- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

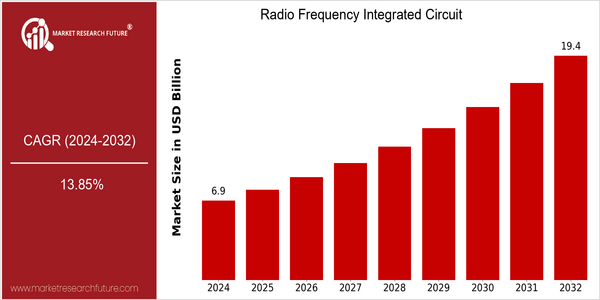

| Year | Value |

|---|---|

| 2024 | USD 6.86 Billion |

| 2032 | USD 19.39 Billion |

| CAGR (2024-2032) | 13.85 % |

Note – Market size depicts the revenue generated over the financial year

The Radio Frequency Integrated Circuit (RFIC) market is poised for significant growth, with a current valuation of USD 6.86 billion in 2024, projected to expand to USD 19.39 billion by 2032. This robust growth trajectory reflects a compound annual growth rate (CAGR) of 13.85% over the forecast period. The increasing demand for wireless communication technologies, coupled with the proliferation of IoT devices and advancements in 5G infrastructure, are key drivers propelling this market forward. As industries continue to embrace digital transformation, the need for efficient and high-performance RFICs is becoming increasingly critical. Technological innovations, such as the development of advanced semiconductor materials and miniaturization of components, are further enhancing the capabilities of RFICs, making them integral to modern electronic devices. Major players in the RFIC market, including Texas Instruments, Analog Devices, and NXP Semiconductors, are actively investing in research and development to introduce cutting-edge products that cater to the evolving needs of consumers and businesses alike. Strategic initiatives, such as partnerships and collaborations aimed at enhancing product offerings and expanding market reach, are also shaping the competitive landscape, ensuring that the RFIC market remains dynamic and responsive to emerging trends.

Regional Market Size

Regional Deep Dive

The Radio Frequency Integrated Circuit (RFIC) market is experiencing significant growth across various regions, driven by the increasing demand for wireless communication technologies, the proliferation of IoT devices, and advancements in semiconductor technology. Each region exhibits unique characteristics that influence market dynamics, including regulatory frameworks, technological innovations, and economic conditions. As 5G networks continue to roll out globally, the RFIC market is poised for expansion, with regional players adapting to local demands and trends.

Europe

- In Europe, the RFIC market is shaped by stringent regulatory standards aimed at reducing electromagnetic interference, with organizations like the European Telecommunications Standards Institute (ETSI) playing a crucial role in setting these guidelines.

- The European Union's Green Deal is driving demand for energy-efficient RFICs, prompting companies like NXP Semiconductors to develop sustainable solutions that align with environmental goals.

Asia Pacific

- Asia-Pacific is witnessing a surge in RFIC demand due to the rapid growth of consumer electronics and mobile devices, with companies like MediaTek and Samsung leading the charge in innovation and production.

- Government initiatives in countries like China, such as the Made in China 2025 plan, are fostering advancements in semiconductor technology, which is expected to enhance the region's RFIC capabilities significantly.

Latin America

- In Latin America, the RFIC market is influenced by the growing adoption of smart technologies and IoT applications, with Brazil and Mexico leading in market growth due to their expanding telecommunications sectors.

- Regulatory changes aimed at improving spectrum allocation for wireless communications are expected to boost the RFIC market, as seen in Brazil's recent auction of 5G spectrum licenses.

North America

- The North American RFIC market is heavily influenced by the rapid deployment of 5G technology, with major telecommunications companies like Verizon and AT&T investing significantly in infrastructure upgrades to support enhanced connectivity.

- Innovations in RFIC design are being spearheaded by companies such as Qualcomm and Texas Instruments, which are focusing on integrating advanced features like beamforming and MIMO technology to improve signal quality and efficiency.

Middle East And Africa

- The Middle East and Africa are emerging markets for RFICs, driven by increasing investments in telecommunications infrastructure, particularly in countries like the UAE and South Africa, where 5G rollout is gaining momentum.

- Local companies are collaborating with international firms to enhance RFIC manufacturing capabilities, with initiatives like the South African government's support for local semiconductor production playing a pivotal role.

Did You Know?

“Did you know that the RFIC market is expected to see a significant increase in demand for integrated circuits that support millimeter-wave frequencies, which are essential for the high-speed data transmission required by 5G networks?” — Market Research Future

Segmental Market Size

The Radio Frequency Integrated Circuit (RFIC) segment plays a crucial role in the overall market, primarily driven by the increasing demand for wireless communication technologies. This segment is currently experiencing growth, fueled by the proliferation of IoT devices, 5G networks, and advancements in automotive applications. Key drivers include the need for higher data rates and improved connectivity, as well as regulatory policies promoting the adoption of smart technologies in various sectors. Currently, the RFIC segment is in a scaled deployment stage, with companies like Qualcomm and Broadcom leading the charge in 5G RFIC solutions. Primary applications include telecommunications, automotive radar systems, and consumer electronics, where RFICs are essential for enabling seamless connectivity. Notable trends accelerating growth include the global push for smart city initiatives and the increasing focus on sustainability, prompting innovations in energy-efficient RF technologies. Emerging methodologies, such as System-on-Chip (SoC) designs, are also shaping the evolution of RFICs, enhancing their performance and integration capabilities.

Future Outlook

The Radio Frequency Integrated Circuit (RFIC) market is poised for significant growth from 2024 to 2032, with a projected market value increase from $6.86 billion to $19.39 billion, reflecting a robust compound annual growth rate (CAGR) of 13.85%. This growth trajectory is primarily driven by the escalating demand for wireless communication technologies, particularly in the realms of 5G and beyond, as well as the increasing adoption of Internet of Things (IoT) devices. As industries continue to embrace digital transformation, the penetration of RFICs in consumer electronics, automotive applications, and telecommunications is expected to rise substantially, with usage rates potentially exceeding 50% in key sectors by 2030. Key technological advancements, such as the development of advanced semiconductor materials and miniaturization techniques, are expected to enhance the performance and efficiency of RFICs, making them more attractive for a wider range of applications. Additionally, supportive government policies aimed at promoting 5G infrastructure and smart city initiatives will further catalyze market growth. Emerging trends, including the integration of artificial intelligence in RF design and the shift towards more sustainable manufacturing practices, will also play a crucial role in shaping the future landscape of the RFIC market. As these dynamics unfold, stakeholders are encouraged to stay attuned to evolving consumer preferences and technological innovations to capitalize on the burgeoning opportunities within this sector.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 5.92 Billion |

| Growth Rate | 13.85% (2024-2032) |

Radio Frequency Integrated Circuit Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.