- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

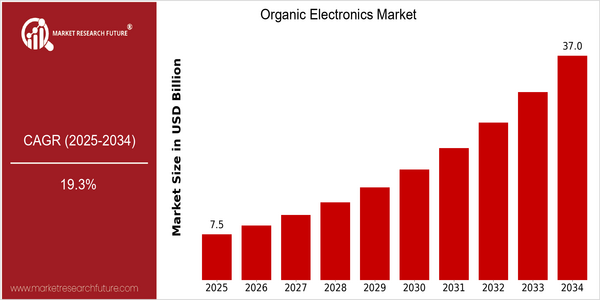

| Year | Value |

|---|---|

| 2025 | USD 7.51 Billion |

| 2034 | USD 37.05 Billion |

| CAGR (2024-2032) | 19.3 % |

Note – Market size depicts the revenue generated over the financial year

The organic electronics market is expected to grow significantly, from a market size of $ 7.5 billion in 2025 to $ 37 billion in 2034. This remarkable growth rate corresponds to a CAGR of 19.3 percent from 2024 to 2032. The development of the market is driven by the growing demand for flexible and lightweight electronics, as well as the advancement of organic materials and manufacturing processes. Organic light-emitting diodes (OLEDs), organic photovoltaics (OPVs) and organic semiconductors have a particular impact on the development of next-generation consumer electronics and the development of new energy solutions. The leading companies in the organic electronics industry, such as Samsung Display, Universal Display and LG Chem, are investing heavily in R & D to improve the performance and cost of their products. Strategic initiatives, such as the establishment of cooperation and joint ventures, also contribute to the growth of the market. Among other things, the collaboration between technology companies and research institutes is driving innovation in organic materials, which is the foundation for the commercialization of advanced organic electronics. The combination of technological development and strategic investment is important for the future development of the organic electronics market.

Regional Market Size

Regional Deep Dive

The Organic Electronics Market is growing rapidly in various regions, driven by the increasing demand for flexible and lightweight devices, the rise in the importance of energy efficiency and the need to protect the environment. The market is influenced by the developments in each region, such as innovations, regulatory frameworks, and economic conditions, which may affect the adoption of organic electronics. Each region has its own opportunities and challenges, and the players and initiatives are determining the future of organic electronics, including displays, sensors, and solar cells.

Europe

- The European Union has implemented stringent regulations on electronic waste, which is encouraging manufacturers to adopt organic electronics as a more sustainable alternative, thus fostering a shift towards eco-friendly technologies.

- Collaborative projects such as the 'Organic Photonics and Electronics' initiative are bringing together universities and industry leaders to advance the development of organic electronic materials and devices, enhancing the region's competitive edge.

Asia Pacific

- Countries like Japan and South Korea are at the forefront of organic electronics innovation, with companies such as Sony and Samsung investing in next-generation organic displays, which are expected to revolutionize consumer electronics.

- The region's growing focus on smart cities and IoT applications is driving demand for organic sensors and flexible electronics, with government initiatives supporting research and development in these areas.

Latin America

- Brazil is leading the world in research on organic electronics. Universities and research centers are collaborating with private industry to develop organic materials for use in the manufacture of these devices, which is expected to boost the country’s manufacturing industry.

- Government initiatives aimed at promoting green technologies are encouraging the adoption of organic electronics, particularly in sectors like agriculture and healthcare, where flexible and lightweight devices can provide significant advantages.

North America

- Several research and development programs have been started by the United States Government, with the object of promoting research in organic chemistry, particularly in the fields of solar energy and new technology.

- Major companies like Universal Display Corporation and Eastman Chemical Company are investing heavily in R&D for organic light-emitting diodes (OLEDs), leading to breakthroughs in efficiency and performance that are likely to drive market growth.

Middle East And Africa

- The Middle East is witnessing a rise in investments in renewable energy projects, which is creating opportunities for organic photovoltaics, particularly in countries like the UAE that are focusing on sustainable energy solutions.

- Local startups are emerging in the organic electronics space, leveraging regional resources and talent to develop innovative solutions tailored to the unique environmental conditions of the region.

Did You Know?

“Organic electronics can be produced using low-cost printing techniques, which allows for the manufacturing of flexible and lightweight devices that can be integrated into a variety of surfaces.” — Journal of Organic Electronics

Segmental Market Size

Organic Electronics, especially Organic Light-Emitting Diodes (OLEDs) and Organic Photovoltaics (OPVs), is currently experiencing a great boom. This is largely driven by the growing demand for flexible and energy-efficient displays, as well as by government regulations that promote sustainable technology. The resulting push towards eco-friendly products is forcing manufacturers to come up with innovations, thus driving the market even further. Organic Electronics has reached the stage of commercialization. Leading OLED manufacturers such as Samsung and LG Display are pushing OLEDs, while Heliatek is leading the way with OPVs and building-integrated photovoltaics. Several key applications are flexible displays in smartphones and wearables, and energy-generating surfaces on buildings. As a result of trends such as sustainable initiatives and regulations, the market is growing rapidly. The market is evolving as a result of advances in printing and materials technology, which are making organic electronics increasingly efficient and accessible.

Future Outlook

. . The emergence of organic electronics has also led to an increase in the use of these materials in flexible displays, organic photovoltaics, and wearables. By 2034, organic electronics are expected to account for 25 percent of the total market for all the devices, driven by advances in materials science and manufacturing. The development of high-performance organic semiconductors and the integration of organic and silicon-based devices will drive the market. Moreover, supportive government policies encouraging sustainable and eco-friendly technology are likely to increase investment in organic electronics. Emerging trends such as the Internet of Things (IoT) and smart textiles will also create opportunities for organic devices. .As the industry evolves, companies must stay agile to take advantage of the opportunities and navigate the competitive landscape.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 19.39% (2024-2032) |

Organic Electronics Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.