Protein A Resin Market Overview

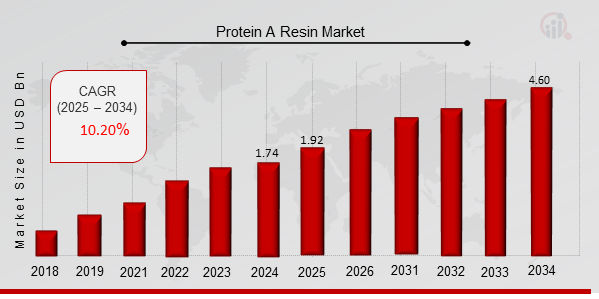

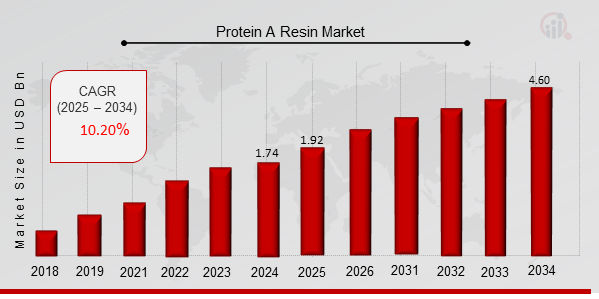

As per MRFR analysis, the Protein A Resin Market Size was estimated at 1.74 (USD Billion) in 2024. The Protein A Resin Market Industry is expected to grow from 1.92 (USD Billion) in 2025 to 4.60 (USD Billion) till 2034, at a CAGR (growth rate) is expected to be around 10.20% during the forecast period (2025 - 2034). Growing need for therapeutic antibodies and the rising desire for monoclonal antibodies are the primary drivers propelling the market's expansion.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Protein A Resin Market Trends

Growing demand for pharmaceutical and biopharmaceutical companies is driving the market growth

Protein analysis is vital to drug discovery and development in the pharmaceutical and biotech industries because pharmaceutical and biopharmaceutical companies primarily use proteins as their primary target. Protein analysis is commonly used for target identification, evaluation, the identification of efficacy and toxicity biomarkers from easily accessible biological fluids, and investigations into the mechanisms of drug action or toxicity, among other purposes. As a result of the numerous ongoing drug development projects in the pharmaceutical and biopharmaceutical industries worldwide, these applications are anticipated to grow significantly.

Furthermore, the market CAGR growth of the studied segment is anticipated to be driven by increased government financing for pharmaceutical R&D and technological developments in the analytical instrument space. Major drivers propelling the protein industry's growth include rising life science R&D spending, advances in medication discovery, and growing chromatography utilization. For instance, according to data released by EFPIA in 2022, European pharmaceutical companies spent EUR 41.5 million (USD 44.6 million) on research and development in 2021.

The need for protein A resin in medication development research and the creation of different diagnostic tests is anticipated to be driven by such high pharmaceutical expenditures, accelerating the growth of the studied market.

Additionally, the market is anticipated to grow due to more product launches meant to meet the demands of the biopharmaceutical and pharmaceutical sectors. For instance, Purolite introduced two cutting-edge next-generation chromatography resins, Praesto Jetted A50 HipH, and Praesto Jetted dt 18-DVD, in September 2021 to meet the variety of biomolecule pipelines for gene therapy, vaccinations, and antibodies.

Additionally, the demand for efficient therapeutic solutions is driven by the continued rise in infectious and chronic diseases worldwide. The increasing popularity of biologics can be attributed to their ability to provide focused therapy options with fewer adverse effects than conventional medications. The development of new biologics with improved specificity and efficacy has been made easier by continuous advances in biotechnology, especially in recombinant DNA technology and cell culture methods. As a result, a wider variety of biological medicines are now available on the market, increasing the demand for effective purification techniques such as those using Protein A Resin.

Thus, this drives the Protein A Resin market revenue.

