Research Methodology on Point of Sale Terminal Market

1. Introduction

This research aims to analyze the global point of sale (POS) terminal market; explore the features, trends, products, and solutions present in the market, their price range, and competitive environment and outline strategies to address competitive challenges. Market Research Future (MRFR) has conducted extensive market research through primary and secondary sources to have a fair idea and detailed explanation of the market. The research covers various segments, including type, components, end-users, and geography.

2. Research Approach

A robust research approach is followed by MRFR to identify relevant and effective insights into the point of sale (POS) terminal market. Different approaches were used to ensure that a sufficient amount of data was gathered. The methods used include primary research and secondary research.

a) Primary Research

This form of research involves direct contact with and interviewing key persons, recording information from industry participants, and gathering facts and data from them. The primary research consists of interviews with industry experts, investors, and distributors in the Point of Sale market. Market experts include in the interviews provided valuable insights about the flourishing market and gave their forecasts about the future of the Point of Sale Terminal market.

b) Secondary Research

The secondary research method is the second step of our process. The core of the secondary research rests in garnering information from authentic sources via annual reports, business magazines, business websites, and associations such as the Point of Sale Retailer Association (POSRA). MRFR also referred to websites such as company websites & market research databases, as well as some of the prominent companies' financials, to gain information about other players in the industry. To calculate the market size is further calculated by the yearly activity volume and product size predictions in the Point of Sale terminal market.

3. Market Segmentation

The Point of Sale (POS) terminal market is segmented by type, component, end-user, and geography.

By type, the market comprises barcode readers, magnetic stripe readers, smart card readers, near-field communication (NFC) readers, and others.

By component, the market is classified into hardware and software.

By end-user, the market is categorized into retail, hospitality, healthcare, transportation and logistics, and others.

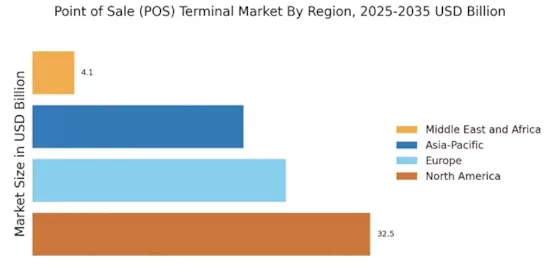

By geography, the market is segmented into North America, Europe, Asia Pacific (APAC) and the Rest of the World (RoW).

4. Assumptions

The Point of Sale (POS) terminal market report also includes assumptions. Some of the assumptions in the report include an increase in demand for POS terminal products, a customer-friendly approach and a larger number of customers protecting their data, and enhanced buying power.

5. Research Design

In-depth interviews and discussions with numerous key industry participants & opinion leaders are employed to collect and verify critical qualitative and quantitative information. The research methodology consists of the following sections:

(i) Breakup of primary interviews

The insights from key opinion leaders in the Point of Sale (POS) Terminal market are showcased through primary interviews. The quotes from the key opinion leaders form the primary base of the report. The interviewees typically came from leading positions in their industry such as CXOs, vice presidents, directors, and regional sales managers.

(ii) Market Structure

MRFR follows a structured research model to assess the Point of Sale (POS) terminal market in detail. This helps gain insight into the strategies that the prominent players are adopting and the competitive environment in the market.

(iii) Analytical Tools

MRFR follows a rigorous analytical process to identify the strengths and weaknesses of the Point of Sale (POS) terminal market. The report establishes a connection between potential trends and their effects on the market, helping stakeholders make informed decisions.

(iv) Market Estimation

The estimated market size was calculated using statistical methods and triangulation. Market data is triangulated by analyzing each segment so that the exact size of the POS Terminal market could be estimated.

(v) Vendor Inclusion Criteria

MRFR included major market players to gain market intelligence for the Point of Sale (POS) market. The report contains a list of these players. Inclusion criteria for the key market players operate on various decisive criteria, including vendor segmentation, the number of their products & services, the company's recent developments, expenses, financial standings & terms of business, and customers & areas served.

(vi) Data Sources

The sources used to collect data and information including press releases, company annual reports, company websites, company literature, industry white papers, and a wide range of other sources available in both public and proprietary databases.

6. Conclusion

The research focuses on the most important factors that impact the Point of Sale (POS) Terminal market, such as market trends, opportunities, competitive landscape, and growth prospects. It also outlines the various strategic initiatives taken by prominent industry players along with the market value chain analysis. MRFR has identified the market dynamics to cater to the ever-changing requirements of the Point of Sale (POS) market, helping stakeholders identify the lucrative avenues, and visualize the roadmap to success.