- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

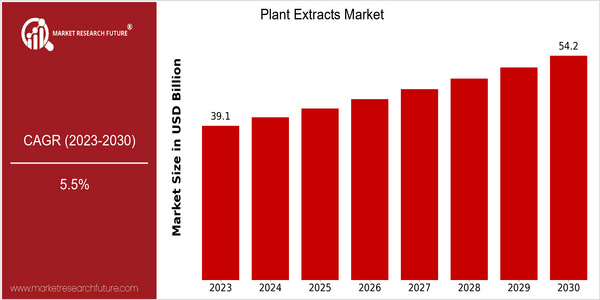

| Year | Value |

|---|---|

| 2023 | USD 39.1 Billion |

| 2030 | USD 54.2 Billion |

| CAGR (2023-2030) | 5.5 % |

Note – Market size depicts the revenue generated over the financial year

The world market for herbal extracts is expected to reach $39 billion in 2023 and $ 54 billion in 2030, at a CAGR of 5.5% from 2018 to 2023. This is mainly driven by the increasing demand for plant-derived products in various industries, such as food, beverage, pharmaceuticals, cosmetics and personal care. The increasing preference for natural and organic ingredients, resulting from health consciousness and concerns about the environment, is also driving the market. In addition, the development of extraction methods, such as supercritical fluid extraction and cold extraction, will greatly enhance the quality and efficiency of plant extraction, thus driving the market. Moreover, the emergence of e-commerce platforms has greatly increased the availability of herbal extracts, and companies have more opportunities to sell their products. The three main players in this market, Givaudan, Symrise and DuPont, have been introducing new products through collaboration and R & D. Among them, Givaudan recently launched a new line of herbal extracts for the health and beauty industry, highlighting the trend of the industry towards natural solutions.

Regional Market Size

Regional Deep Dive

The market for plant extracts is growing in all regions, owing to the increasing demand for natural and organic products and the growing awareness of the health benefits associated with plant extracts. In North America, Europe, Asia-Pacific, the Middle East and Africa (MEA) and Latin America, the market is influenced by different cultural preferences, regulations and economic conditions. Each region showcases different trends, innovations and key players that are shaping the future of the plant extracts market, thereby making it a vibrant and highly competitive market.

Europe

- Among the dietary supplements and natural cosmetics on the European market, there is a growing demand for the quality of plant extracts, and the European Federation of Associations of Health Product Manufactures (EHPM) has been established to regulate them.

- Sustainability initiatives are gaining traction, with companies like BASF and Croda focusing on sourcing plant extracts from sustainable farms, which is expected to enhance consumer trust and brand loyalty.

Asia Pacific

- The Asia-Pacific region is experiencing rapid growth in the herbal medicine sector, with countries like India and China leading the way in traditional plant extract usage, supported by government programs promoting herbal research and development.

- Innovations in extraction techniques, such as supercritical CO2 extraction, are being adopted by local companies like Herbalife and Amway, enhancing the quality and efficacy of plant extracts in various applications.

Latin America

- Latin America is rich in biodiversity, and companies like Natura and Grupo Boticário are leveraging local plant species to create innovative beauty and wellness products, driving the demand for plant extracts.

- The region is also seeing increased investment in sustainable harvesting practices, with initiatives supported by organizations like the United Nations Development Programme (UNDP) aimed at promoting the conservation of native plant species.

North America

- The rise of the clean label trend has led to increased demand for plant extracts in food and beverage applications, with companies like Givaudan and Symrise investing in innovative extraction technologies to enhance product offerings.

- Regulatory changes, such as the FDA's updated guidelines on the use of natural flavors, are encouraging manufacturers to explore plant extracts as viable alternatives, thereby expanding their market presence.

Middle East And Africa

- In the MEA region, there is a growing interest in traditional herbal remedies, with local companies like Al Haramain and Herbal Hills capitalizing on the rich biodiversity of the region to develop unique plant extract products.

- Regulatory frameworks are evolving, with the Gulf Cooperation Council (GCC) implementing stricter guidelines on herbal products, which is expected to improve product safety and efficacy in the market.

Did You Know?

“Over 80% of the world's population relies on traditional medicine, much of which is derived from plant extracts, highlighting the critical role these natural resources play in global health.” — World Health Organization (WHO)

Segmental Market Size

Plant extracts market is expected to grow at a robust CAGR over the forecast period, owing to the growing demand for natural and organic products in the various industries such as food & beverages, cosmetics, and pharmaceuticals. Moreover, the stringent regulations imposed by the government on the use of synthetic products are likely to drive the demand for natural plant extracts. In addition, the technological advancements in extraction processes are likely to enhance the quality and yield of plant extracts, which in turn, are likely to boost the market growth. Plant extracts are currently being used in the mature applications. Some of the major companies using plant extracts in their products include Givaudan and Symrise. The major applications of plant extracts include flavoring in food products, active ingredients in cosmetic formulations, and therapeutics in dietary supplements. Plant extracts are also being used in the pharmaceutics and agro-chemicals industries. The growing emphasis on the natural and sustainable products and the clean label products is also driving the market growth. Also, the e-commerce platforms have increased the access to the plant extracts, whereas the supercritical fluid extraction has revolutionized the extraction processes.

Future Outlook

Plant extracts are a big business and they are going to grow a lot from now until 2023. From $39 billion to $ 54 billion, with a CAGR of 5.5%, which is a very good figure. It’s driven by the fact that the natural and organic product market is growing in many different industries, including food and beverage, cosmetics and pharmaceuticals. Plant extracts are going to grow because of the health-conscious consumers who are looking for natural alternatives. By 2030, the penetration rate in the food and beverage industry is expected to be about 30%, up from about 20% in 2023. There will be many technological and policy developments that will have a significant impact on the future of the market. Supercritical fluid extraction and ultrasonic extraction are new extraction methods that improve the quality and efficiency of plant extraction and thus increase the appeal of plant extracts for manufacturers. Also, government policies that support sustainable agriculture and the use of natural ingredients will stimulate the market. The growing popularity of herbal supplements and the integration of plant extracts in functional foods will also contribute to the expansion of the market, which will make it a vital part of the worldwide health and wellness trend.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 37.1 Billion |

| Market Size Value In 2023 | USD 39.1 Billion |

| Growth Rate | 5.5% (2023-2030) |

Plant Extracts Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.