- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

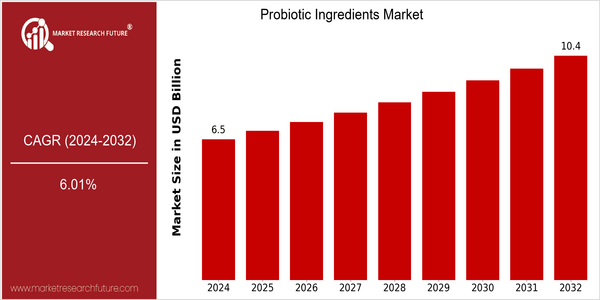

Probiotic Ingredients Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 6.51 Billion |

| 2032 | USD 10.39140335 Billion |

| CAGR (2024-2032) | 6.01 % |

Note – Market size depicts the revenue generated over the financial year

The market for probiotics is a promising one, with a projected value of $ 6.5 billion in 2024 and a projected value of $ 10.39 billion in 2032. This growth reflects a CAGR of 6.01% for the forecast period. The growth is largely due to the rising demand for functional foods and supplements. As health-conscious consumers look for products that can improve their well-being, the probiotic ingredients market is seeing an increase in innovation and development. In addition, technological advances in fermentation processes and the development of new probiotic strains are driving the market. In the meantime, companies are increasing their R&D spending in order to develop more effective and diverse probiotic formulations. Danone, CHR. Hansen, and Danisco are among the companies that are driving the market. Danisco, CHR. Hansen, and Danone have recently teamed up to develop probiotic-fortified beverages and foods.

Regional Deep Dive

The pro-biotics market is experiencing significant growth across all regions, owing to increasing awareness of the health benefits associated with pro-biotics, growing demand for functional foods, and advancements in fermentation technology. North America has a strong presence of key players and a well-established regulatory framework, while Europe is characterized by a wide range of pro-biotics applications in food and beverages. The Asia-Pacific region is witnessing high growth, owing to rising incomes and changing dietary habits, while the Middle East and Africa (MEA) region is adopting pro-biotics at a slow pace, influenced by the health trends and urbanization. Latin America is also emerging as a promising market, with increasing interest in gastrointestinal health and well-being products.

North America

- In recent months, the FDA has made a clearer definition of probiotics and labeling, which is expected to improve public trust and market transparency.

- DuPont and CHRIS are the leading companies. DuPont and Chr. Hansen are investing in research and development of new probiotics strains that have a special effect on health, such as the digestive system and the immune system.

- With the development of e-commerce, smaller probiotic brands can now reach consumers directly, thereby increasing competition.

Europe

- The European Food Safety Authority (EFSA) has been very active in evaluating health claims for probiotics. This has resulted in stricter regulations, requiring that health claims are backed by scientific data, which has affected product development.

- The delivery systems for probiotics are being developed, for example by companies like ProbioFerm, with the aim of increasing the stability and the efficiency of the probiotics in food products.

- The growing trend for natural and organic products is influencing the demand for plant-based probiotics.

Asia-Pacific

- Among the pro- and prebiotics, the increasing popularity of kimchi and miso is fostering a new appreciation of the concept of “good bacteria.”

- Pro-health food makers like Yakult Honsha and Danone are expanding their range of products to include localised varieties to cater for local tastes and health needs.

- Japan and South Korea have launched government-backed probiotics initiatives with the aim of promoting gut health and thus improving public health.

MEA

- This interest in probiotics as a preventive measure against the spread of lifestyle diseases is increasing in the region. Some local companies are investing in probiotic product development.

- In countries like the United Arab Emirates, the regulatory authorities are beginning to draw up regulations for probiotic products. This is expected to bring more order to the market and encourage foreign investment.

- There is a strong trend towards health and well-being in the cities. This is reflected in the growing demand for so-called ‘functional’ foods, including those fortified with probiotics.

Latin America

- The growing awareness of the importance of gut health and its connection to general health has led to a boom in the demand for probiotic supplements and functional foods in countries such as Brazil and Mexico.

- The collaboration of the local companies with the international ones is a good example. We see this in the case of the Brazilian companies and the world's probiotic manufacturers.

- A new regulatory framework is emerging. In Argentina, for example, a new food code was recently introduced, which included a specific section on probiotics and health claims.

Did You Know?

“The fact that 70 per cent of the immune system is located in the gut shows the importance of probiotics for health and well-being.” — Harvard Health Publishing

Segmental Market Size

Probiotics Market is experiencing a steady growth, mainly driven by the increasing awareness among consumers regarding the importance of gastrointestinal health and the benefits of probiotics. The health and well-being industry is growing at a rapid pace, and this market is playing a crucial role in the food and beverage, dietary supplements, and pharmaceuticals sectors. The increasing occurrence of digestive disorders and the growing demand for natural and health-enhancing foods are also driving the demand for probiotics.

The market for pro- and prebiotics is now in a fairly advanced state, with Danone and Nestlé leading the way in product development and market penetration. In the area of dairy products, dietary supplements and functional beverages, probiotics are used to enhance health benefits. Interest in the immune system has been heightened by the emergence of the COVID pandemic, which is also driving demand for pro- and prebiotics. Furthermore, developments in fermentation and encapsulation technology are helping to improve the delivery and effectiveness of probiotics.

Future Outlook

The Probiotics Market is slated for a significant growth from 2024 to 2032, with a projected market size of $65 million to reach a value of $93 million. This translates into a CAGR of 6.01% from 2018 to 2032. Rising awareness of gut health and the growing use of probiotics in food and dietary supplements are the two main factors driving the market. As more and more consumers seek to improve their health through natural means, the demand for probiotics is likely to increase in various sectors such as dairy, beverages, and nutraceuticals, with a potential penetration of over 30% in these categories by 2032.

A key technological advancement is the use of encapsulation technology to enhance the stability of probiotics. Furthermore, supportive regulatory frameworks and growing investment in research and development are likely to encourage innovation in probiotic formulations. Also, the trend towards personalised nutrition and the increasing use of probiotics in non-human applications, such as pet food and cosmetics, will have a major impact on the market. The key to success in this evolving industry will be the ability of companies to be flexible and respond to the increasing demand for high-quality, scientifically proven probiotics.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 6.09 billion |

| Growth Rate | 6.01%(2024-2032) |

Probiotic Ingredients Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.