- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

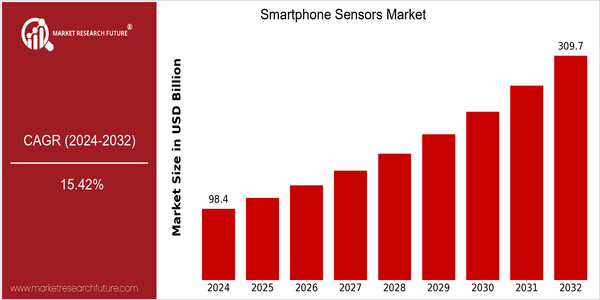

| Year | Value |

|---|---|

| 2024 | USD 98.36 Billion |

| 2032 | USD 309.7 Billion |

| CAGR (2024-2032) | 15.42 % |

Note – Market size depicts the revenue generated over the financial year

The global mobile phone sensors market is expected to grow at a CAGR of 20.6% from 2024 to 2032, reaching a market size of $ 98.36 billion by 2024. The CAGR of 15.42% will be achieved from 2032 to 2032. The main driving force is the integration of advanced sensors in smart phones, driven by the increasing demand for smart phones for augmented reality, health monitoring and camera functions. Besides, the development of miniaturization and new sensors will also drive the growth of the market. Lidar sensors, which are used to measure distance and depth, and biometric sensors, which are used to improve security, have become a common standard in high-end smart phones. These trends have led to a large number of companies, such as Apple, Samsung and Qualcomm, investing heavily in research and development, and forming strategic alliances to launch new products. The integration of advanced sensors into smart phones, such as the introduction of the latest motion sensors by Apple in the latest generation of iPhones, has driven the market growth.

Regional Market Size

Regional Deep Dive

The market for mobile phone sensors is growing fast in different regions, driven by the increasing penetration of smartphones, the development of new sensors and the growing demand for improved mobile phone experiences. Each region is characterized by its own characteristics influenced by local economic conditions, technological developments and regulations. In North America, for example, the market is characterized by high consumer spending and fast adoption of new technologies. In Asia-Pacific, on the other hand, the growth of the manufacturing industry and the growing middle class are driving the demand for smartphones with advanced sensors.

Europe

- European manufacturers are focusing on sustainability, with companies like Nokia and Bosch leading initiatives to develop eco-friendly sensors that reduce environmental impact, aligning with the EU's Green Deal.

- The European Union's stringent regulations on electronic waste and recycling are pushing smartphone manufacturers to innovate in sensor design, promoting longer product life cycles and easier recyclability.

Asia Pacific

- China's rapid advancements in semiconductor technology are enabling local companies like Huawei and Xiaomi to produce high-quality sensors at competitive prices, significantly impacting the global supply chain.

- The rise of 5G technology in countries like South Korea and Japan is driving demand for more sophisticated sensors that can support enhanced connectivity and new applications in smartphones.

Latin America

- Latin America is witnessing a growing trend towards mobile payment solutions, with companies like MercadoLibre leveraging smartphone sensors to enhance transaction security and user experience.

- Economic challenges in the region are prompting manufacturers to focus on cost-effective sensor solutions, leading to innovations that balance affordability with advanced features.

North America

- The integration of advanced sensors in smartphones is being propelled by major tech companies like Apple and Google, which are continuously innovating to enhance user experience through features like augmented reality and health monitoring.

- Regulatory changes in data privacy, particularly with the California Consumer Privacy Act (CCPA), are influencing how smartphone manufacturers design and implement sensor technologies, ensuring user data protection while maintaining functionality.

Middle East And Africa

- In the Middle East, the increasing adoption of smart technologies in urban development projects, such as Saudi Arabia's NEOM, is creating demand for advanced smartphone sensors that facilitate smart city applications.

- Government initiatives in Africa, such as the Digital Economy Strategy by the African Union, are promoting the use of smartphones and their sensors to enhance connectivity and access to information across the continent.

Did You Know?

“Did you know that the average smartphone contains over 10 different types of sensors, including accelerometers, gyroscopes, and ambient light sensors, which work together to enhance user experience?” — TechInsights

Segmental Market Size

The smartphone sensors market is a dynamic market that plays a crucial role in enhancing the experience and functionality of mobile devices. It is a growing market, driven by the growing demand for advanced features such as augmented reality (AR) and health monitoring capabilities. The integration of artificial intelligence (AI) and the Internet of Things (IoT) in mobile devices is also driving the demand for sensors. The market is currently in the mature phase of adoption, with leading players such as Apple and Samsung integrating advanced sensors into their devices. There are many applications for sensors in smartphones, such as motion sensors for gaming, ambient light sensors for smart homes, and biometric sensors for security. The growing trend towards energy efficiency and the emphasis on health and well-being is driving the demand for sensors that monitor physical activity and vital signs. The evolution of the sensors market is being driven by MEMS and advanced image sensors, which are enabling smaller and more efficient designs.

Future Outlook

The Smartphone Sensors Market is set to grow at a CAGR of 15.42% from 2024 to 2032, with the market size expected to grow from $98.36 billion to $309.7 billion. The main growth drivers of this market are the increasing integration of advanced sensors into smartphones, such as accelerometers, gyroscopes, and biometric sensors. The penetration of these sensors will be further increased by the increasing demand for smartphones with more advanced features, such as enhanced security, health monitoring, and augmented reality capabilities. By 2032, it is estimated that over 90% of smartphones will contain multiple sensors to meet the demands of users and the competition. The development of miniaturized sensors, as well as improvements in the accuracy and energy efficiency of these sensors, will also support market growth. Also, the growing trend of the Internet of Things and the smart home will create new opportunities for smartphone sensors, as users will increasingly rely on their phones to interact with other smart devices. Moreover, supportive government policies to promote the development of mobile technology and consumer electronics will enhance market dynamics, ensuring that the Smartphone Sensors Market remains at the forefront of technological evolution through 2032.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 70.9 Billion |

| Market Size Value In 2023 | USD 83.5 Billion |

| Growth Rate | 17.8% (2023-2032) |

Smartphone Sensors Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.