Protein A Resin Market Segment Insights

Protein A Resin Product Insights

Based on product, the Protein A Resin market segmentation includes agarose-based protein A resin, glass/silica-based protein A resin, and organic polymer-based protein A resin. In 2023, the agarose-based protein A resin segment dominated the market due to the proteins' superior binding selectivity over other matrices regarding ligand attachment. Furthermore, the protein A resins based on agarose exhibit enhanced mechanical strength, longer half-lives, and a high degree of metal dopant absorption at appropriate pH values. Over the projected year, this trend will continue to drive the segment's expansion.

The organic polymer-based protein A resin category is anticipated to grow the fastest due to its significant molecular separation speed. Due to their great biocompatibility and biodegradability can be used in various fields, such as imaging, medication delivery, biosensors, and bioseparation. Furthermore, several biopharmaceutical and biotechnological research institutes can use organic polymer-based protein A matrix resins for targeted drug delivery techniques since they have great solubility, safety, and stability when combined with nanoparticles.

Protein A Resin Type Insights

Based on type, the Protein A Resin market segmentation includes Recombinant Protein A Resin and Natural Protein A Resin. The recombinant protein A resin category generated the most income. The pharmaceutical sector is experiencing an increasing demand for recombinant protein resins due to its cutting-edge technological advancements in drug discovery. This results from the more focused binding capability they provide, which is anticipated to boost this segment's expansion throughout the projected period.

The market for Protein A Resin natural protein A resin segment is anticipated to grow fastest during the forecast period. Staphylococcus aureus is the source of this material, extracted from the bacterial cell utilized in the purification process of monoclonal antibodies. Additionally, affinity chromatography, vaccine and medicines development, antibody purification, and many other biomedical research applications are made possible by natural protein A resins.

Figure 1: Protein A Resin Market, by Type, 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Protein A Resin Application Insights

Based on application, the Protein A Resin market segmentation includes antibody purification and immunoprecipitation. The antibody purification category leads the market. The manufacturing of mAbs for therapeutic purposes, both for scientific and industrial purposes, has been in steady demand. Isolation and enrichment of antibodies from polyclonal Abs, ascites fluids, and mAb cell culture supernatant are examples of antibody purification. This has increased demand for commercial manufacture of protein A resins for the various antibody manufacturing downstream procedures. There is a greater need for monoclonal antibodies to treat and cure diseases as the burden of chronic illnesses rises.

The protein A resin market’s immunoprecipitation segment is anticipated to grow the fastest during the projection period. Immunoprecipitation is used in R&D and thrives in the pharmaceutical and biotechnology sectors. The sector will take the lead in the upcoming years and gain a significant market share.

Protein A Resin End User Insights

Based on end users, the Protein A Resin market segmentation includes pharmaceutical and biopharmaceutical companies, academic research institutes, and other end users. The pharmaceutical and biopharmaceutical companies category leads the market. The growing use of continuous manufacturing techniques and protein A resins in drug discovery, mAb, vaccine, and therapies production processes in biopharmaceutical manufacturing accounts for a significant portion of this market. The expansion of this segment is driven by the increasing demand for protein engineering, along with new scientific discoveries and technical breakthroughs.

Throughout the projection period, this segment's revenue growth is anticipated to be influenced by technological breakthroughs in the biotechnology and pharmaceutical industries and the rapidly expanding biopharmaceutical sector globally.

The academic research institutes segment of the protein A resin market is predicted to develop quickly over the projected period. This is due to increased government spending on R&D and healthcare around the globe, as well as the growing importance of medicines, monoclonal antibodies therapy , and methods for disease surveillance and outbreak prevention. Similarly, the availability of high-throughput testing capabilities and the expansion of hospital testing capacities following the pandemic can significantly improve market prospects for the protein A resins market.

