Research Methodology on Pet Food Packaging Market

1 Introduction

The research methodology adopted for this research report is aimed at gathering information from both primary and secondary sources. The following section will provide a detailed discussion of the various techniques and strategies adopted for the research report. This report gives an analysis of the global Pet Food Packaging Market, highlighting the market drivers and opportunities that are expected to be generated by the industry in the near future.

2 Objectives Of The Study

The main objective of this research report is to:

- Analyse the global Pet Food Packaging Market and identify the key trends and drivers of the industry.

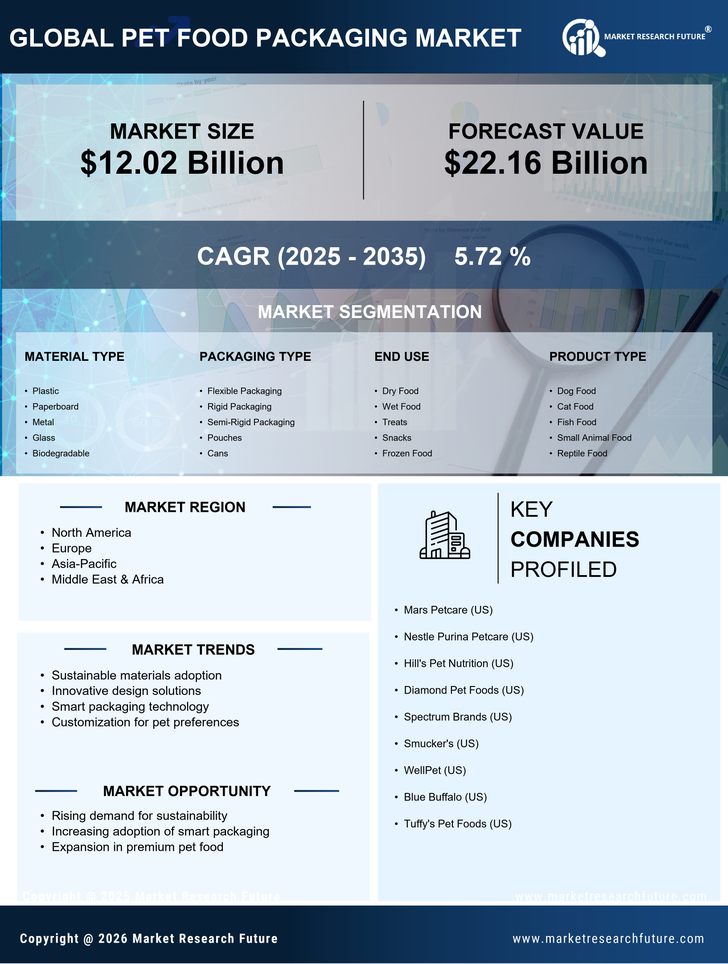

- Estimate the size and growth rate of the Pet Food Packaging Market.

- Provide an in-depth understanding of the factors affecting the growth of the industry and analyse the various technological advancements in the industry

- Analyse the effect of different regulatory and policy changes on the growth of the industry.

- Analyse the competitive landscape of the industry and identify the major players in the market

3 Research Design

3.1 Primary Research

This research study is based on primary research that was conducted using several sources, such as interviews with industry experts, key opinion leaders, consumer surveys, and industry journals. The primary research was conducted to research and understand the current trends, challenges, and opportunities in the industry.

3.2 Secondary Research

The secondary research was conducted using numerous sources such as company websites, country-specific data, World Bank publications, media publications, and SEC filings. Secondary research was also conducted to understand the size and scope of the Pet Food Packaging Market and the various segments within it.

4 Scope Of The Study

The scope of the research report was to analyse the global Pet Food Packaging Market and determine its development opportunities. The research report also provides a detailed analysis of the factors driving the industry and the various macro factors such as regulatory and policy changes, technological advancements, and the competitive landscape of the industry.

5 Market Segmentation

The global Pet Food Packaging Market has been segmented based on product type, material type, and region.

• By Product Type:

o Boxes

o Bags

o Cans

o Pouches

o Others

• By Material Type:

o Plastic

o Paper

o Metal

o Glass

o Others

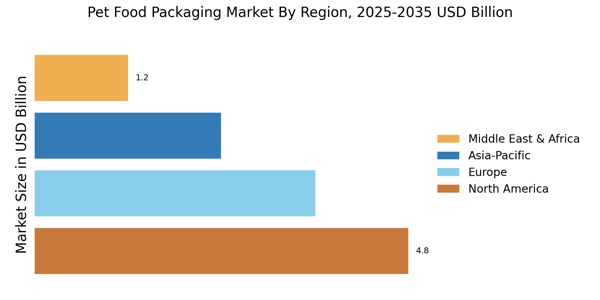

• By Region:

o North America

o Europe

o Asia Pacific

o Latin America

o Middle East & Africa

6 Data Collection & Data Analysis

The data collection process included interviews with industry experts, secondary research using industry journals, and consumer surveys. The data is analysed using several techniques, such as Porter’s Five Force Model, PESTEL Analysis, SWOT Analysis, and Market Attractiveness Analysis.

7 Conclusion

The research methodology adopted for this research report was aimed at gathering information from both primary and secondary sources. It is expected that the research techniques used for this research report will provide an in-depth understanding of the global Pet Food Packaging Market, its drivers and challenges, and the various opportunities that are expected to be generated by the industry in the near future.