Market Trends

Key Emerging Trends in the Point Of Care Glucose Testing Market

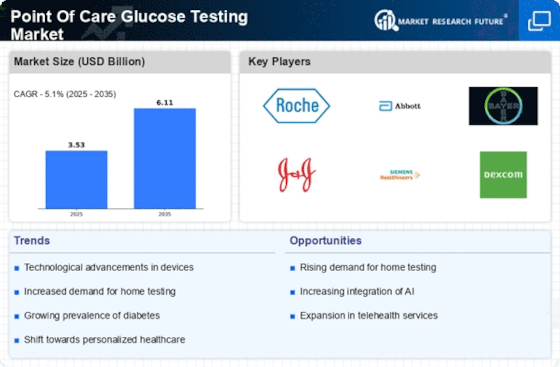

The joining of constant glucose observing frameworks into the point of care glucose testing market is driving advancement by upgrading continuous information for improved glycaemic control and patient results. Cell phone associated glucose meters and versatile wellbeing applications that empower clients to screen and examine their glucose levels are on the ascent on the lookout, mirroring the growing job of computerized wellbeing arrangements in diabetes management. The mix of man-made consciousness and AI calculations is affecting the market. These calculations help in proactive diabetes management through the examination of information designs and the arrangement of customized experiences. Point of Care glucose testing is turning out to be progressively preferred in local area and locally established care. It permits people with diabetes to deal with their condition in recognizable conditions, which is reliable with the decentralized medical care development and underscores patient independence in wellbeing management. There is an ongoing business sector pattern towards easy-to-use glucose observing arrangements, including streak frameworks and consistent glucose screens. This pattern means to work on quiet consistence and lessen trouble, at last improving the general client experience in glucose checking. Altogether changing the market for point of care glucose testing is telemedicine and far off persistent reconnaissance in virtual diabetes care. This component empowers medical services experts to remotely assess patient information, working with brief adjustments to therapy designs and empowering constant consideration from the solace of one's own home. As the market shifts toward information availability and interoperability, glucose testing gadgets are turning out to be more flawlessly incorporated with EHRs and medical services data frameworks to work with composed diabetes care. Area of care HbA1c testing is turning out to be all the more generally perceived for its capacity to screen long haul glycaemic control, give experiences into quick and long-haul glycaemic status, and equilibrium constant information in diabetes management. Drug organizations and makers of glucose testing gadgets are teaming up to work on the adequacy of diabetes care through the mix of advances into point of care glucose testing frameworks that convey keen insulin. Endeavours toward normalization and administrative drives are changing the market for point of care glucose testing to guarantee accuracy, reliability, and consistency in diabetes the board methods.

Leave a Comment