Innovation in Product Development

Innovation in product development is emerging as a significant driver for the Plant-Based Food Color Market. Companies are investing in research and development to create new, vibrant, and stable plant-based colorants that meet consumer demands. This focus on innovation is reflected in the introduction of novel color sources, such as spirulina and beetroot, which are gaining popularity. Market data suggests that innovative products are capturing a larger share of the market, with consumers willing to pay a premium for unique offerings. The Plant-Based Food Color Market is likely to continue evolving as manufacturers strive to differentiate their products through innovative color solutions.

Rising Vegan and Vegetarian Trends

The increasing prevalence of vegan and vegetarian diets is likely to serve as a strong driver for the Plant-Based Food Color Market. As more individuals adopt these lifestyles, the demand for plant-based ingredients, including food colors, is expected to rise correspondingly. Market data indicates that the number of consumers identifying as vegan has doubled in recent years, leading to a surge in plant-based product offerings. This trend suggests that the Plant-Based Food Color Market will experience heightened demand as food manufacturers seek to cater to this growing demographic. The alignment of plant-based colors with vegan principles further enhances their appeal, potentially driving market growth.

Health Consciousness Among Consumers

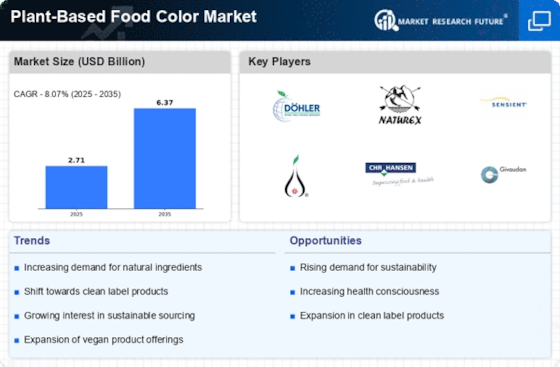

The increasing awareness regarding health and wellness among consumers appears to be a pivotal driver for the Plant-Based Food Color Market. As individuals become more informed about the adverse effects of synthetic additives, there is a noticeable shift towards natural alternatives. This trend is reflected in market data, which indicates that the demand for plant-based food colors has surged, with a projected growth rate of approximately 8% annually. Consumers are actively seeking products that align with their health goals, thereby propelling the market forward. The Plant-Based Food Color Market is likely to benefit from this heightened health consciousness, as manufacturers respond by innovating and expanding their offerings to include more natural colorants.

Sustainability Trends in Food Production

The growing emphasis on sustainability within the food production sector appears to be a crucial driver for the Plant-Based Food Color Market. As consumers increasingly prioritize eco-friendly practices, manufacturers are compelled to adopt sustainable sourcing and production methods. This shift is evidenced by market data indicating that products labeled as sustainable are experiencing higher sales volumes. The Plant-Based Food Color Market stands to gain from this trend, as plant-based colorants are often derived from renewable resources, thus appealing to environmentally conscious consumers. Companies that embrace sustainability are likely to enhance their market position and attract a broader customer base.

Regulatory Support for Natural Ingredients

Regulatory frameworks increasingly favoring natural ingredients are likely to bolster the Plant-Based Food Color Market. Governments and food safety authorities are implementing stricter regulations on synthetic additives, which may lead to a more favorable environment for plant-based alternatives. For instance, recent guidelines have encouraged the use of natural colorants in food products, thereby enhancing consumer trust. This regulatory support is expected to drive market growth, as companies adapt to comply with these standards. The Plant-Based Food Color Market could see a significant uptick in demand as manufacturers pivot towards compliant, natural solutions, aligning with both consumer preferences and regulatory expectations.

.png)