- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Smart Home Device Market Size Snapshot

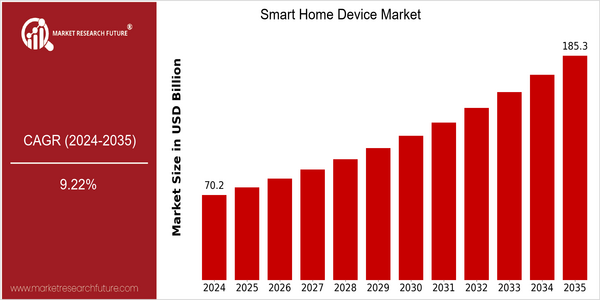

| Year | Value |

|---|---|

| 2024 | USD 70.25 Billion |

| 2035 | USD 185.3 Billion |

| CAGR (2025-2035) | 9.22 % |

Note – Market size depicts the revenue generated over the financial year

In 2024, the smart home market will be worth 70 billion dollars, and in 2035 it will be worth 185 billion dollars. This is a high CAGR of 9.22% between 2025 and 2035, showing a high demand for smart home technology. This is due to the widespread use of IoT devices, the development of artificial intelligence and machine learning, and the development of the Internet of Things. The convenience, energy saving and security that smart home devices bring through automation and interconnection are becoming more and more popular. Amazon, Google and Apple are the leading players in the smart home device market, and they are actively developing new products and forming strategic alliances to increase market share. Amazon's Alexa is constantly expanding its functions, and Nest is integrating smart home technology. The combination of smart home devices and smart home solutions has become a new trend. The cooperation between smart phone manufacturers and home appliance manufacturers has also led to the development of smart home solutions. The awareness and acceptance of smart home technology is increasing, and the market is expected to grow steadily in the future.

Regional Deep Dive

The Smart Home Devices Market is a worldwide industry which is growing rapidly due to technological developments, increased demand for convenience and energy-efficiency. In North America, the market is characterized by a high uptake of smart devices supported by strong digital infrastructure and a technically advanced population. In Europe, smart home devices are mainly used for energy-saving and green purposes. The Asia-Pacific region is becoming an important market due to rising incomes and urbanization. The Middle East and Africa is growing slowly, driven by the diversification of economies, and Latin America is also beginning to embrace smart home devices, but at a slower pace due to economic restrictions and differences in digital infrastructure.

North America

- The integration of smart home devices with voice assistants such as Amazon Alexa and Google Assistant has become a major trend, enhancing the user experience and driving sales.

- The new security solutions offered by Nest and Ring have set the pace, while major retailers like Best Buy are enhancing their smart-home product lines.

- Among the reasons why the market is expected to grow so strongly is the development of smart home products with greater energy efficiency.

Europe

- The European Union’s Green Deal is influencing the smart home market. By promoting energy-efficient products, the Green Deal is causing a rise in investment in smart technology.

- In the field of smart lighting and home automation, companies like Philips Hue and BOHEM are innovating. They focus on interoperability and easy to use.

- Culture and a strong emphasis on environmentalism and energy-saving solutions are driving consumers to smart home solutions.

Asia-Pacific

- In the cities of China and India, the rising wealth of the population and the fast urbanization are the main reasons for the demand for smart devices.

- There are already many big companies, such as Xiaomi and Huawei, which are launching smart home products at a lower price, which can be regarded as a smart home solution for everyone.

- In the Middle East, the development of smart cities is a major driver of smart home technology.

MEA

- The aspired to project of a smart home in the United Arab Emirats is the one of the project of Smart Dubai. It aims at enhancing the quality of life through the use of the most modern and most advanced technology.

- Local companies are beginning to develop smart-home solutions, with some companies, like Axiom Telecom, introducing smart-home products suited to local tastes.

- In Saudi Arabia, the drive to diversify the economy is leading to increased investment in technology, which will boost the smart home market.

Latin America

- Brazil’s smart home market is growing, and new companies are launching products that are both inexpensive and tailored to the local market.

- Increasingly difficult economic conditions have slowed the take-up of smart-home devices, but increasing Internet penetration is opening up new opportunities.

- The government’s programs to improve the digital infrastructure are expected to help the growth of smart home technology in the region.

Did You Know?

“In 2022, the percentage of smart home devices in U.S. households was estimated to be more than 50%, which demonstrates the rapidity with which these devices were being adopted.” — Statista

Segmental Market Size

The smart home devices market is characterised by its rapid growth, driven by an increase in the demand for convenience, security and energy efficiency. This growth is mainly due to the growing use of IoT technology, which allows seamless communication between devices, and a higher awareness of the benefits of home automation. Also, government regulations encouraging the use of smart home solutions are driving the market.

At present, the market is a mass market, with the likes of Amazon, Google and Apple leading the way with their respective smart-home platforms. In some countries, North America and Europe, there is a high rate of penetration, especially in urban areas. The most common applications are smart lighting, security and climate control. With the success of products such as the Philips Hue lightbulb and the Nest Thermostat, these have been well realised. The emergence of a trend towards remote monitoring and control, driven by the COVID-19 pandemic, has increased the need for remote monitoring and control. Recent advances in artificial intelligence and machine learning are enabling smart-home technology to develop, to improve the experience and functionality of the smart home.

Future Outlook

In 2024, the market for smart home devices is expected to grow from $70.25 billion to $185 billion at a CAGR of 9.22%. This growth will be driven by the growing demand for convenience, energy savings and enhanced security in the home. In developed countries, the penetration of smart home devices will be around 60% by 2035. The proliferation of the Internet of Things and the growing adoption of smart home platforms will also contribute to this growth.

A number of important technological developments, such as the improvement of artificial intelligence and the development of interoperability between devices, will play a major role in shaping the market. The integration of voice-controlled assistants and smart home hubs is expected to improve the user experience and make smart home technology more widely available. Meanwhile, government support for energy-saving technology and smart city initiatives will further drive growth. Also, the increasing popularity of do-it-yourself smart home solutions and the increasing awareness of the benefits of home automation will play a significant role in the market’s development over the next decade.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 89.28 Billion |

| Market Size Value In 2023 | USD 115.87 Billion |

| Growth Rate | 10.45% (2023-2030) |

Smart Home Device Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.