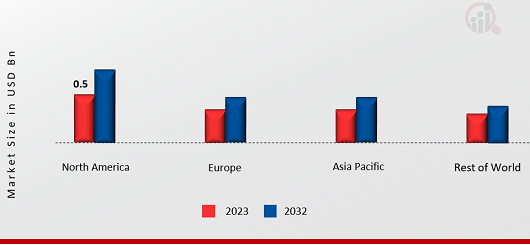

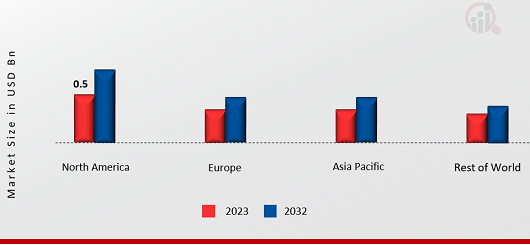

Protein A Resin Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Protein A resin market will dominate because of the growing number of FDA-approved pharmaceutical and biotechnology businesses in this region and the growing demand for protein-based medicines to treat infectious diseases. In addition, the number of partnerships, mergers, and acquisitions among the major participants that drive the sector's expansion is rising. Moreover, the government and commercial sectors are investing more in R&D and the advancement of healthcare.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: PROTEIN A RESIN MARKET SHARE BY REGION 2023 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe's Protein A Resin market accounts for the second-largest market share because the biopharmaceutical manufacturing industry benefits from substantial investments made by European nations in biotechnology research and development, which promotes innovation and technological changes. Because of this investment, new purification methods and applications are developed, which drives growth in the market for Protein A Resin. Further, the German Protein A Resin market held the largest market share, and the UK Protein A Resin market was the fastest-growing market in the European region.

The Asia-Pacific Protein A Resin Market is expected to grow at the fastest CAGR from 2025 to 2034. Because of the rising need for biologics and monoclonal antibodies, Protein A Resin is an essential purification instrument that is becoming increasingly desired. This evolution results from the growing prevalence of chronic illnesses and the need for innovative therapies. The biomanufacturing infrastructure and capacities of many Asia-Pacific nations are being actively expanded. Market conditions for Protein A Resin are becoming more favorable due to investments in cutting-edge bioprocessing facilities and the development of biotech hubs.

Moreover, China’s Protein A Resin market held the largest market share, and the Indian Protein A Resin market was the fastest-growing market in the Asia-Pacific region.

Protein A Resin Key Market Players & Competitive Insights

The Protein A Resin market will continue to grow due to major industry companies making significant R&D investments to extend their product ranges. Significant market developments include new product releases, contractual agreements, mergers and acquisitions, greater investments, and cooperation with other organizations. To increase their worldwide reach, market players also participate in a number of strategic initiatives. The Protein A Resin sector must provide affordable products to grow and thrive in a more cutthroat and dynamic market.

One of the main strategies manufacturers use in the worldwide Protein A Resin market manufacturing is expanding the market sector and helping customers by lowering operating costs. Some of the biggest medical benefits in recent years have come from the Protein A Resin sector. Major players in the Protein A Resin market, including Danaher Corporation, Merck KGAa, Agilent Technologies, GenScript, Repligen Corporation, Thermo Fisher Scientific, PerkinElmer Inc., Bio-Rad Laboratories, Inc., Abcam Plc., Orochem Technologies Inc., Kaneka Corporation, Agarose Bead Technologies, Avantor, Inc., and others, are attempting to increase market demand by investing in research and development operations.

Agilent Technologies, Inc. (Agilent) supplies consumables, reagents, and analytical tools for laboratory operations. It also provides related services and software. Scientific research, patient diagnostics, and food, water, and pharmaceutical safety testing are the company's main areas of concentration. Its product offerings include vacuum technologies, flow cytometry, microarray solutions, and mass spectrometry. Agilent serves various industries, including chemicals, applied materials, pharmaceuticals, diagnostics, contract research organizations (CROs), and contract manufacturing organizations (CMOs).

