Reusable Water Bottle Size

Reusable Water Bottle Market Growth Projections and Opportunities

The reusable water bottle market is influenced by various factors that shape its dynamics and growth trajectory. One significant factor is the increasing awareness and concern about environmental sustainability. As people become more conscious of the environmental impact of single-use plastic bottles, there's a growing preference for reusable alternatives. Consumers are actively seeking eco-friendly options to reduce plastic waste and minimize their carbon footprint. This shift in consumer behavior has propelled the demand for reusable water bottles, driving market growth.

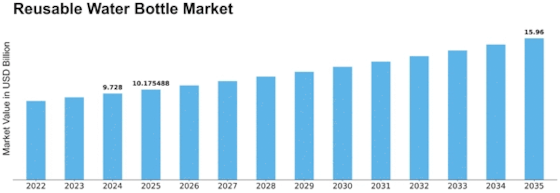

The Reusable Water Bottle market is projected to grow from USD 8.9 Billion in 2023 to USD 12.7 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 4.60% during the forecast period (2023 - 2032).

Moreover, government regulations and initiatives aimed at reducing plastic pollution play a pivotal role in shaping the market. Many countries have implemented bans or levied taxes on single-use plastics, incentivizing the use of reusable alternatives. These regulatory measures not only create a conducive environment for the reusable water bottle market but also raise awareness about the importance of sustainable consumption practices.

Technological advancements also contribute to the growth of the reusable water bottle market. Manufacturers are continuously innovating to develop bottles that are durable, lightweight, and convenient to use. Advancements in materials science have led to the emergence of new materials such as stainless steel, glass, and BPA-free plastics, which offer safer and more sustainable alternatives to traditional plastic bottles. Additionally, features like insulated designs and leak-proof lids enhance the functionality and appeal of reusable water bottles, driving consumer interest and adoption.

Changing lifestyles and increasing health consciousness among consumers are additional factors influencing the market. As more people prioritize fitness and wellness, the demand for hydration solutions on the go has surged. Reusable water bottles offer a convenient and eco-friendly way to stay hydrated throughout the day, whether at the gym, office, or outdoor activities. The growing popularity of sports and outdoor recreational activities further fuels the demand for durable and portable water bottles, driving market growth.

Furthermore, the rise of e-commerce platforms has significantly expanded the reach of reusable water bottles. Online channels provide consumers with a wide range of options to choose from, along with the convenience of doorstep delivery. This accessibility has facilitated market penetration, particularly among younger demographics and urban consumers who are more inclined towards online shopping.

Social trends and cultural influences also play a role in shaping the market dynamics of reusable water bottles. The increasing popularity of sustainable living movements, coupled with the rise of influencer culture on social media, has amplified awareness about eco-friendly products like reusable water bottles. Celebrities, influencers, and environmental activists often advocate for sustainable lifestyle choices, driving consumer interest and influencing purchasing decisions.

Leave a Comment