Increasing Consumer Awareness

Increasing consumer awareness regarding the benefits of smart thermostats is significantly impacting the Global Smart Thermostat Market Industry. As more individuals become informed about the potential for energy savings and enhanced comfort, the demand for these devices continues to grow. Educational campaigns and marketing efforts by manufacturers are effectively communicating the advantages of smart thermostats, such as remote access and programmable settings. This heightened awareness is expected to contribute to the market's growth, with projections indicating a rise to 10 USD Billion by 2035. Consequently, manufacturers are likely to focus on developing user-friendly interfaces and features that cater to consumer preferences.

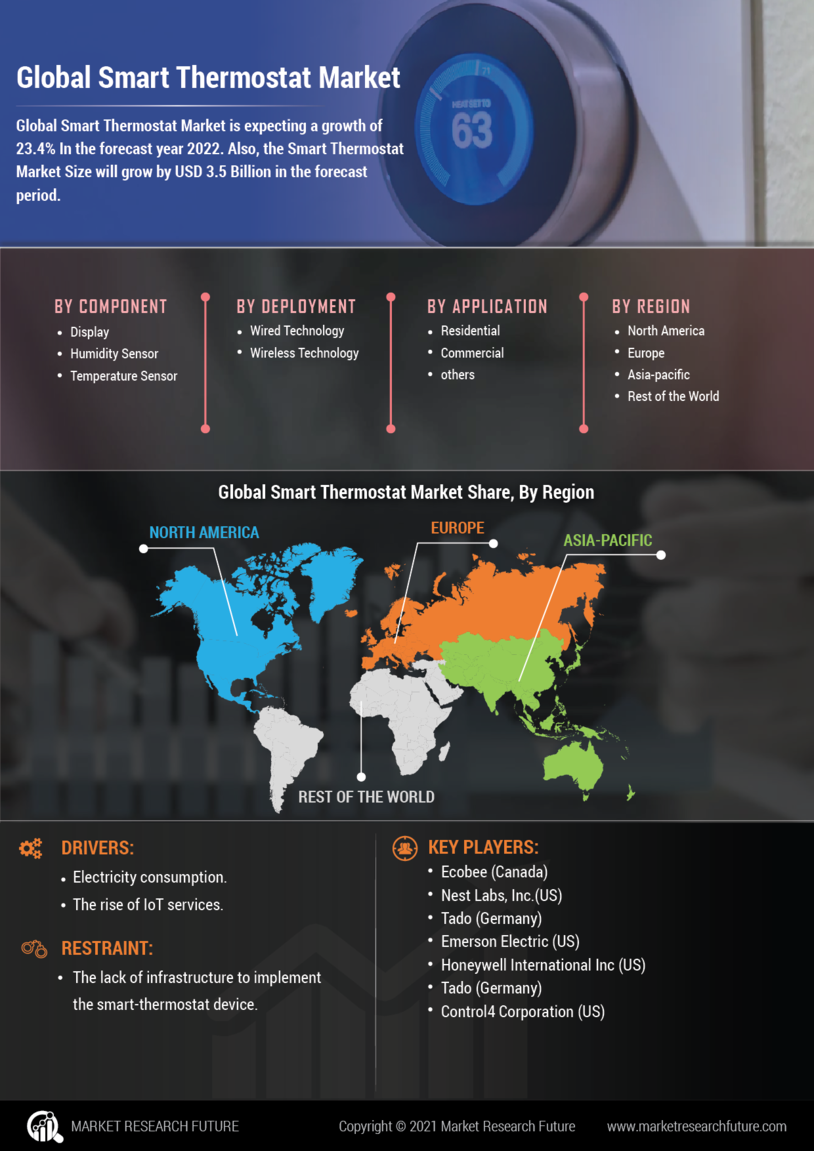

Technological Advancements in IoT

Technological advancements in the Internet of Things (IoT) are significantly influencing the Global Smart Thermostat Market Industry. The integration of IoT technology allows smart thermostats to connect seamlessly with other smart home devices, enhancing user experience and functionality. For instance, users can control their thermostats via smartphones or voice-activated assistants, making home automation more accessible. As the market evolves, innovations such as machine learning algorithms are being incorporated to optimize heating and cooling patterns based on user behavior. This trend is expected to propel the market towards a valuation of 10 USD Billion by 2035, indicating a robust growth trajectory.

Growing Demand for Energy Efficiency

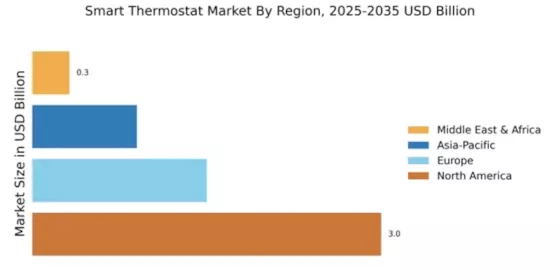

The Global Smart Thermostat Market Industry is experiencing a notable increase in demand for energy-efficient solutions. As consumers become more environmentally conscious, the adoption of smart thermostats is rising. These devices enable users to monitor and control their energy consumption remotely, leading to significant cost savings. In 2024, the market is projected to reach 3.31 USD Billion, reflecting a growing trend towards sustainable living. Governments worldwide are also promoting energy efficiency through incentives and regulations, further driving the adoption of smart thermostats. This shift not only benefits consumers but also contributes to broader environmental goals.

Government Initiatives and Incentives

Government initiatives aimed at promoting energy efficiency and reducing carbon footprints are playing a crucial role in the Global Smart Thermostat Market Industry. Various countries are implementing policies that encourage the adoption of smart technologies in residential and commercial buildings. For example, tax credits and rebates for energy-efficient appliances, including smart thermostats, are becoming increasingly common. These incentives not only lower the initial investment barrier for consumers but also raise awareness about the benefits of smart thermostats. As a result, the market is likely to witness a compound annual growth rate of 10.57% from 2025 to 2035, highlighting the impact of supportive government policies.

Rising Adoption of Smart Home Technologies

The rising adoption of smart home technologies is a key driver for the Global Smart Thermostat Market Industry. As households increasingly integrate smart devices for convenience and efficiency, smart thermostats are becoming essential components of modern homes. This trend is fueled by the growing availability of affordable smart home products and the desire for enhanced control over home environments. The market is projected to reach 3.31 USD Billion in 2024, reflecting this shift towards smart living. Furthermore, as consumers seek to create interconnected ecosystems within their homes, the demand for compatible smart thermostats is expected to surge, further propelling market growth.