- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

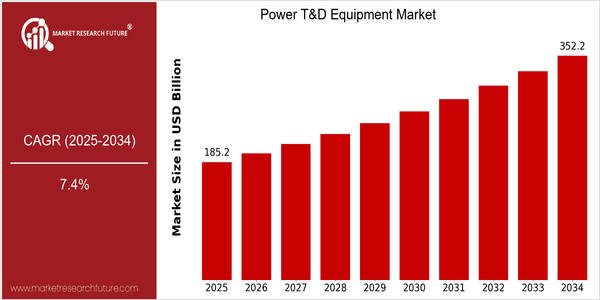

| Year | Value |

|---|---|

| 2025 | USD 185.21 Billion |

| 2034 | USD 352.19 Billion |

| CAGR (2025-2034) | 7.4 % |

Note – Market size depicts the revenue generated over the financial year

The world market for power transmission and distribution equipment is expected to grow from the current $ 185.21 billion to $ 352.19 billion by 2034. The growth rate is a very strong 7.4 percent. The main reasons for this are the increasing demand for safe and efficient power transmission and distribution systems. The transition to the use of renewable energy sources is also a driving force. In addition, technological developments, such as the integration of smart grids and the use of new energy storage systems, are improving the efficiency and reliability of the equipment. This has led to the emergence of new opportunities for companies such as Siemens, GE and Schneider Electric. These companies have the opportunity to make the most of the energy transition and take advantage of their expertise to drive the growth of the market.

Regional Market Size

Regional Deep Dive

In the past decade, the global power transmission and distribution equipment market has undergone a series of structural changes in all regions, driven by the increasing demand for reliable and efficient energy transmission and distribution systems. In North America, the market is characterized by a relatively solid foundation and a high degree of concern for modernization and smart grid technology. In Europe, the focus is on integrating new energy sources. In Asia-Pacific, the expansion of power generation capacity has led to an increase in demand for transmission and distribution equipment. The Middle East and Africa are expanding their energy projects to meet growing demand, while Latin America is focusing on grid reliability and access to electricity. Each region has its own opportunities and challenges, shaped by regulations, economics, and technology.

Europe

- The European Union's Green Deal aims to achieve carbon neutrality by 2050, prompting significant investments in renewable energy sources and necessitating upgrades to existing T&D infrastructure.

- Companies like ABB and Schneider Electric are leading the charge in developing sustainable T&D solutions, including high-voltage direct current (HVDC) technology, which is crucial for integrating offshore wind farms into the grid.

Asia Pacific

- China's commitment to achieving peak carbon emissions by 2030 has led to a surge in investments in renewable energy projects, significantly increasing the demand for T&D equipment to support this transition.

- India's government has launched the 'Power for All' initiative, aiming to provide electricity access to all citizens, which is driving the expansion of T&D networks and creating opportunities for local and international suppliers.

Latin America

- Brazil's National Electric System Operator (ONS) is implementing measures to enhance grid reliability, which includes upgrading T&D equipment to accommodate increasing energy demands.

- The region is witnessing a rise in public-private partnerships aimed at improving electricity access, particularly in rural areas, which is expected to drive demand for T&D solutions.

North America

- The U.S. Department of Energy has launched initiatives to promote smart grid technologies, which are expected to enhance the efficiency and reliability of power transmission systems, driving demand for advanced T&D equipment.

- Major companies like General Electric and Siemens are investing in innovative solutions such as digital substations and energy storage systems, which are reshaping the landscape of the Power T&D Equipment Market in North America.

Middle East And Africa

- The UAE's Energy Strategy 2050 aims to increase the contribution of clean energy in the total energy mix, leading to substantial investments in T&D infrastructure to support renewable energy integration.

- Saudi Arabia's NEOM project is set to be a hub for advanced energy technologies, including smart grids, which will require innovative T&D solutions and attract global players in the market.

Did You Know?

“Approximately 80% of the global electricity transmission and distribution losses occur in developing countries, highlighting the urgent need for improved T&D infrastructure.” — International Energy Agency (IEA)

Segmental Market Size

The market for power transmission and distribution equipment is experiencing steady growth, mainly because of the growing demand for reliable and efficient energy transmission and distribution systems. Also driving the market are the increasing need to develop the grid to include the growing share of renewable energy, and the increasingly stringent regulations aimed at reducing carbon emissions and ensuring grid reliability. Technological advances in smart grid solutions are also driving demand for new equipment. The market for power transmission and distribution equipment is currently in its mature phase. In North America and Europe, the leading suppliers are Siemens and General Electric. The main applications are the control of energy production, the integration of distributed energy resources, and the reinforcement of the grid. The growing share of renewable energy in the energy mix and the increasing number of green initiatives are driving the growth of this market. Also driving the market are technological developments such as advanced metering infrastructure (AMI) and energy storage systems, which enable the more efficient distribution and consumption of energy.

Future Outlook

“The electricity distribution and transmission equipment market is expected to grow significantly between 2025 and 2034, from $185.21 billion to $352.19 billion, with a robust compound annual growth rate of 7.4 percent. The main reason for this is the increasing demand for reliable and efficient electricity distribution and transmission equipment, mainly driven by urbanization, industrialization and the worldwide shift to green energy. As a result, investment in modernizing and expanding the grid will be crucial. The penetration of advanced electricity distribution and transmission equipment will thus increase. Also, the development of smart grid solutions, energy storage systems and high-voltage direct current (HVDC) technology will play an important role in shaping the market. These technological innovations will not only improve the efficiency and reliability of electricity transmission, but also make it easier to integrate more green energy, which is expected to become a much larger share of the energy mix by 2034. In addition, supportive government policies and regulations on reducing carbon emissions and increasing energy efficiency will help to further drive the market. In this way, the electricity distribution and transmission equipment market is expected to change drastically, with the digitalization and automation of electricity distribution and transmission becoming the main trends.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 7.40%(2023-2032) |

Power TD Equipment Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.