- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

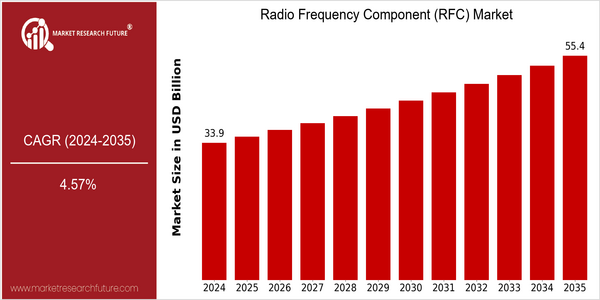

| Year | Value |

|---|---|

| 2024 | USD 33.88 Billion |

| 2035 | USD 55.4 Billion |

| CAGR (2025-2035) | 4.57 % |

Note – Market size depicts the revenue generated over the financial year

Radio Frequency Components Market will be worth US$33.88 billion in 2024, growing to US$55.40 billion by 2035. Its CAGR between 2025 and 2035 is 4.57%, indicating steady growth driven by the increasing demand for wireless communication technology and the proliferation of IoT devices. The transformation of various industries is bringing with it a greater need for efficient and reliable RF components. The development of 5G technology, for example, is driving the market forward, as it requires more powerful RF components to ensure greater coverage and faster data transmission. The increasing use of smart devices and the growing number of automobiles with wireless communication capability are also expected to drive demand. These trends are enabling industry leaders like Qualcomm, Broadcom, and Texas Instruments to launch new products and enter strategic alliances. The recent efforts of Qualcomm in developing a front-end solution for 5G networks are a good example of these efforts.

Regional Market Size

Regional Deep Dive

Rf Components Market - Across the Globe by 2022 is Expected to Grow at a Significant CAGR with the Growing Demand for Wireless Communications, Rising Adoption of IoT, and Development of 5G Infrastructure. Each region has its own market dynamics, which are influenced by technological developments, regulations, and economic conditions. The market for rf components is growing steadily, as industries such as telecommunications, transportation, and automotive continue to adopt rf components. The market is characterized by the presence of a large number of regional players that are adapting to local demands and the latest global trends.

Europe

- In Europe, regulatory changes aimed at promoting 5G technology adoption are driving the RFC market, with the European Commission's initiatives to allocate more spectrum for wireless communication playing a crucial role.

- Key players like STMicroelectronics and NXP Semiconductors are investing in research and development to create advanced RF components that comply with stringent European environmental regulations, thereby enhancing market competitiveness.

Asia Pacific

- The Asia-Pacific region is seeing a rapid rise in the use of RF components because of the strong growth of the consumer electronics industry, particularly in China and South Korea. Leading players in this market are Huawei and Samsung.

- Government initiatives, such as China's 'Made in China 2025' plan, are fostering innovation in RF technologies, encouraging local manufacturers to enhance their capabilities and compete on a global scale.

Latin America

- Latin America is experiencing a gradual increase in the adoption of RF components, driven by the expansion of mobile networks and the growing interest in IoT applications, particularly in Brazil and Mexico.

- Regulatory bodies in the region are working to harmonize spectrum allocation, which is expected to facilitate the deployment of advanced RF technologies and improve market access for international players.

North America

- The North American RFC market is heavily influenced by the rapid deployment of 5G networks, with major telecommunications companies like Verizon and AT&T investing significantly in RF technologies to enhance network capabilities.

- In the field of RF materials and components, companies such as Qorvo and Skyworks Solutions are developing high-performance RF filters and amplifiers to meet the increasing demand for communication systems.

Middle East And Africa

- In the Middle East and Africa, the RFC market is being shaped by increasing investments in telecommunications infrastructure, with projects like Saudi Arabia's Vision 2030 aiming to enhance connectivity and digital transformation.

- Local companies are collaborating with international firms to develop RF solutions tailored to regional needs, addressing unique challenges such as harsh environmental conditions and limited infrastructure.

Did You Know?

“Did you know that the global demand for RF components is expected to be significantly influenced by the rise of smart cities, where RF technologies play a crucial role in enabling seamless communication between devices?” — Market Research Future

Segmental Market Size

The radio frequency components market is experiencing a strong growth, mainly because of the growing demand for high-speed data transmission and the proliferation of IoT devices. The main reasons for this are the explosive growth in mobile data traffic and the rollout of 5G networks, which require advanced radio frequency components to ensure efficient signal processing and transmission. Furthermore, government initiatives to encourage the adoption of smart technology are boosting the market. The market is now in the early stages of commercialization, with Qualcomm and Broadcom leading the way in developing new products. North America and Asia-Pacific are the most advanced regions in terms of adoption, and they are investing heavily in telecommunications networks. The main applications of radio frequency components are in telecommunications, car radars and consumer electronics. They enable seamless interoperability and enhanced performance. Also driving the market are the growing emphasis on green technology and the ongoing digital transformation of industry. New developments in materials and production processes, such as GaN and SiGe, are also influencing the evolution of the market.

Future Outlook

OVERVIEW: OVERVIEW: The radio frequency component (RFC) market is projected to show a CAGR of 4.57% from 2024 to 2035. This growth is mainly due to the rising demand for advanced communication technology, especially 5G and beyond. The use of high-performance RF components is expected to drive this demand. As the wireless industry continues to develop, the penetration of RF components in the consumer electronics, automotive, and telecommunications industries is expected to increase significantly, and the penetration rate of RF components in new electronic devices is expected to exceed 70% by 2035. The development of GaN and SiC materials will further enhance the efficiency and performance of RF components, thus expanding the application scope of RF components. Also, the 5G network construction and the Internet of Things (IoT) are expected to be supported by the government. The trend of integrating RF components into smart devices and focusing on miniaturization and energy conservation will further shape the RFC industry. The RFC industry must be flexible and innovative to seize emerging opportunities and maintain its competitive advantage in the fast-changing environment.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 16.00% (2023-2030) |

Radio Frequency Component Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.