- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

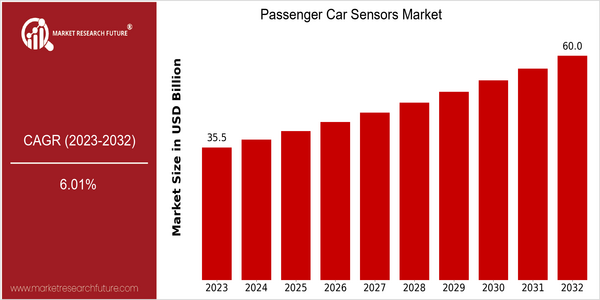

| Year | Value |

|---|---|

| 2023 | USD 35.49 Billion |

| 2032 | USD 60.0 Billion |

| CAGR (2024-2032) | 6.01 % |

Note – Market size depicts the revenue generated over the financial year

The global market for car sensors is valued at $34.88 billion in 2023 and is expected to reach $60 billion by 2032, growing at a CAGR of 6% from 2024 to 2032. This growth trajectory reflects the strong demand for advanced sensors in the automobile industry, which is mainly driven by the increasing importance of vehicle safety, automation and network. The integration of sensors in collision avoidance, parking assistance and driver monitoring is becoming an essential part of the car. There are many factors driving this growth, including the rising popularity of electric vehicles and the development of the trend towards self-driving. Lidar, radar and advanced camera systems are being used to enhance the capabilities and safety of vehicles. The major players in the market, such as Robert Bosch, Continental AG and Denso, are constantly developing new sensors and introducing new products. Strategic initiatives, such as collaborations with technology companies and the development of smart mobility, will help them to take advantage of the growing demand for sensors and thus drive market growth in the future.

Regional Market Size

Regional Deep Dive

The Passenger Cars Sensors Market is growing rapidly across various regions. This growth is mainly due to the technological advancements in the automobile industry, increasing demand for safety features, and the regulatory requirements. The North America region is characterized by the strong presence of major automobile manufacturers and the high penetration of advanced driver assistance systems (ADAS). The Europe region is experiencing a high level of innovation, especially in electric vehicles and driverless cars. The Asia-Pacific region is the fastest-growing region due to the growing vehicle production and the rising middle class. The Middle East and Africa region is slowly adopting smart technology in vehicles, mainly because of the growing urbanization and the development of public transport. The Latin America region is focusing on enhancing the vehicle safety and emissions standards, which is driving the demand for sensors.

Europe

- The European Union's Green Deal is pushing for the adoption of electric vehicles, leading to increased demand for battery management and environmental sensors.

- Innovations in sensor technology are being spearheaded by companies like Valeo and Infineon, focusing on enhancing vehicle connectivity and safety features.

Asia Pacific

- China is rapidly becoming a leader in the passenger car sensors market, with significant investments in smart vehicle technologies and government support for electric vehicle production.

- Japanese automakers, such as Toyota and Honda, are integrating advanced sensor systems into their vehicles to enhance safety and fuel efficiency, responding to consumer demand for smarter cars.

Latin America

- Brazil is implementing new regulations aimed at improving vehicle safety, which is increasing the demand for passenger car sensors.

- Local companies are beginning to partner with global sensor manufacturers to enhance the technological capabilities of their vehicles, focusing on affordability and safety.

North America

- The U.S. government has implemented stricter safety regulations, mandating the inclusion of advanced sensors in new vehicles, which is driving innovation and investment in the sector.

- Major companies like Bosch and Continental are investing heavily in R&D for sensor technologies, particularly in the development of LiDAR and radar systems for autonomous vehicles.

Middle East And Africa

- The UAE is investing in smart city initiatives, which include the integration of advanced sensors in vehicles to improve traffic management and safety.

- Local automotive manufacturers are collaborating with international tech firms to develop sensor technologies tailored to the unique driving conditions in the region.

Did You Know?

“Did you know that the average modern vehicle can contain over 100 sensors, monitoring everything from tire pressure to engine performance?” — Automotive News

Segmental Market Size

The passenger car sensors market is experiencing a steady growth due to the rising demand for advanced driver assistance systems (ADAS) and the demand for enhanced vehicle safety. The main drivers of this market are stricter regulations on road safety and the increasing demand for smart, connected vehicles. The technological advancements in sensors, such as LiDAR and radar, are also stimulating the market, as car manufacturers are integrating them into new models. The market is now at the stage of mass production, with companies such as Tesla and Ford leading the way in deploying advanced sensors in their fleets. The main applications are collision avoidance systems, parking assistance and active cruise control, which are becoming standard in many new passenger cars. The macro-economic trends of sustainability and electric vehicles are also boosting the market, as manufacturers are focusing on improving vehicle efficiency and safety. Machine learning and artificial intelligence are also influencing the evolution of passenger car sensors, as they enable more accurate data processing and real-time decision-making.

Future Outlook

The Passenger Car Sensors Market is set to experience significant growth between 2023 and 2032, as the market value is expected to increase from US$35.49 billion to $60 billion, at a Compound Annual Growth Rate (CAGR) of 6.01%. The key growth drivers are the growing demand for ADAS and the growing focus on vehicle safety and automation. The penetration of sensors in passenger cars is expected to increase to more than 70% in 2032, from about 47% in 2023. Further technological developments, such as the development of more sophisticated radar, lidar and camera systems, will also enhance the functionality of sensors. The push for electric vehicles and the implementation of smart city initiatives will also open up new opportunities for sensors, especially in the field of vehicle-to-everything (V2X) communication. The rise in demand for autonomous driving and the use of artificial intelligence in the processing of sensor data will also have a major impact on the market. The evolution of these trends will continue, and market participants will need to be flexible and agile to make the most of the opportunities presented by this dynamic market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | (2022-2030 Base Year 2021 Forecast Period 2022-2030 Historical Data 2019 & 2020 Forecast Units Value (USD Million Report Coverage Revenue Forecast, Competitive Landscape, Growth Factors, and Trends Segments Covered Sensor Type, Application Geographies Covered North America, Europe, Asia-Pacific, and Rest of the World (RoW) Key Vendors Robert Bosch GmbH, Continental AG, Denso Corporation, Delphi Automotive PLC, Allegro Microsystems LLC, Analog Devices Inc., CTS Corporation, Elmos Semiconductors, Infineon Technologies and TRW Automotive Key Market Opportunities New product launches and R&D Amongst major key Players Key Market DriversEfficiency, stringent emission norms, safety and comfortAdvancements such as tire pressure monitoring systems, occupant detection, electronic stability control, heating and ventilation air conditioning |

Passenger Car Sensors Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.