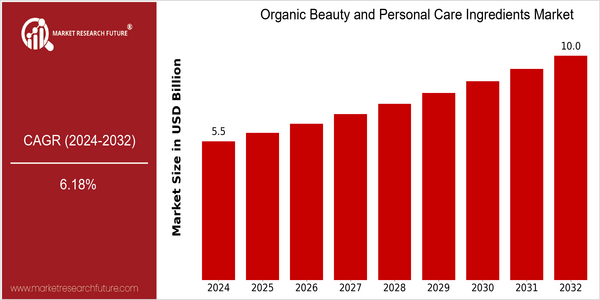

| Year | Value |

|---|---|

| 2024 | USD 5.5 Billion |

| 2032 | USD 10.02 Billion |

| CAGR (2024-2032) | 6.18 % |

Note – Market size depicts the revenue generated over the financial year

The Organic Personal Care and Beauty Market is expected to reach $ 5.5 billion by 2024, reaching $ 10.2 billion by 2032. This growth rate represents a high CAGR of 6.8 % during the forecast period. The growing demand for natural and organic products, mainly due to the increasing awareness of the harmful effects of synthetic substances, is driving this market. Furthermore, the trend towards clean beauty and the growing interest in sustainable and eco-friendly products are also contributing to the change in consumer behavior. In addition, the major market players, such as BASF, Croda International, and Evonik Industries, are investing in research and development to expand their product portfolio. Strategic initiatives, such as the establishment of strategic alliances with organic farms and the establishment of sustainable sourcing systems, are increasingly common. Moreover, the integration of advanced technologies in the development of organic products will help to develop more effective and safer products.

Regional Market Size

Regional Deep Dive

Organic cosmetics and personal care ingredients are experiencing significant growth in all regions of the world, driven by the increasing awareness of consumers about the benefits of natural ingredients and the shift towards sustainable practices. In North America and Europe, the stricter regulations and the growing demand for clean label products are bolstering the market, while in Asia-Pacific the demand is being driven by rising living standards and changing beauty standards. In the Middle East and Africa, and Latin America, too, the market is gaining momentum, largely due to cultural preferences for natural products and a growing middle class that is increasingly concerned with health and well-being.

Europe

- The European Union's REACH regulation is pushing companies to reformulate products with safer, organic ingredients, thereby enhancing the market for organic beauty and personal care ingredients.

- Innovative brands like L'Occitane and Weleda are leading the charge in sustainable sourcing and production, setting benchmarks for environmental responsibility in the beauty industry.

Asia Pacific

- The rise of K-beauty (Korean beauty) has introduced a plethora of organic ingredients, with brands like Innisfree focusing on natural components sourced from Jeju Island, influencing consumer preferences across the region.

- Regulatory bodies in countries like Japan and South Korea are increasingly endorsing organic certifications, which is expected to boost consumer trust and market growth for organic beauty products.

Latin America

- Brazil is emerging as a key player in the organic beauty market, with local brands like Natura focusing on biodiversity and sustainable sourcing from the Amazon rainforest, appealing to both local and international consumers.

- The region is witnessing a rise in consumer preference for cruelty-free and organic products, influenced by cultural values that prioritize natural beauty and environmental conservation.

North America

- The Clean Beauty movement is gaining momentum, with brands like Beautycounter advocating for stricter regulations on cosmetic ingredients, leading to increased consumer demand for transparency and safety in beauty products.

- Major companies such as Estée Lauder and Procter & Gamble are investing heavily in organic formulations, reflecting a broader trend towards sustainability and eco-friendly practices in product development.

Middle East And Africa

- The demand for organic beauty products is being driven by a growing awareness of health and wellness, with local brands like KAYALI and Huda Beauty emphasizing natural ingredients in their formulations.

- Government initiatives in countries like the UAE are promoting sustainable practices in the beauty industry, encouraging local manufacturers to adopt organic ingredients and eco-friendly packaging.

Did You Know?

“Over 70% of consumers in the U.S. are willing to pay more for beauty products that contain organic ingredients, reflecting a significant shift in purchasing behavior towards health-conscious choices.” — example.com, 2023

Segmental Market Size

The organic cosmetics and personal care ingredients market is growing rapidly, driven by a growing awareness of consumers about health and the environment. The shift towards a cleaner cosmetics market, in which consumers seek natural and organic products without harmful chemicals, and the increasingly stringent regulatory requirements for safer formulations, are driving demand. Also, technological innovations in the sourcing and formulation of ingredients, which enhance the performance and the sustainable development of products, are contributing to the growth of the market. The market is currently at a mature stage of development, with L'Oréal and Unilever leading the way in the development of organic products. In the most developed regions of North America and Europe, consumers are increasingly choosing brands that prioritise the environment. The major applications of organic ingredients are in skin care, hair care and makeup. The main applications are transparency and efficacy. The emergence of the COV 19 pandemic and the resulting rise in personal care has pushed the trend towards more personal care products. The growing trend towards sustainable development is pushing brands to develop new products with eco-friendly practices and materials.

Future Outlook

In the beauty and cosmetics market, the organic cosmetics and personal care market is expected to grow from $ 5.5 billion in 2024 to $ 10 billion in 2032, with a CAGR of 6.18%. The growth is driven by the growing demand for natural and organic products due to the growing awareness of the harmful effects of synthetic chemicals in cosmetics. The penetration of organic ingredients into the main cosmetics and personal care market is expected to be more than 30% in developed countries by 2032. In addition, technological development and government policies will also play an important role in the development of the market. Technological advances in extraction and formulation technology will increase the stability and effectiveness of organic ingredients, making them more attractive to both manufacturers and consumers. The government's support for sustainable development and organic certification will also boost the development of the market. The trend of clean beauty, the development of ingredient transparency, and the popularity of individualized beauty solutions will also drive the demand for organic ingredients.

Organic Beauty & Personal Care Ingredients Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.