The corporation operates sales offices, logistics hubs, R&D centers, and business buildings worldwide. It uses a network of manufacturers' representatives, distributors, resellers, direct sales agents, and online retailers to market its products. Agilent Technologies and Delaware State University (DSU) joined in September 2022 as part of Agilent Foundation's humanitarian endeavors to increase the proportion of minority students choosing STEM careers.

A life science company called Repligen Corp. (Repligen) creates and markets bioprocessing technologies for the production of biological medications. Its offerings include ligands, fluid management, chromatography products, upstream and downstream filtration, cell culture supplements, and operating room disposables. The business also offers ways to get around creating and manufacturing novel drug classes. It offers implementation consulting services as well as hands-on process services. Repligen and Navigo finished working together to develop a unique affinity ligand in September 2021 that solves aggregation problems related to pH-sensitive antibodies and Fc-fusion proteins.

Purolite produces and supplies this NGL-Impact HipH ligand in a resin product intended for platform usage.

Key Companies in the Protein A Resin market include

- Danaher Corporation

- Merck KGAa

- Agilent Technologies

- GenScript

- Repligen Corporation

- Thermo Fisher Scientific

- PerkinElmer Inc.

- Bio-Rad Laboratories, Inc.

- Abcam Plc.

- Orochem Technologies Inc.

- Kaneka Corporation

- Agarose Bead Technologies

- Avantor, Inc.

Protein A Resin Industry Developments

November 2022: Repligen makes most Protein A ligands, and Purolite announced that they had extended and broadened their ligand supply deal. As a result of the current relationship, Praesto Jetted A50 HipH, which combines Puro lite's base beads and Repligen's ligand technology to deliver a unique protein A resin, was developed and commercialized.

June 2022: Navigo Proteins GmbH, a leading provider of affinity ligands for customized chromatography solutions, recently announced the successful creation of an affinity resin to remove the glycoprotein gp64, an unwanted contaminant, from the baculovirus insect cell expression system.

Protein A Resin Market Segmentation

Protein A Resin Product Outlook

- Agarose-based protein A resin

- Glass/Silica based protein A resin

- Organic polymer-based protein A resin

Protein A Resin Type Outlook

- Recombinant protein A resin

- Natural protein A resin

Protein A Resin Application Outlook

- Antibody Purification

- Immunoprecipitation

Protein A Resin End User Outlook

- Pharmaceutical and Biopharmaceutical Companies

- Academic Research Institutes

- Other End Users

Protein A Resin Regional Outlook

North America

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size 2024 |

1.74 (USD Billion) |

| Market Size 2025 |

1.92 (USD Billion) |

| Market Size 2034 |

4.60 (USD Billion) |

| Compound Annual Growth Rate (CAGR) |

10.20 % (2025 - 2034) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2034 |

| Historical Data |

2020 - 2024 |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product, Type, Application, End User and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Danaher Corporation, Merck KGAa, Agilent Technologies, GenScript, Repligen Corporation, Thermo Fisher Scientific, PerkinElmer Inc., Bio-Rad Laboratories, Inc., Abcam Plc., Orochem Technologies Inc., Kaneka Corporation, Agarose Bead Technologies, and Avantor, Inc. |

| Key Market Opportunities |

Expansion in biotechnology and a growing number of CMOs and CROs |

| Key Market Dynamics |

There is a growing need for therapeutic antibodies and a rising desire for monoclonal antibodies. |

Frequently Asked Questions (FAQ):

The Protein A Resin market size was valued at USD 1.4 Billion in 2023.

The market is projected to grow at a CAGR of 10.20% during the forecast period 2025-2034.

North America had the largest share of the market

The key players in the market are Danaher Corporation, Merck KGAa, Agilent Technologies, GenScript, Repligen Corporation, Thermo Fisher Scientific, PerkinElmer Inc., Bio-Rad Laboratories, Inc., Abcam Plc., Orochem Technologies Inc., Kaneka Corporation, Agarose Bead Technologies, and Avantor, Inc.

The agarose-based protein A resin category dominated the market in 2023.

The Recombinant protein A resin had the largest share in the market.