- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

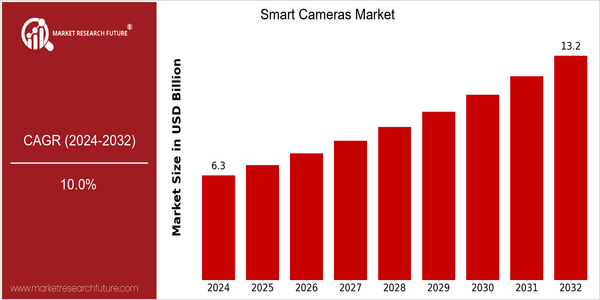

| Year | Value |

|---|---|

| 2024 | USD 6.3 Billion |

| 2032 | USD 13.2 Billion |

| CAGR (2024-2032) | 10.0 % |

Note – Market size depicts the revenue generated over the financial year

The world market for smart cameras is growing rapidly, with a current market size of $ 6.3 billion in 2024, projected to grow to $13.2 billion by 2032. This represents a healthy CAGR of 10.0% over the forecast period. The demand for advanced imaging solutions in various industries, such as security, automotive, and consumer electronics, is the main reason for this growth. Also, as smart cameras become more common in smart home applications and surveillance systems, the market is expected to grow further. In particular, the increasing use of artificial intelligence and machine learning will enhance the processing and analysis capabilities of smart cameras. Besides, the smart camera industry, such as Canon, Sony, and Hikvision, has been investing in R & D to develop new products. Strategic alliances and the launch of smart cameras with facial recognition and real-time data analysis capabilities are also driving the market. Also, as consumers prefer smart and connected devices, the smart camera market will be able to take advantage of this trend.

Regional Market Size

Regional Deep Dive

The smart camera market is experiencing significant growth across various regions, mainly driven by technological advancements, increasing demand for security solutions, and the proliferation of smart devices. In North America, the market is characterized by high adoption of smart home devices and strong focus on security and surveillance. In Europe, smart cameras are experiencing a rise in demand due to regulatory changes, which are promoting the security and surveillance of public spaces. In Asia-Pacific, the market is growing rapidly, mainly driven by the urbanization of economies and the growing middle class, which is investing heavily in smart devices. In the Middle East and Africa, smart camera applications are growing in the retail and transportation sectors, while Latin America is gradually adopting smart camera solutions, mainly driven by the growing focus on public security.

Europe

- The European Union's General Data Protection Regulation (GDPR) has prompted manufacturers to innovate in privacy-preserving technologies, leading to the development of smart cameras that prioritize user consent and data protection.

- Key players such as Bosch and Axis Communications are investing in smart camera solutions that cater to the growing demand for smart city initiatives, enhancing urban safety and surveillance capabilities.

Asia Pacific

- Rapid urbanization in countries like China and India is driving the demand for smart cameras, with local companies such as Hikvision and Dahua Technology expanding their product offerings to meet the needs of smart city projects.

- Government initiatives aimed at enhancing public safety and security are leading to increased investments in smart camera infrastructure, particularly in urban areas.

Latin America

- In Latin America, urban safety initiatives are prompting local governments to invest in smart camera technologies, with countries like Brazil and Mexico leading the way in adopting these solutions.

- Partnerships between technology firms and local governments are emerging to enhance public safety, with companies like Intel and local startups collaborating on smart camera projects.

North America

- The integration of artificial intelligence (AI) in smart cameras is transforming the market, with companies like Ring and Nest leading the charge in developing advanced features such as facial recognition and motion detection.

- Regulatory changes, particularly in data privacy laws, are influencing how smart cameras are deployed in public and private spaces, with organizations like the Federal Trade Commission (FTC) emphasizing consumer protection and data security.

Middle East And Africa

- The rise of e-commerce in the Middle East is leading to increased demand for smart cameras in retail environments, with companies like Amazon investing in smart surveillance solutions for their fulfillment centers.

- Government programs aimed at improving public safety, such as the UAE's Smart City initiative, are driving the adoption of smart cameras in urban areas, enhancing security and surveillance capabilities.

Did You Know?

“As of 2023, it is estimated that over 70% of new security camera installations in urban areas are now smart cameras equipped with AI capabilities.” — Market Research Future

Segmental Market Size

The smart camera plays a crucial role in the smart camera market, which is experiencing strong growth due to the increasing demand for home security and automation. The smart home industry is growing, and the smart camera industry is growing with it. The main factors driving the growth are the popularization of smart home technology and the development of artificial intelligence, which can provide smarter surveillance solutions. In addition, the public security policy is also expected to promote the development of the smart camera industry. The current smart camera has entered the stage of mass production and commercialization, and the market penetration has reached a high level in North America and Europe. The main application fields are home security, traffic monitoring, and retail analysis. The macro trend of increased safety awareness due to the current public health crisis and the trend of sustainable development will further drive the market. The trend of smarter and smarter. Machine learning and cloud technology will continue to develop, and will play a more important role in the integration of smart devices.

Future Outlook

The smart camera market is set to grow from $6.3 billion in 2024 to $13.2 billion by 2032, at a robust CAGR of 10.0%. This growth will be driven by the increasing adoption of smart cameras across various industries such as security, retail, and automobile, as companies seek to enhance surveillance and data analytics. By 2032, smart cameras are expected to represent approximately 30% of the security camera market, up from the projected 16% penetration in 2024, indicating a strong shift towards intelligent surveillance solutions. Also, key technological advancements, such as the integration of artificial intelligence (AI) and machine learning (ML) capabilities, are set to drive the market growth. These technologies enable smart cameras to perform real-time analytics, facial recognition, and anomaly detection, thereby increasing their utility in both commercial and residential applications. Also, supportive government policies, such as those aimed at enhancing public safety and security, are expected to drive market growth. Furthermore, the rising popularity of the Internet of Things (IoT) and the increasing demand for cloud-based storage solutions will make smart cameras an integral part of modern security systems.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 4.6 billion |

| Growth Rate | 10% (2024-2030) |

Smart Cameras Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.