- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

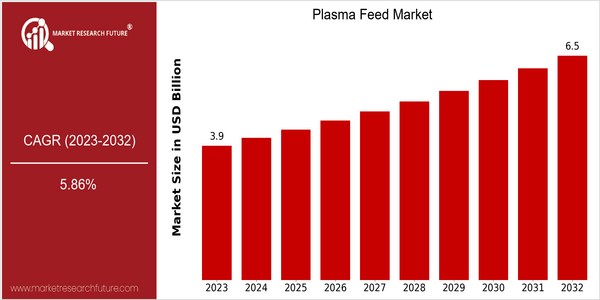

| Year | Value |

|---|---|

| 2023 | USD 3.89 Billion |

| 2032 | USD 6.5 Billion |

| CAGR (2024-2032) | 5.86 % |

Note – Market size depicts the revenue generated over the financial year

The market for feed additives is estimated to reach $ 6.48 billion by 2032, growing at a CAGR of 5.86% from 2024 to 2032. This growth rate reflects the strong demand for plasma-based feed additives, which are increasingly used in the aquaculture and livestock industries. As the world's population continues to grow, the need for a high-quality source of animal protein is becoming more urgent, further driving the market. A number of factors are driving this growth, including the development of new plasma technology, which can improve the nutritional value of feed, and the growing awareness of the benefits of using plasma feed by livestock breeders. The strategic cooperation of the major players in the industry and the large-scale investment in R & D are driving innovation and expanding the scope of products. The APC, the Axiom Food Company and the Proliant Company are at the forefront of these developments, and they are constantly launching new products and forming new strategic cooperation with other companies to meet the changing needs of the market.

Regional Market Size

Regional Deep Dive

Throughout the world, the global market for blood meal is experiencing significant growth, driven by the rising demand for high-quality animal feed and growing awareness of the nutritional benefits of blood meal. In North America, Europe, Asia-Pacific, the Middle East and Africa, and Latin America, the market for blood meal is influenced by factors such as trends in livestock production, regulatory frameworks, and consumers’ preferences for sustainable and nutritional feed. Each region offers opportunities and challenges, and innovations in processing and formulation play an important role in shaping the market.

Europe

- In Europe, the market is heavily influenced by stringent regulations regarding animal feed safety and quality, with organizations like the European Food Safety Authority (EFSA) playing a pivotal role in establishing guidelines for plasma feed usage.

- In countries like Germany and France, the growing trend towards organic and sustainable farming is driving the development of new products for the feed industry. This is in response to the growing demand for animal products of high quality and from sustainable farming.

Asia Pacific

- The Asia-Pacific region is experiencing rapid growth in the Plasma Feed Market, particularly in countries like China and India, where rising meat consumption is prompting livestock producers to seek high-quality feed alternatives.

- Innovations in processing technologies, such as spray-drying and freeze-drying, are being adopted by key players like Darling Ingredients and Kemin Industries to enhance the nutritional profile of plasma feed products.

Latin America

- Latin America is witnessing a growing interest in plasma feed, particularly in Brazil and Argentina, where the beef and poultry industries are expanding and seeking high-quality feed solutions to enhance growth rates and feed conversion efficiency.

- It is precisely the consumption of meat, a peculiarity of the region, that has created the need for new and improved feed products. This is why companies such as Proteon and Lallemand Animal Nutrition are working on the development of new and improved feed products, based on blood serum, for the needs of the livestock in the region.

North America

- North America has the highest level of livestock production in the world. In the United States, companies like APC, Inc. and Alltech are advancing the development of new products.

- Recent regulatory changes by the USDA have facilitated the use of plasma proteins in animal feed, enhancing the market's growth potential as producers seek to improve feed efficiency and animal health.

Middle East And Africa

- In the Middle East and Africa, the Plasma Feed Market is gaining traction due to increasing investments in livestock production and a growing awareness of the benefits of plasma proteins in animal nutrition.

- Government initiatives aimed at boosting local agriculture, such as the UAE's National Food Security Strategy, are encouraging the adoption of advanced feed technologies, including plasma feed, to improve livestock health and productivity.

Did You Know?

“Did you know that plasma proteins can improve the immune response in livestock, leading to better overall health and productivity?” — Journal of Animal Science

Segmental Market Size

The plasma feed market is currently experiencing a steady growth, owing to the increasing demand for quality animal feed and the increasing awareness of sustainable agriculture. This market is mainly driven by the need for alternative feed sources, which are high in dietary protein, and by regulations promoting the use of food industry by-products. Moreover, the recent technological advances in plasma processing make the feed products more attractive for farmers. The current market penetration of the plasma feed is in the process of being scaled up. Notable examples are companies such as APC, which have established a strong presence in North America and Europe. The main applications of the plasma feed are in the pig and poultry industries, where it is used to improve growth and health. Moreover, the trend towards sustainable agriculture and the government regulations reducing the use of antimicrobials in livestock production have accelerated the use of the plasma feed. The most important technology driving the market is the advanced processing of the plasma feed, which improves the digestibility and nutritional value of the feed.

Future Outlook

The world market for plasma feeds is expected to grow at a CAGR of 5.86% from 2023 to 2032, from $3.89 billion to $6.5 billion. This growth is driven by an increasing demand for high-quality animal feed, driven by a growing world population and the resulting need for sustainable sources of animal protein. As a result, livestock producers are increasingly looking for feed efficiency and animal health. This is expected to result in an increased acceptance of plasma-based feeds, which will lead to higher penetration rates in both developed and emerging markets. Also, technological advances and supportive policies will play a major role in shaping the future of the market. The development of the processing of blood components will result in an improved nutritional profile and digestibility of the feed, making it an increasingly attractive feed. In addition, the use of alternative feeds will be promoted by governments. Furthermore, the increasing focus on animal welfare and the growing interest in organic and non-GMO feed will also drive the adoption of blood-based feeds and will position them as an important component of sustainable agriculture in the future.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 2.226 Billion |

| Growth Rate | 5.23 % (2024-2032) |

Plasma Feed Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.