- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

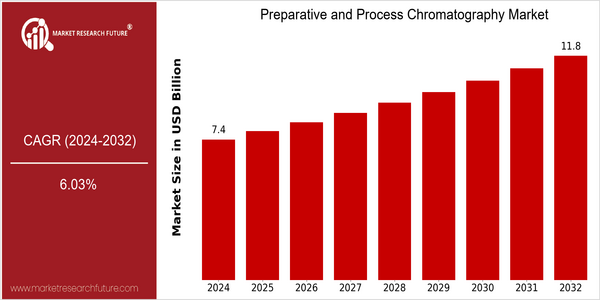

Preparative and Process Chromatography Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 7.42 Billion |

| 2032 | USD 11.85 Billion |

| CAGR (2024-2032) | 6.03 % |

Note – Market size depicts the revenue generated over the financial year

The chromatography industry is in the process of a radical change. It has reached the point where it can no longer be called a business but a science. The industry is growing at a CAGR of 6.03% over the forecast period. The increasing demand for high-purity products in the pharmaceutical, biotechnology and food industries is the main driver for the growth of this industry. Furthermore, the development of high-performance liquid chromatography (HPLC) and ultra-high-performance liquid chromatography (UHPLC) is increasing the efficiency and effectiveness of the separation process. The main players in the Preparative and Process Chromatography Market, such as Agilent Technologies, Thermo Fisher Scientific and Merck KGaA, are investing heavily in research and development to improve their products and services. Strategic initiatives, such as the launch of new chromatography systems, mergers and acquisitions, are also contributing to the competitive landscape. In recent times, many collaborations have been established in order to automate and integrate artificial intelligence into chromatography processes. This will improve the performance and cost-effectiveness of chromatography processes and thus encourage end users to adopt advanced solutions.

Regional Deep Dive

Preparative and process chromatography market is growing significantly in different regions. The growing demand for high-purity compounds in the pharmaceutical, biotechnology, and food industries is driving the growth of this market. North America leads in technological advancements and research, while Europe is characterized by strict regulations that ensure the quality of the products. Asia-Pacific is experiencing rapid industrialization, which is contributing to the development of the market. The Middle East and Africa (MEA) are gradually adopting chromatography technology, influenced by the increase in investment in the health sector. Latin America is experiencing growth due to the development of the pharmaceutical industry.

North America

- The United States Food and Drug Administration has recently issued new guidelines for chromatographic methods that require improved validation, which is causing companies to invest in more advanced chromatography.

- Waters and Agilent are launching new products such as ultra-high performance liquid chromatography (UHPL) systems that are finding their way into laboratories all over the region.

- The trend towards individualized medicine is driving the demand for preparative chromatography solutions. In the course of developing such therapies, companies need to isolate and purify specific compounds for a targeted therapy.

Europe

- The stricter quality requirements for biopharmaceuticals imposed by the European Medicines Agency (EMA) have led to a significant increase in the use of process chromatography to meet these standards.

- In a chromatography system, the steps of a process are integrated and the efficiency of the production of medicines is improved. Companies like Merck KGaA and Sartorius AG have developed integrated chromatography systems for the pharmaceutical industry.

- Green chromatography techniques are also gaining ground in Europe, with less solvent and less waste.

Asia-Pacific

- The National Medical Products Administration of China has recently been pushing the use of advanced chromatography techniques in the development of new medicines. This is accelerating the adoption of these techniques in the region.

- Biopharmaceutical companies in India have been investing in preparative chromatography systems. Several companies like Biocon have been able to procure the latest chromatography systems from GE.

- Japan has seen a great resurgence in research on chromatography, thanks to government support for pharmaceutical and biotechnological research.

MEA

- The Gulf Cooperation Council is investing heavily in health care. This is resulting in a higher uptake of chromatography in research and clinical laboratories.

- Companies such as Thermo Fisher Scientific are expanding their presence in the Middle East and Africa region and are offering advanced chromatography solutions, tailored to local market needs.

- In the sphere of laboratory technology, the authorities in the region are beginning to adopt international standards of laboratory work. This will increase the demand for high-quality chromatography equipment.

Latin America

- The Brazilian National Agency for Surveillance of Health, ANVISA, has strengthened its requirements for the manufacture of pharmaceuticals, requiring companies to invest in advanced chromatography techniques to meet these requirements.

- The biotechnology sector in Argentina is growing, and is resulting in an increased demand for preparative chromatography. Local companies are looking for international technology partners.

- In Mexico, where Pfizer and Novartis are expanding their activities, the need for chromatographic methods is growing.

Did You Know?

“Chromatographic methods are not only employed in the laboratory, but also play a vital role in the study of the environment. They help to determine the constituents of water and air samples.” — American Chemical Society

Segmental Market Size

Preparative and process chromatography is a crucial part of the chromatography market and is currently growing steadily. It is a key technology for the separation and purification of compounds in a range of industries, including pharmaceuticals, biotechnology and the food and beverage industries. Demand for preparative and process chromatography is being driven by the increasing need for highly pure products, increasingly stringent regulations and the availability of new chromatographic methods that are more efficient and effective.

In the field of preparative and process chromatography the application stage has reached its maturity. Leading companies such as Waters and Agilent are deploying advanced systems in their operations. HPLC is the standard method of analysis for the pharmaceutical industry and for food industry control. The trend towards sustainable development and the development of individualized medicine are driving growth. New developments in automation and stationary phases are shaping the industry’s evolution.

Future Outlook

During the period from 2024 to 2032, the market for preparative and process chromatography will grow at a strong CAGR of 6.03%. The high-purity compounds required in the pharmaceutical, biotechnological and food industries are in great demand. Chromatographic techniques are essential for product development and quality assurance. The demand for advanced purification methods will continue to rise as regulatory standards become more stringent. The use of chromatography will increase significantly in all industries, particularly in the biopharmaceutical industry, where the demand for monoclonal antibodies and other biopharmaceuticals is growing rapidly.

High-pressure liquid chromatography and automation and artificial intelligence in chromatography will increase the efficiency and reduce the cost of operations. Green chemistry and the trend towards sustainable development will encourage the use of greener solvents and chromatography materials. This will help to meet the UN's sustainable development goals. Lastly, growth in Asia-Pacific and Latin America will be a result of the growing investment in health care and R & D. In summary, the preparative and process chromatography market will be shaped by innovation, regulations and the trend towards more sustainable practices.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 6.94 billion |

| Growth Rate | 6.03% (2024-2032) |

Preparative and Process Chromatography Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.