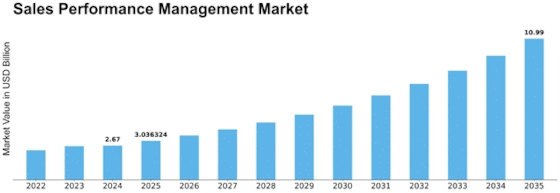

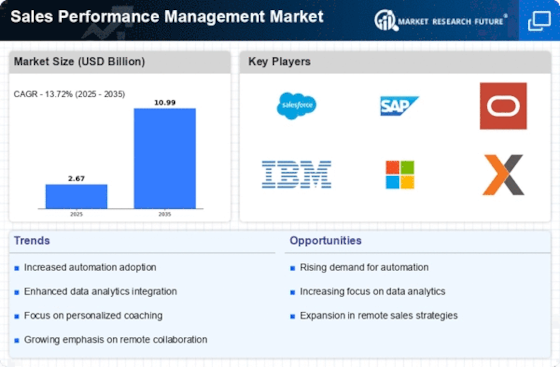

Sales Performance Management Size

Sales Performance Management Market Growth Projections and Opportunities

One pivotal determinant is the worldwide financial scene. Monetary circumstances, like downturns or times of development, directly influence organizations' readiness to put resources into SPM arrangements. During monetary declines, organizations might focus on cost-cutting estimates over putting resources into new advancements, influencing the interest for SPM arrangements. On the other hand, during monetary prosperity, organizations are bound to dispense financial plans for cutting edge sales performance devices to improve their strategic advantage. Mechanical headways assume an essential part in molding the SPM market.

As innovation keeps on advancing, new and more refined SPM arrangements arise. Developments in AI, and information examination have changed the capacities of SPM stages, empowering organizations to acquire further fragments of knowledge into their sales performance. The combination of these cutting-edge innovations upgrades the productivity of sales processes as well as gives an upper hand to associations embracing these arrangements. Administrative changes similarly apply a huge effect on the SPM market. Consistency necessities, particularly in enterprises like money and medical services, influence the highlights and functionalities that SPM arrangements should offer. As guidelines develop, SPM merchants should adjust their contributions to guarantee that their answers line up with the most recent consistency norms. Moreover, administrative changes can drive associations to put resources into SPM instruments to meet new revealing and direct prerequisites.

As clients become seriously knowing and requesting, associations should upgrade their sales methodologies and performance management to meet these advancing assumptions. SPM arrangements that focus on client driven approaches, for example, customized sales encounters and productive client relationship management, are probably going to get some decent momentum in the market. The versatility and adaptability of SPM arrangements are critical market factors also. Organizations are attracted to arrangements that can consistently adjust to their developing requirements and scale close by their development. Versatile SPM stages empower associations to extend their tasks without the requirement for broad upgrades or framework substitutions, giving a financially smart and effective answer for long haul use.

Leave a Comment