- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

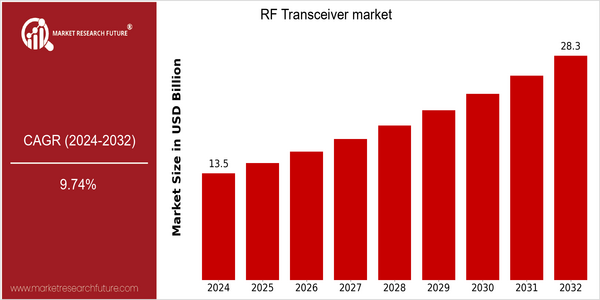

| Year | Value |

|---|---|

| 2024 | USD 13.47 Billion |

| 2032 | USD 28.34 Billion |

| CAGR (2024-2032) | 9.74 % |

Note – Market size depicts the revenue generated over the financial year

The global RF transceiver market is poised for significant growth, with a current market size of USD 13.47 billion in 2024, projected to reach USD 28.34 billion by 2032. This represents a robust compound annual growth rate (CAGR) of 9.74% over the forecast period. The increasing demand for wireless communication technologies, driven by the proliferation of IoT devices, 5G networks, and smart city initiatives, is a primary factor propelling this market expansion. As industries continue to embrace digital transformation, the need for efficient and high-performance RF transceivers becomes critical to support advanced applications such as autonomous vehicles, smart homes, and industrial automation. Key players in the RF transceiver market, including Qualcomm, Texas Instruments, and NXP Semiconductors, are actively investing in research and development to enhance their product offerings. Strategic initiatives such as partnerships and collaborations are also on the rise, aimed at leveraging complementary technologies and expanding market reach. For instance, recent product launches focusing on integrated RF solutions that cater to the growing demand for high-speed data transmission are indicative of the innovative trends shaping the industry. As the market evolves, these technological advancements and strategic moves will be pivotal in sustaining the growth trajectory of the RF transceiver market.

Regional Market Size

Regional Deep Dive

The RF Transceiver market is experiencing significant growth across various regions, driven by the increasing demand for wireless communication technologies and the proliferation of IoT devices. In North America, the market is characterized by advanced technological infrastructure and a strong presence of key players, while Europe is focusing on regulatory frameworks that promote innovation in wireless technologies. The Asia-Pacific region is witnessing rapid adoption of RF transceivers due to the booming electronics manufacturing sector, whereas the Middle East and Africa are gradually embracing these technologies, influenced by government initiatives aimed at enhancing connectivity. Latin America, while still developing, shows potential for growth as mobile network operators expand their services. Overall, the market dynamics in each region are shaped by local economic conditions, regulatory environments, and technological advancements.

Europe

- The European Union's Horizon 2020 program is funding various projects aimed at enhancing wireless communication technologies, which is likely to drive innovation in the RF transceiver market.

- Companies like NXP Semiconductors are focusing on developing energy-efficient RF transceivers to meet the stringent environmental regulations in Europe, thereby influencing market trends.

Asia Pacific

- China's push for technological self-sufficiency has led to increased investments in local RF transceiver manufacturing, with companies like Huawei and ZTE leading the charge.

- The rapid growth of the consumer electronics market in India is driving demand for RF transceivers, as more manufacturers seek to integrate advanced wireless capabilities into their products.

Latin America

- Brazil's National Telecommunications Agency (ANATEL) is working on regulatory reforms to improve the telecommunications landscape, which could positively impact the RF transceiver market.

- The growing mobile penetration in countries like Mexico is leading to increased demand for RF transceivers as operators upgrade their networks to support higher data rates.

North America

- The Federal Communications Commission (FCC) has recently updated regulations to facilitate the deployment of 5G networks, which is expected to significantly boost the demand for RF transceivers in the region.

- Key players such as Qualcomm and Texas Instruments are investing heavily in R&D to develop next-generation RF transceivers that support advanced applications like autonomous vehicles and smart cities.

Middle East And Africa

- Governments in the UAE and Saudi Arabia are launching initiatives to enhance digital infrastructure, which is expected to create new opportunities for RF transceiver adoption in the region.

- The increasing focus on smart city projects in countries like Qatar is driving demand for advanced RF transceivers to support IoT applications and connectivity.

Did You Know?

“Did you know that the RF transceiver market is expected to play a crucial role in the development of 6G technology, which aims to provide data rates up to 100 times faster than 5G?” — International Telecommunication Union (ITU)

Segmental Market Size

The RF Transceiver market segment plays a crucial role in enabling wireless communication across various applications, and it is currently experiencing stable growth. Key drivers of demand include the increasing need for high-speed data transmission in telecommunications and the proliferation of IoT devices, which require efficient and reliable RF communication. Additionally, regulatory policies promoting the deployment of 5G networks are further fueling demand for advanced RF transceivers. Currently, the adoption stage of RF transceivers is in the scaled deployment phase, with companies like Qualcomm and Texas Instruments leading the charge in developing innovative solutions. Regions such as North America and Asia-Pacific are at the forefront of this adoption, driven by significant investments in telecommunications infrastructure. Primary applications include mobile communications, automotive systems, and smart home devices, where RF transceivers facilitate seamless connectivity. Trends such as the push for smart cities and the rise of autonomous vehicles are accelerating growth, while technologies like MIMO (Multiple Input Multiple Output) and beamforming are shaping the segment's evolution.

Future Outlook

The RF Transceiver market is poised for significant growth from 2024 to 2032, with the market value projected to increase from $13.47 billion to $28.34 billion, reflecting a robust compound annual growth rate (CAGR) of 9.74%. This growth trajectory is underpinned by the escalating demand for wireless communication technologies, driven by the proliferation of IoT devices, advancements in 5G networks, and the increasing adoption of smart technologies across various sectors. As industries continue to embrace digital transformation, the penetration of RF transceivers in applications such as automotive, telecommunications, and consumer electronics is expected to rise substantially, with usage rates potentially exceeding 60% in key markets by 2032. Key technological advancements, including the development of more efficient and compact RF transceiver designs, are anticipated to further enhance market growth. Innovations such as integrated circuit technology and software-defined radio (SDR) are expected to improve performance while reducing costs, making RF transceivers more accessible to a broader range of applications. Additionally, supportive government policies promoting the expansion of wireless infrastructure and the rollout of next-generation communication networks will serve as critical drivers for market expansion. As the RF Transceiver market evolves, emerging trends such as the integration of artificial intelligence for enhanced signal processing and the shift towards sustainable manufacturing practices will shape the competitive landscape, positioning the market for sustained growth in the coming years.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 12.12 billion |

| Growth Rate | 9.74% (2024-2032) |

RF Transceiver Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.