Research Methodology on Radio Frequency Identification Market

The study of the radio frequency identification (RFID) market was conducted using the Market Research Future (MRFR) four-step research procedure: secondary research, primary research, market factor analysis and market forecast. The secondary research was conducted to gain factual data and relevant data related to the RFID market, such as market categories, base year, historical data, and annual growth rate, among others. The primary research was conducted to identify the potential development opportunities, growth factors, risk factors and market threats in the RFID market for the period 2024 to 2032.

Secondary Research:

In the study of the RFID market, secondary research techniques were used to gain insight into the market and its components. Secondary research consists of sources such as white papers, books, webcasts, and press releases, as well as industry magazines and reports. These sources were referred to while preparing the study of the RFID market.

Primary Research:

This research involves a series of interviews and surveys to validate the points put forward in the secondary research. The interviews were administered to experts in the RFID market to gain valuable information and deep insight into the topics of concern. A combination of both primary and desk-based research was conducted for the study.

Market Factor Analysis:

The RFID market was studied in detail to understand the various components which have been impacting its growth. Various drivers, trends, and macroeconomic and microeconomic factors were taken into consideration while analyzing the market. The economic, legal, political and technological factors were studied from both a domestic and international perspective. The market environment analysis was done to gain a thorough understanding of the factors influencing the performance of the market.

Market Forecasting:

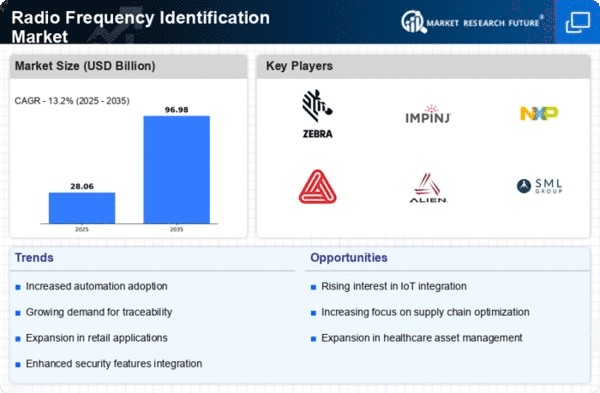

The market size was estimated using different sources and data points collected throughout the study. The historical market data was studied, collected, and analyzed to make projections regarding the RFID market’s future performance. The market size was estimated by making use of the bottom-up approach and the top-down approach. Statistical modelling techniques such as linear and non-linear regression models were used to make valid predictions regarding the market. The assumptions and estimations considered while creating the forecasting models were tested and evaluated multiple times for accuracy.

Data Interpretation & Analysis:

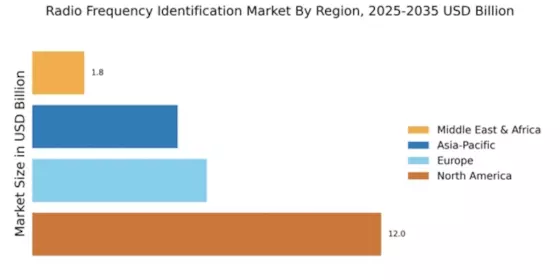

For the purpose of this study, a combination of both primary and secondary data was used. The data collected was filtered and validated, after which relevant data were used in the final analysis. The statistical data was collected from secondary sources and was presented in graphs, tables, and charts, making it easier for the reader to interpret the data and analyze it. The collected data was analyzed using advanced analytical tools such as SWOT analysis and Porter’s 5 Forces Model. Further, the data was analyzed for accuracy, consistency and validity through a process of primary and desk-based research, triangulation and feedback loops.

Finally, the raw data collected was investigated and analyzed to reach the final market size, share and forecast of the market.