- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

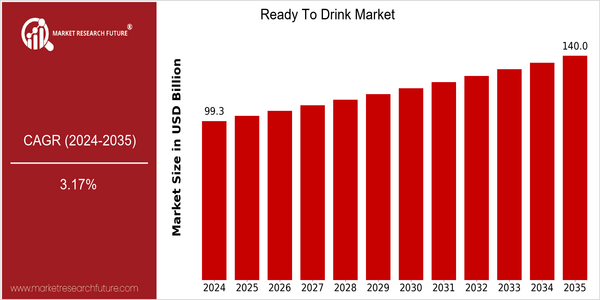

Ready To Drink Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 99.35 Billion |

| 2035 | USD 140.0 Billion |

| CAGR (2025-2035) | 3.17 % |

Note – Market size depicts the revenue generated over the financial year

The Ready-to-Drink (RTD) market is poised for significant growth, with a current market size of $99 billion in 2024, projected to reach $ 140 billion by 2035. This translates into a CAGR of 3.17% between 2025 and 2035, reflecting steady growth in demand for convenient beverage options. The increasing pace of urbanization and changing lifestyles are driving this market. The increasing health consciousness among consumers is encouraging manufacturers to develop healthier, low-calorie, and more nutritious RTDs, which is also driving growth. The major players in the RTD market, such as Coca-Cola, PepsiCo, and Nestlé, are constantly working to increase their market share. They are investing in product development and launching new flavors and formulations to cater to changing consumer preferences. Coca-Cola’s introduction of the Coca-Cola Energy line and PepsiCo’s expansion into plant-based beverages are examples of how the market leaders are introducing products that are in line with changing consumer preferences. Also, the companies are investing in establishing strong distribution networks and ensuring that their packaging is more sustainable.

Regional Deep Dive

The market for ready-to-drink beverages is experiencing significant growth in various regions, mainly due to changing consumers’ preferences towards convenience and on-the-go consumption. In North America, the market is characterised by a wide range of products, including alcoholic and non-alcoholic beverages, with a strong emphasis on health and well-being trends. In Europe, there is a growing demand for organic and premium RTDs, while in Asia-Pacific, the non-alcoholic RTDs market is growing rapidly. Middle East and Africa (MEA) are seeing increased local production and investment, and Latin America is capitalising on its rich cultural heritage to introduce unique flavours and beverages, which enhance the overall market dynamics.

North America

- The rising number of health-conscious consumers has triggered a surge in demand for low-calorie and health-enhancing ready-to-drink beverages.

- A new era of innovations in packaging has begun, with the use of eco-friendly materials and the development of convenient single-servings. Keurig Dr Pepper has focused on the environment to attract more conscious consumers.

- The legalization of cannabis-infused beverages in several states is bringing new opportunities to market. Canopy Growth, for example, is entering the RTD market.

Europe

- RTDs, mainly organic and premium, are enjoying a boom in Europe, where Innocent Drinks and Fever-Tree are establishing a new trend for the use of natural ingredients.

- The new European regulations on labelling and health claims are forcing food manufacturers to reformulate their products and ensure transparency and the promotion of healthier foods, thereby strengthening trust in the industry.

- The trend towards artisanal and craft beverages is also affecting the market, with local distilleries and breweries such as BrewDog gaining popularity for their unique and inventive RTDs.

Asia-Pacific

- The non-alcoholic RTD segment is growing rapidly in the Asia-Pacific region, mainly driven by urbanization and the younger population, and the leading brands are Suntory and Asahi.

- The development of new tastes and new ingredients, such as herbal and health drinks, is also gaining ground. Companies such as Nestlé are introducing products which cater to the tastes and preferences of consumers in individual countries.

- Government initiatives to encourage a healthy diet and to reduce sugar intake are influencing product development.

MEA

- The demand for RTD beverages is on the rise, and there is an increasing interest in local production. The Al Ain Water Company is expanding its operations to meet the growing demand for these beverages.

- The diversity of the cultural groups in the MEA region has given rise to many new tastes and drinks, which are adapted to the local tastes.

- The regulatory frameworks are evolving, and governments are focusing on food safety and quality standards. This has encouraged international companies to enter the market and adapt their products to these requirements.

Latin America

- Latin America is a region with many fruits, which, in combination with the wide range of products, makes it a unique region for RTD beverages, with brands such as Grupo Modelo introducing flavors that are local and original.

- The advent of e-commerce and on-demand delivery has transformed the way consumers access RTDs. The digital platforms developed by companies such as Ambev have increased the scope for distribution.

- The sugar regulations which are being introduced in many countries are causing manufacturers to reformulate their products, thus leading to a shift towards healthier RTDs.

Did You Know?

“In 2022, there were to be more than 1,000 new products launched on the RTD market. This was a sign of the rapid innovation and diversification in the sector.” — Mintel, 2023

Segmental Market Size

The RTD segment plays an important role in the beverage industry and is currently experiencing robust growth, driven by changing consumer preferences for the convenience of on-the-go consumption. This segment comprises a wide range of products, including iced teas, coffee beverages and alcoholic beverages, which cater to a diverse audience seeking quick and easy consumption.

The rising trend of consumers towards healthy drinks is driving demand. The trend towards health drinks and the emergence of e-commerce have made a wide range of RTDs more accessible to consumers. The current maturity stage is characterized by a wide range of RTDs, especially in North America and Europe. Companies such as Coca-Cola and Diageo are leading the market with their innovations. RTDs are mainly used in cafes and convenience stores. The demand for RTDs is driven by macro trends such as the pursuit of sustainable development and health consciousness. Technological advances in packaging, such as the use of biodegradable materials, have a significant impact on the evolution of the industry.

Future Outlook

READY-TO-DRINK MARKET SET TO GROW SMOOTHER BETWEEN 2024 AND 2035 WITH CAGR OF 3.17% Amid the changing preferences of consumers towards convenience and health-conscious options, as well as the rising popularity of premium and craft beverages, the market for ready-to-drink beverages is expected to grow steadily. In 2035, it is expected that ready-to-drink beverages will make up about 60% of the beverage market. This is due to the changing preferences of consumers, especially the younger generation who are seeking convenience without sacrificing quality.

RTD will continue to be influenced by technological and policy developments. Packaging innovations, such as the use of eco-friendly materials and smart packaging, are intended to improve product appeal and sustainability. They respond to the growing demand for products that are both aesthetically pleasing and sustainable. In addition, the regulatory support for healthier beverage options with lower sugar content and natural ingredients will encourage manufacturers to reformulate existing products and develop new ones. In addition, the emergence of new trends, such as the rise of beverages with health benefits and the increasing use of digital marketing to engage consumers, will play an important role in driving the market. RTD’s rapid evolution requires its players to be flexible and responsive to consumers’ changing needs.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 1.1 billion |

| Growth Rate | 11.20% (2024-2032) |

Ready To Drink Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.