- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

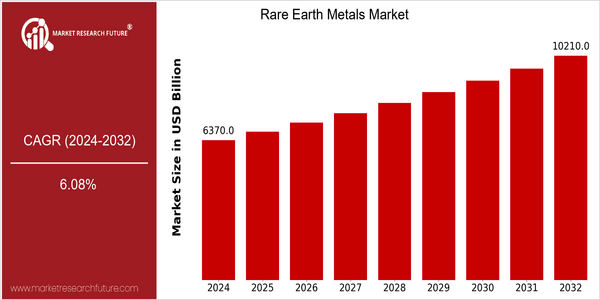

| Year | Value |

|---|---|

| 2024 | USD 6370.0 Billion |

| 2032 | USD 10210.0 Billion |

| CAGR (2024-2032) | 6.08 % |

Note – Market size depicts the revenue generated over the financial year

Despite the fact that the rare earth metals market is currently valued at about $ 6,000 billion, the market is expected to grow to $ 10,200 billion by 2032. The CAGR of this market is 6%. The main reason for this is the high demand for rare earth elements due to their essential role in the development of high-tech products such as electric cars, solar cells and wind power generation. The market will continue to grow as industries continue to develop and use rare earth materials in their products. Besides, the development of technology and the strategic plans of rare earth industry giants will also drive the growth of this market. Companies such as Lynas and MPP are actively investing in the production of rare earth elements and establishing strategic alliances to ensure the supply chain and enhance market share. Furthermore, the increasing focus on sustainable development and the development of rare earth recycling will also provide opportunities for the rare earth industry. The world's economy is shifting to a greener path, and rare earth elements are expected to become the focus of future development.

Regional Market Size

Regional Deep Dive

Each region has its own particular characteristics, shaped by the local demand, the availability of resources, and the regulatory framework. North America has focused on reducing its dependence on imports, while Europe has focused on a shift to sustainable practices. Asia-Pacific remains the largest producer and the biggest consumer, driven by industrial demand, especially in China. Middle East and Africa are emerging as new sources of supply, while Latin America is exploring the rare earths potential, as the interest in the region increases.

Europe

- The European Union has launched the European Raw Materials Alliance to secure a stable supply of rare earth metals, emphasizing recycling and sustainable sourcing to reduce reliance on imports.

- Countries like Sweden and Finland are investing in mining projects, such as the Norra Karr project, which aims to extract rare earth elements while adhering to stringent environmental regulations.

Asia Pacific

- China continues to dominate the rare earth market, with recent government policies aimed at consolidating production and enhancing environmental standards, impacting global supply chains.

- Australia's Lynas Corporation is expanding its operations to meet rising demand, with plans for a processing facility in the U.S. to support local industries and reduce reliance on Chinese imports.

Latin America

- Brazil is exploring its rare earth resources, with initiatives to develop mining projects that could cater to both domestic and international markets, particularly in the electronics sector.

- Chile is investigating the potential of rare earth elements in its lithium mining operations, aiming to create a more integrated supply chain for electric vehicle batteries.

North America

- The U.S. government has initiated several programs aimed at boosting domestic production of rare earth metals, including the establishment of the Defense Production Act to support mining projects like the Mountain Pass mine in California.

- Canada is actively exploring partnerships with companies like Neo Performance Materials to develop a rare earth supply chain, focusing on sustainable extraction methods and reducing environmental impact.

Middle East And Africa

- Countries like South Africa are beginning to explore their rare earth potential, with projects like the Steenkampskraal mine aiming to tap into the region's untapped resources.

- The UAE is investing in technology to process rare earth metals, positioning itself as a future hub for rare earth processing in the region.

Did You Know?

“Rare earth metals are not actually rare; they are relatively abundant in the Earth's crust, but their extraction is often economically challenging due to environmental concerns and complex processing requirements.” — U.S. Geological Survey

Segmental Market Size

The rare earths market is characterized by its critical role in high-tech applications and is currently experiencing a high growth rate, driven by the increasing demand from industries such as electronics, renewable energy, and electric vehicles. The key factors driving the market are the growing demand for advanced technology, the strict regulations for the use of clean energy, and the continuous technological progress in the production of batteries and electric motors. The rare earths industry is dominated by China, the United States, and Japan, with companies such as Lynas and MP Materials leading the way in terms of production and innovation. The rare earths market is characterized by its mature development, particularly in the automobile and electronics industries, where rare earths are essential for the production of magnets and catalysts. Neodymium is used in electric motors, and lanthanum is used in catalytic converters. In addition, the increasing demand for rare earths is driven by macro-economic factors such as the green economy and government support for green technology. The development of extraction and re-use technology is also shaping the evolution of the industry, which will ensure the sustainable development of rare earths.

Future Outlook

From 2024 to 2032, the rare earth metals market is expected to grow at a compound annual growth rate (CAGR) of 6.08%. The market will be driven by the growing demand for rare earth metals in high-tech applications, such as electric vehicles (EVs), wind power, and new-generation digital equipment. As the global energy transition accelerates, the use of rare earths, especially neodymium and dysprosium, in the permanent magnets of EV motors and wind power is expected to increase, thereby driving the market penetration rate to new heights. The major technological breakthroughs and supportive government policies will play an important role in shaping the future of the rare earth metals market. New extraction and separation methods will reduce the cost of rare earths, making them more accessible. In addition, the market will be influenced by the trade policy and the national strategy of rare earths. The market will see an increase in investment in domestic mining and processing. This will create a rare earth industry with greater stability and sustainability. The future of the rare earth industry is bright.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 6,000 Million |

| Growth Rate | 6.08% (2024-2032) |

Rare Earth Metal Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.