- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

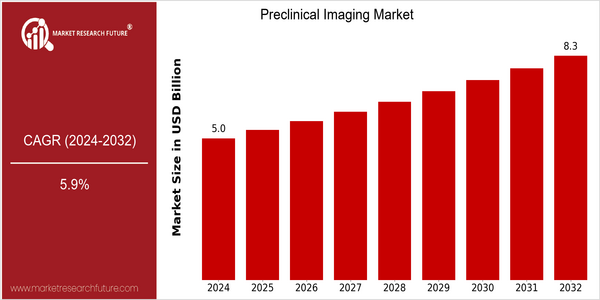

Preclinical Imaging Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 4.97 Billion |

| 2032 | USD 8.33 Billion |

| CAGR (2024-2032) | 5.9 % |

Note – Market size depicts the revenue generated over the financial year

Preclinical imaging is a market that is set to grow. The current market size of $ 4,970,200,000 in 2024 is projected to grow to $ 8,334,200,000 by 2032. The CAGR from 2024 to 2032 is 5.9%. The factors driving this growth are the growing demand for advanced imaging in drug development and the increasing prevalence of chronic diseases. In addition, the integration of new imaging modalities such as molecular and hybrid imaging systems will further enhance the capabilities of preclinical studies and will enable more accurate and efficient research outcomes. The major players in the field of preclinical imaging, such as Bruker, PerkinElmer and Siemens Healthineers, are all investing heavily in R & D to provide new and advanced imaging solutions. Strategic alliances are also being set up to further strengthen the technological capabilities of the industry. Recent collaborations between imaging companies and pharmaceutical companies have been aimed at reducing the drug discovery time, thus further highlighting the critical role of preclinical imaging in the advancement of medical research and the development of new therapies.

Regional Deep Dive

The preclinical diagnostics market is characterized by a significant growth across various regions, which is mainly driven by the advancements in the imaging technology and the increasing investment in research and development. In North America, the market is characterized by the presence of leading companies and research institutions that foster innovation and collaboration. Europe has a strong regulatory framework that supports the development of preclinical diagnostics. Asia-Pacific is rapidly emerging as a hub for research activities due to the expansion of the pharmaceutical and biotechnology industries. The Middle East and Africa are experiencing a steady growth, mainly driven by the increasing investment in the healthcare industry, while Latin America is expected to benefit from the increasing demand for advanced imaging solutions in preclinical research.

North America

- The National Institutes of Health (NIH) have increased their funding for preclinical research, promoting innovation and collaboration between academic institutions and private industry.

- Bruker and PerkinElmer are developing new x-ray systems that can be used in preclinical studies, especially in the fields of oncology and neurology.

- It is also known that the regulatory agencies, such as the Food and Drug Administration, have been accelerating the approval of medical devices, which is expected to speed up the introduction of new products to the market.

Europe

- Among the projects supported by the Horizon 2020 program of the European Union, several are devoted to the development of new methods of medical imaging, and are intended to promote collaboration between universities and industry.

- Companies such as Siemens Healthineers and Philips are investing in R & D to develop new diagnostics tailored to preclinical applications, in particular drug discovery.

- In Europe, the strict regulations are driving the industry to adopt the highest standards of quality and safety, which will lead to an improvement in the overall reliability of preclinical imaging systems.

Asia-Pacific

- China is developing its preclinical imaging capabilities rapidly. The government's biotechnology promotion strategy has included a large investment in preclinical imaging.

- Companies such as Fujifilm and Hitachi are now developing advanced systems for the study of cancer.

- The increasing number of pharma companies setting up R & D centers in India is driving the demand for preclinical imaging solutions, as these companies are trying to improve their drug development processes.

MEA

- To achieve this, the United Arab Emirates is investing in the development of medical equipment and in the most advanced methods of medical diagnosis.

- A new kind of collaboration between local universities and international companies is emerging, with the aim of developing preclinical imaging solutions tailored to the needs of the region’s health care.

- Regulations are changing in countries like South Africa, enabling the introduction of new imaging techniques. This will enhance research capacity in the region.

Latin America

- Brazil is seeing a rise in public and private investments in biotechnology. This has led to an increased demand for preclinical imaging technology in drug development.

- Local companies are now beginning to collaborate with foreign firms to develop their imaging capabilities in oncology and neurology.

- In Mexico, for example, the regulatory authorities are working to accelerate the approval of new medical imaging devices, which is expected to speed up the entry of new products onto the market.

Did You Know?

“Preclinical imaging can save time and money in drug development, by providing critical information on the safety and effectiveness of new compounds before they enter clinical trials.” — National Institutes of Health (NIH)

Segmental Market Size

Preclinical imaging has a vital role in the drug discovery process, especially in the pharmaceutical and biotechnology industries. This market is currently growing due to the increasing demand for advanced imaging techniques that enable early-stage drug discovery. In addition, the growing need for non-invasive methods for evaluating the progress of diseases and the effectiveness of therapies, along with the stricter regulatory requirements for preclinical testing, are also driving this market.

The preclinical imaging market is already well developed. Major companies such as Siemens Healthineers and Bruker are a leading force in the field. In vivo imaging in the field of oncology, neurology and cardiology is the main application of MRI, PET and CT. The growing trend towards individualized medicine and the integration of artificial intelligence in the analysis of images will continue to drive the market. Moreover, the continued emphasis on reducing animal testing through innovative imaging solutions will further shape the future of preclinical imaging.

Future Outlook

The preclinical diagnostics market is expected to grow at a CAGR of 5.9 per cent from 2024 to 2032, reaching a value of $ 5.97 billion by 2032. This growth is mainly due to the increasing demand for advanced imaging in drug discovery and development processes. The increasing use of MRI, PET and CT increases the ability to visualize in vivo biological processes. In 2032, the penetration of preclinical imaging in laboratories and research institutions is expected to reach 60 per cent, up from 40 per cent in 2024. The growing dependence of research on these tools for effective research outcomes.

The market is expected to be further driven by technological developments, including the integration of artificial intelligence and machine learning in the analysis of images. These developments will not only improve the accuracy and efficiency of the image acquisition, but also facilitate the analysis of complex biological data and shorten the development of drugs. In addition, the increasing focus on individualized medicine and the need for more accurate preclinical models will drive the demand for high-end imaging solutions. Also, the emergence of multi-modality imaging systems, which combine different types of images to obtain comprehensive data, will also play an important role in the development of the preclinical imaging market. According to the report, the market will continue to grow in the future, becoming an important part of the biomedical research platform.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 4.4 Billion |

| Market Size Value In 2023 | USD 4.54 Billion |

| Growth Rate | 3.20% (2023-2030) |

Preclinical Imaging Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.