- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

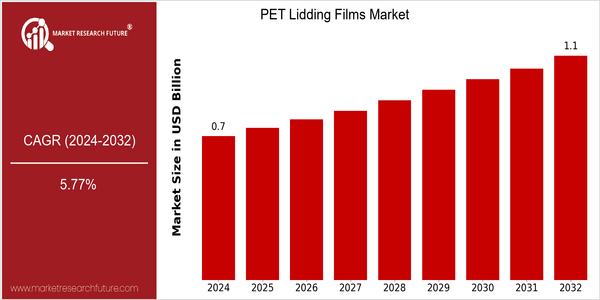

| Year | Value |

|---|---|

| 2024 | USD 0.68 Billion |

| 2032 | USD 1.07 Billion |

| CAGR (2024-2032) | 5.77 % |

Note – Market size depicts the revenue generated over the financial year

PET lidding films market is estimated to reach a market size of $ 680 million by 2024, and is projected to reach $ 1,070 million by 2032, at a CAGR of 5.77%. This upward trend indicates a high demand for PET lidding films, driven by the versatility and increasing applications in various industries, especially in food packaging, pharmaceuticals and consumer goods. The focus on the environment by both manufacturers and consumers is driving the demand for sustainable packaging, which is reflected in the shift towards recyclability and lower environmental impact compared to other packaging materials. This is the main reason why the leading companies in the PET lidding films market, such as Amcor, Sealed Air, Bemis, etc., are investing in new production methods and strategic alliances to enhance their product offerings and market positions. These companies are developing new lidding films with better barrier properties and more individualized designs to meet the needs of the end users. These companies are also working closely with food and beverage companies to develop new lidding film solutions for sustainable packaging.

Regional Market Size

Regional Deep Dive

PET top films market is experiencing a high growth in demand for convenient packaging solutions in the food and beverage sector. The North American market is characterized by a high focus on innovation and on the development of eco-friendly lidding films. Europe is characterized by a strong regulatory framework that encourages the use of recyclate materials, while the Asia-Pacific region is experiencing a high growth in urbanization and industrialization, resulting in an increased demand for products in packaging. The Middle East and Africa are gradually adopting modern packaging solutions, driven by changing consumer preferences, while the Latin American market is experiencing high growth due to increasing incomes and the growth of the food industry.

Europe

- The European Union's Circular Economy Action Plan is driving significant changes in the PET lidding films market, with companies like Coveris and Klöckner Pentaplast investing in biodegradable and recyclable film technologies.

- Regulatory changes in several European countries are mandating the reduction of plastic waste, leading to increased demand for lidding films that comply with these new standards.

Asia Pacific

- The rapid growth of the food and beverage industry in countries like China and India is leading to increased demand for PET lidding films, with companies such as Uflex and Jindal Poly Films expanding their production capacities.

- Innovations in printing technology are allowing for high-quality graphics on lidding films, enhancing product appeal and driving market growth, particularly in the snack food segment.

Latin America

- The growing middle class in Latin America is driving demand for packaged food products, leading to increased consumption of PET lidding films, with companies like Grupo Phoenix expanding their product lines.

- Regulatory changes in countries like Brazil are promoting the use of recyclable materials in packaging, influencing local manufacturers to adapt their PET lidding film offerings.

North America

- The U.S. Food and Drug Administration (FDA) has introduced new guidelines that encourage the use of recyclable materials in food packaging, prompting companies like Amcor and Sealed Air to innovate their PET lidding film offerings.

- Recent trends indicate a shift towards lightweight and thinner lidding films, which are being developed by companies such as Bemis Company, Inc., to reduce material usage and enhance sustainability.

Middle East And Africa

- The rise of modern retail formats in the Middle East is increasing the demand for convenient packaging solutions, with companies like Al Bayader International investing in advanced PET lidding film technologies.

- Government initiatives aimed at reducing plastic waste are encouraging manufacturers to explore sustainable alternatives, impacting the types of lidding films produced in the region.

Did You Know?

“Approximately 30% of all food packaging in the world is made from PET, making it one of the most widely used materials in the packaging industry.” — European PET Bottle Platform (EPBP)

Segmental Market Size

The PET-Lidding-Films division plays a crucial role in the packaging industry, especially in food and beverage applications, where it is currently experiencing solid growth. There are several reasons for this: the trend towards greater convenience and the increasing importance of hygiene and shelf life. The growing demand for sustainable packaging solutions is also pushing manufacturers towards PET lidding films, which are more sustainable and more environmentally friendly than conventional materials. PET lidding films are currently in a mature phase of their development, and companies such as Amcor and Sealed Air are driving forward the technological development. These lidding films are especially suitable for ready-to-eat meals, dairy products and medical packaging. The growing demand for hygienic and sustainable packaging is driven by the global trend towards greater sustainability and the pandemic influenza of 1918-19, which has increased the demand for hygienic packaging. The development of PET lidding films is also driven by the technological progress in printing and barrier properties.

Future Outlook

The PET Windowed Films Market is projected to experience a CAGR of 5.77% from 2024 to 2032, reflecting a growth from $68.2 million to $107.8 million. This growth is largely attributed to the increasing demand for sustainable packaging solutions, especially in the food and beverage industry where the need for extended shelf life and product safety are paramount. PET windowed films, being a lightweight, easily recycled material, are expected to gain in popularity in the years to come. Also, technological advancements in the form of high barrier PET films and innovations in the manufacturing process are expected to further drive market growth. The government’s emphasis on reducing plastic waste and promoting the use of recycled materials will also likely benefit the PET windowed films market. Also, the integration of smart packaging and the growing popularity of e-commerce are likely to influence the demand for high-quality, versatile top-labeling solutions. In the long run, the PET windowed films market is expected to experience a dynamic evolution, characterized by innovation and sustainability, which will position it as a key component of the packaging industry.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 0.64 Billion |

| Growth Rate | 5.77% (2024-2032) |

PET Lidding Films Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.