- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

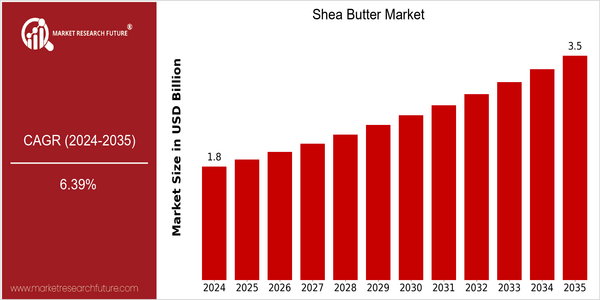

| Year | Value |

|---|---|

| 2024 | USD 1.77 Billion |

| 2035 | USD 3.5 Billion |

| CAGR (2025-2035) | 6.39 % |

Note – Market size depicts the revenue generated over the financial year

The global shea butter market is poised for significant growth, with a current market size of USD 1.77 billion in 2024, projected to reach USD 3.5 billion by 2035. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 6.39% from 2025 to 2035. The increasing demand for natural and organic ingredients in cosmetics, personal care, and food products is a primary driver of this market expansion. Consumers are increasingly seeking products that are free from synthetic additives, which has led to a surge in the popularity of shea butter as a versatile ingredient known for its moisturizing and healing properties. Technological advancements in extraction and processing methods are also contributing to the market's growth. Innovations that enhance the quality and yield of shea butter, along with sustainable sourcing practices, are attracting investments from key players in the industry. Companies such as The Body Shop, L'Occitane, and SheaMoisture are leading the charge, implementing strategic initiatives like partnerships with local cooperatives in West Africa to ensure a steady supply of high-quality shea nuts. These efforts not only support local economies but also align with the growing consumer preference for ethically sourced products, further propelling the shea butter market forward.

Regional Market Size

Regional Deep Dive

The Shea Butter Market is experiencing dynamic growth across various regions, driven by increasing consumer awareness of natural and organic products, as well as the rising demand for sustainable beauty and personal care ingredients. In North America and Europe, the market is characterized by a strong preference for ethically sourced and fair-trade shea butter, while the Asia-Pacific region is witnessing a surge in demand due to the growing beauty and cosmetics industry. The Middle East and Africa, being the primary producers of shea butter, are seeing a focus on enhancing production capabilities and export potential, while Latin America is gradually adopting shea butter in its cosmetic formulations, influenced by global trends towards natural ingredients.

Europe

- European consumers are increasingly favoring products with transparent sourcing, leading to a rise in partnerships between European brands and African cooperatives, such as the partnership between Fair Trade and local shea producers.

- Innovations in product formulations, including the incorporation of shea butter in skincare and haircare products, are being driven by companies like Unilever and Beiersdorf, which are investing in research to enhance the benefits of shea butter.

Asia Pacific

- The booming beauty and personal care market in Asia-Pacific, particularly in countries like South Korea and Japan, is driving the adoption of shea butter in various cosmetic products, with brands like Innisfree incorporating it into their offerings.

- The region is witnessing a surge in e-commerce platforms that promote natural ingredients, making shea butter more accessible to consumers and encouraging local manufacturers to explore shea butter-based products.

Latin America

- Latin American beauty brands are increasingly incorporating shea butter into their formulations, influenced by global trends towards natural and organic ingredients, with companies like Natura &Co leading the charge.

- The region's growing middle class and increasing disposable income are driving demand for premium beauty products, including those featuring shea butter, as consumers seek high-quality, effective skincare solutions.

North America

- The rise of clean beauty trends has led to an increased demand for shea butter in personal care products, with companies like L'Occitane and The Body Shop emphasizing ethically sourced ingredients in their formulations.

- Regulatory changes, such as the FDA's increased scrutiny on cosmetic ingredients, have prompted brands to seek natural alternatives like shea butter, which is perceived as safer and more sustainable.

Middle East And Africa

- In Africa, initiatives like the African Development Bank's support for shea value chain development are enhancing production capabilities and empowering local women who are primarily involved in shea nut harvesting.

- The Middle East is seeing an increase in demand for shea butter in the luxury cosmetics segment, with brands focusing on high-quality, organic shea butter sourced from West Africa.

Did You Know?

“Did you know that shea butter is not only used in cosmetics but also has culinary applications in some African countries, where it is used as a cooking fat and ingredient in traditional dishes?” — International Journal of Food Science & Technology

Segmental Market Size

The Shea Butter Market is experiencing stable growth, driven primarily by increasing consumer demand for natural and organic skincare products. Key factors propelling this segment include the rising awareness of the benefits of shea butter, such as its moisturizing properties and anti-inflammatory effects, alongside a shift towards clean beauty products. Additionally, regulatory policies promoting the use of natural ingredients in cosmetics further enhance demand. Currently, the adoption of shea butter in the cosmetics and personal care industry is in a mature stage, with companies like L'Occitane and The Body Shop leading in its utilization. Primary applications include moisturizers, hair care products, and lip balms, where shea butter serves as a key ingredient. Trends such as sustainability initiatives and the growing popularity of ethical sourcing are catalyzing growth, as consumers increasingly prefer products that align with their values. Technologies like cold-press extraction methods are also shaping the segment, ensuring higher quality and purity of shea butter, which appeals to health-conscious consumers.

Future Outlook

The Shea Butter Market is poised for significant growth from 2024 to 2035, with a projected market value increase from $1.77 billion to $3.5 billion, reflecting a robust compound annual growth rate (CAGR) of 6.39%. This growth trajectory is underpinned by rising consumer demand for natural and organic personal care products, as well as the increasing application of shea butter in the food and pharmaceutical industries. As awareness of the benefits of shea butter continues to expand, particularly in regions such as North America and Europe, penetration rates are expected to rise, with an estimated 25% of consumers incorporating shea butter products into their daily routines by 2035. Key drivers of this market expansion include advancements in extraction and processing technologies that enhance the quality and yield of shea butter, making it more accessible to manufacturers. Additionally, supportive policies promoting sustainable sourcing and fair trade practices are likely to bolster the market, as consumers increasingly favor ethically produced goods. Emerging trends such as the integration of shea butter in clean beauty formulations and the rise of e-commerce platforms for direct-to-consumer sales will further shape the landscape, ensuring that the Shea Butter Market remains dynamic and responsive to evolving consumer preferences.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.17 billion |

| Growth Rate | 6.89% (2022-2030) |

Shea Butter Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.