- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

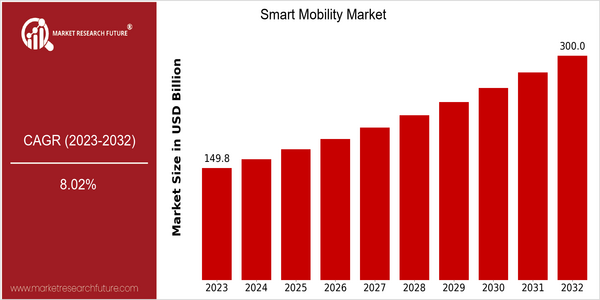

| Year | Value |

|---|---|

| 2023 | USD 149.76 Billion |

| 2032 | USD 300.0 Billion |

| CAGR (2024-2032) | 8.02 % |

Note – Market size depicts the revenue generated over the financial year

The Smart Mobility Market is currently valued at USD 149.76 billion in 2023 and is projected to reach USD 300.0 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 8.02% from 2024 to 2032. This growth trajectory indicates a significant shift towards more efficient, sustainable, and technologically advanced transportation solutions. The increasing urbanization, coupled with the rising demand for smart city initiatives, is propelling the adoption of smart mobility solutions across the globe. Several factors are driving this market expansion, including advancements in connected vehicle technology, the proliferation of electric vehicles (EVs), and the integration of artificial intelligence (AI) in transportation systems. These technological trends are enhancing the efficiency and safety of mobility solutions, thereby attracting investments from both public and private sectors. Key players in the market, such as Tesla, Uber, and Siemens, are actively engaging in strategic initiatives, including partnerships and product innovations, to capitalize on the growing demand for smart mobility solutions. For instance, Tesla's continuous advancements in autonomous driving technology and Uber's expansion into electric vehicle ride-sharing services exemplify the dynamic nature of this market.

Regional Market Size

Regional Deep Dive

The Smart Mobility Market is experiencing significant growth across various regions, driven by urbanization, technological advancements, and a shift towards sustainable transportation solutions. In North America, the market is characterized by a strong emphasis on innovation and infrastructure development, with cities increasingly adopting smart technologies to enhance mobility and reduce congestion. Europe is leading in regulatory frameworks that promote electric vehicles and shared mobility, while Asia-Pacific is witnessing rapid adoption of smart transportation solutions due to its large population and urban centers. The Middle East and Africa are focusing on integrating smart mobility solutions to address unique challenges in urban planning and transportation, while Latin America is exploring innovative public transport solutions to improve accessibility and efficiency.

Europe

- The European Union has implemented stringent regulations aimed at reducing carbon emissions from transportation, which has accelerated the adoption of electric vehicles and smart mobility solutions.

- Cities like Amsterdam and Copenhagen are leading the way in bike-sharing programs and integrated public transport systems, showcasing successful models of smart mobility.

Asia Pacific

- China is heavily investing in smart city initiatives, with companies like Didi Chuxing and Baidu developing advanced ride-hailing and autonomous vehicle technologies.

- Japan's focus on robotics and AI is driving innovations in smart mobility, particularly in urban areas where congestion is a significant issue.

Latin America

- Brazil is implementing smart public transport systems in cities like São Paulo, integrating real-time data to improve service efficiency and user experience.

- Innovative ride-sharing platforms are emerging in Latin America, addressing unique transportation challenges and providing affordable mobility solutions.

North America

- The U.S. government has launched initiatives like the Smart Cities Challenge, encouraging cities to develop innovative mobility solutions, which has led to increased investment in smart infrastructure.

- Companies like Uber and Lyft are expanding their services to include electric and autonomous vehicles, reflecting a shift towards sustainable and efficient transportation options.

Middle East And Africa

- The UAE is pioneering smart mobility with projects like the Dubai Autonomous Transportation Strategy, aiming to convert 25% of all transportation in Dubai to autonomous modes by 2030.

- African nations are increasingly adopting mobile payment solutions for public transport, enhancing accessibility and efficiency in urban mobility.

Did You Know?

“By 2030, it is estimated that over 60% of the world's population will live in urban areas, significantly increasing the demand for smart mobility solutions.” — United Nations Department of Economic and Social Affairs

Segmental Market Size

The Smart Mobility Market segment focuses on innovative transportation solutions that enhance urban mobility, and it is currently experiencing robust growth. Key drivers include increasing urbanization, which necessitates efficient transportation systems, and stringent regulatory policies aimed at reducing carbon emissions. Technological advancements, such as the rise of electric vehicles (EVs) and autonomous driving technologies, further fuel demand in this segment. Currently, the adoption stage varies by region, with cities like Amsterdam and San Francisco leading in the deployment of smart mobility solutions, including shared mobility services and integrated public transport systems. Primary applications include ride-sharing platforms like Uber and Lyft, electric scooter rentals, and smart traffic management systems. Macro trends such as sustainability initiatives and government mandates for cleaner transportation options are accelerating growth. Technologies like IoT, AI, and big data analytics are pivotal in shaping the evolution of smart mobility, enabling real-time data collection and enhancing user experience.

Future Outlook

The Smart Mobility Market is poised for significant growth from 2023 to 2032, with a projected market value increase from $149.76 billion to $300 billion, reflecting a robust compound annual growth rate (CAGR) of 8.02%. This growth trajectory is underpinned by the increasing urbanization and the rising demand for efficient transportation solutions. By 2032, it is anticipated that smart mobility solutions will penetrate approximately 60% of urban transportation systems, driven by the integration of advanced technologies such as artificial intelligence, Internet of Things (IoT), and 5G connectivity. These technologies will enhance real-time data analytics, enabling more efficient traffic management and improved user experiences. Key drivers of this market expansion include supportive government policies aimed at reducing carbon emissions and promoting sustainable transport options. Initiatives such as electric vehicle (EV) incentives, investments in public transportation infrastructure, and the development of smart city frameworks are expected to catalyze the adoption of smart mobility solutions. Additionally, emerging trends such as shared mobility services, autonomous vehicles, and integrated multimodal transport systems will further reshape the landscape, making transportation more accessible and efficient. As stakeholders across the public and private sectors collaborate to innovate and implement these solutions, the Smart Mobility Market is set to transform urban mobility, enhancing the quality of life for millions while addressing critical environmental challenges.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 44 Billion |

| Growth Rate | 20.1% (2023-2032)Base Year2022Market Forecast Period2023 - 2032Historical Data2018- 2022Market Forecast UnitsValue (USD Billion)Report CoverageRevenue Forecast, Market Competitive Landscape, Growth Factors, and TrendsSegments CoveredElement, Solution Type, TechnologyGeographies CoveredNorth America, Europe, Asia Pacific, and the Rest of the WorldCountries CoveredThe US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and BrazilKey Companies ProfiledCisco, Excelfore Corporation, Ford Motor Company, Innoviz Technologies. Inc., MAAS Global Oy, QuaLiX Information System, Robert Bosch GmbH, Siemens, TomTom International, and Toyota Motor CorporationKey Market OpportunitiesImproved performance of autonomous vehiclesKey Market DynamicsIncreasing trend of on-demand transportation services |

Smart Mobility Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.