- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

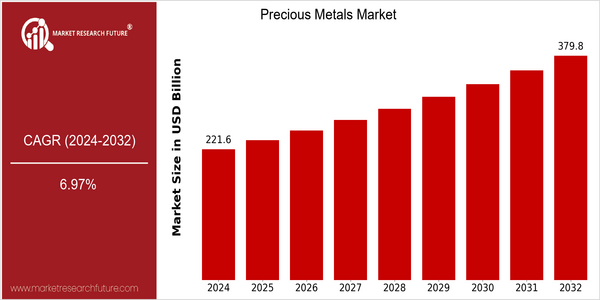

| Year | Value |

|---|---|

| 2024 | USD 221.62 Billion |

| 2032 | USD 379.8 Billion |

| CAGR (2024-2032) | 6.97 % |

Note – Market size depicts the revenue generated over the financial year

The precious metals market is poised for significant growth. The market is expected to reach $221 billion in 2024, and grow to $379 billion by 2032. This represents a CAGR of 6.97% over the forecast period. The increasing demand for precious metals in various industries such as the automobile, jewelry, and electronics industries is a major factor for this growth. The increasing interest in sustainable and environment-friendly technology is also driving the market, as precious metals are used in advanced manufacturing processes and in the production of green energy. Moreover, the growing importance of electronics and green energy is also expected to play a significant role in the growth of the market. For instance, the increasing use of electric vehicles has led to an increase in the demand for platinum and palladium, which are used in the manufacture of catalytic converters. The major players in the market such as Barrick Gold, Anglo American, and Newmont are focusing on strategic initiatives such as acquiring smaller mining companies and investing in new mining methods in order to increase their production capacity and meet the increasing demand. The efforts of these players, along with the favourable regulatory scenario and the growing awareness about the importance of precious metals, are expected to fuel the growth of the market in the coming years.

Regional Market Size

Regional Deep Dive

Gold is a precious metal, which is used as a medium of exchange, a monetary coin, a currency, a bar, a jewel, a monetary coin, a silver coin, a gold coin, a silver coin, a monetary coin, a monetary coin, a gold coin, a silver coin, a monetary coin, a silver coin, a gold coin, a silver coin, a gold coin, a silver coin, a silver coin, a silver coin, a gold coin, a silver coin, a gold coin, a currency, a monetary coin, a monetary coin, a coin, a coin of the moneyer, a coin of the state, of a certain denomination, a certain weight, a certain currency, a certain gold, silver, and so on. The market is driven by a strong industrial demand and the purchase of gold and silver as safe assets. In Europe, the market is very active and focuses on sustainable and ethical exploitation. In Asia-Pacific, high consumption of gold, especially in jewelry and electronics, is the hallmark of the market. In the Middle East and Africa, the richness of mineral resources is a unique opportunity, and Latin America is increasingly becoming a major player in mining and production.

Europe

- The European Union's Green Deal is influencing the precious metals market by promoting the recycling of metals, with companies like Umicore investing heavily in recycling technologies.

- Regulatory frameworks around conflict minerals are prompting European jewelers to source gold and diamonds from certified suppliers, enhancing transparency and ethical practices in the market.

Asia Pacific

- China remains the largest consumer of gold, with the government promoting gold as a strategic asset, leading to increased domestic production and investment.

- India's recent push for gold monetization schemes aims to reduce the physical gold holdings of households, potentially increasing liquidity in the market and driving demand for gold-backed financial products.

Latin America

- Brazil and Peru are enhancing their mining regulations to attract foreign investment, with initiatives aimed at improving environmental standards and community engagement.

- The rise of artisanal mining in Colombia is drawing attention, as it presents both opportunities for local economies and challenges related to regulation and environmental impact.

North America

- The U.S. has seen a surge in gold investments, particularly during economic uncertainty, with companies like Barrick Gold and Newmont Corporation leading the charge in mining operations.

- Regulatory changes in Canada, such as the implementation of stricter environmental standards, are pushing mining companies to adopt more sustainable practices, which could reshape operational costs and market dynamics.

Middle East And Africa

- Countries like South Africa and Ghana are ramping up their mining activities, with government initiatives aimed at attracting foreign investment in the precious metals sector.

- The UAE is emerging as a global hub for gold trading, with the Dubai Multi Commodities Centre (DMCC) facilitating a significant increase in gold imports and exports.

Did You Know?

“Approximately 80% of the world's gold supply comes from just 20 countries, with China, Australia, and Russia being the top producers.” — World Gold Council

Segmental Market Size

The market for precious metals, notably gold and silver, plays an important role in both investment portfolios and industrial applications, and is currently enjoying a stable demand. Among the main factors driving this demand are the growing consumer interest in assets that are safe havens during periods of economic uncertainty, and the increasing use of precious metals in the manufacture of electrical equipment and in the production of alternative energy sources. The increasing demand for gold and silver is also being influenced by government regulations which encourage sustainable mining practices. Gold and silver are currently among the most mature markets. The leading gold mining companies are Barrick Gold and Newmont, and the most important mining regions are South Africa and Australia. Gold and silver are used mainly for the manufacture of jewelry, for investment purposes (such as the shares of ETFs), and in the manufacture of electrical equipment and solar cells. The growing importance of sustainable mining and the impact of geopolitical tensions are accelerating the growth of the sector, while technological innovations such as bioleaching are shaping the evolution of this market.

Future Outlook

The Precious Metals Market is projected to rise at a CAGR of 6.97% from 2024 to 2032, from $221.62 billion to $379.80 billion. The demand for precious metals is rising in a number of industries such as the electronics industry, the automobile industry, the electrical industry, the mechanical industry, the chemical industry, and the new energy industry. The use of precious metals in advanced applications will also increase, which will promote the increase of market penetration and use rate. The main driving force of the market is the technological development of extraction and processing. The promotion of green and sustainable development by the government will also boost the demand for precious metals. The trend of silver being used in photovoltaic cells and gold being used as a hedge against inflation and uncertainty in the economy will also affect the market. In the future, the market will be in a state of change and development, with opportunities and challenges.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 190 Billion |

| Market Size Value In 2023 | USD 205.2 Billion |

| Growth Rate | 8.00% (2023-2032) |

Precious Metals Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.