- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

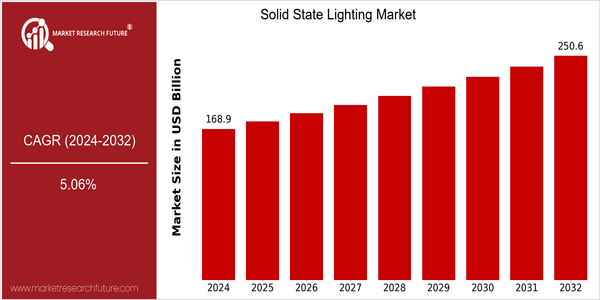

| Year | Value |

|---|---|

| 2024 | USD 168.9 Billion |

| 2032 | USD 250.64 Billion |

| CAGR (2024-2032) | 5.06 % |

Note – Market size depicts the revenue generated over the financial year

The global solid state lighting market is poised for significant growth, with a current market size of USD 168.9 billion in 2024, projected to reach USD 250.64 billion by 2032. This represents a compound annual growth rate (CAGR) of 5.06% over the forecast period. The steady increase in market size reflects a growing demand for energy-efficient lighting solutions, driven by rising energy costs and a global push towards sustainability. As consumers and businesses alike seek to reduce their carbon footprints, solid state lighting technologies, particularly LED lighting, have emerged as a preferred choice due to their longevity and lower energy consumption compared to traditional lighting options. Several factors are propelling this market growth, including advancements in LED technology, which have led to improved performance and reduced costs. Additionally, government initiatives promoting energy efficiency and the adoption of smart lighting systems are further stimulating market expansion. Key players in the industry, such as Philips Lighting, Osram, and Cree, are actively investing in research and development, forming strategic partnerships, and launching innovative products to capture a larger market share. For instance, Philips has been focusing on smart lighting solutions that integrate IoT technology, enhancing user experience and energy management. These strategic initiatives underscore the dynamic nature of the solid state lighting market and its potential for continued growth in the coming years.

Regional Market Size

Regional Deep Dive

The Solid State Lighting Market is experiencing significant growth across various regions, driven by advancements in technology, increasing energy efficiency demands, and supportive government policies. In North America, the market is characterized by a strong emphasis on sustainability and energy conservation, with a growing adoption of LED technology in both residential and commercial sectors. Europe is witnessing a rapid transition towards energy-efficient lighting solutions, spurred by stringent regulations and a commitment to reducing carbon emissions. The Asia-Pacific region is emerging as a manufacturing hub for solid-state lighting products, fueled by rising urbanization and infrastructure development. Meanwhile, the Middle East and Africa are gradually adopting solid-state lighting technologies, influenced by economic diversification efforts and a focus on sustainable development. Latin America is also beginning to embrace solid-state lighting, driven by urbanization and the need for energy-efficient solutions in growing cities.

Europe

- The European Union's Ecodesign Directive mandates that all lighting products meet specific energy efficiency standards, significantly boosting the adoption of solid-state lighting solutions.

- Companies such as Osram and Signify are leading the charge in developing smart lighting systems that integrate IoT technology, enhancing user experience and energy management.

Asia Pacific

- China is the largest producer of LED lighting products, with government support through initiatives like the 'Made in China 2025' plan, which aims to advance the country's manufacturing capabilities in solid-state lighting.

- Japan is focusing on innovative applications of solid-state lighting in urban infrastructure, with projects like the Tokyo Smart City initiative integrating advanced lighting solutions into public spaces.

Latin America

- Brazil is seeing a rise in solid-state lighting adoption due to government incentives aimed at reducing energy consumption in urban areas, particularly in public lighting projects.

- Mexico is investing in smart city initiatives that incorporate solid-state lighting, enhancing urban infrastructure and energy efficiency in metropolitan areas.

North America

- The U.S. Department of Energy has launched initiatives to promote the adoption of LED lighting, including the 'LED Lighting Facts' program, which provides consumers with reliable information on LED products.

- Major companies like Cree, Inc. and Philips Lighting are investing heavily in R&D to innovate new solid-state lighting technologies, enhancing energy efficiency and product lifespan.

Middle East And Africa

- The UAE has launched the 'Dubai Clean Energy Strategy 2050', which aims to increase the share of clean energy in the total energy mix, promoting the use of solid-state lighting in public and private sectors.

- South Africa is implementing the 'Integrated Resource Plan', which includes provisions for energy-efficient lighting solutions to address the country's energy crisis.

Did You Know?

“Solid-state lighting technology, particularly LEDs, can last up to 25 times longer than traditional incandescent bulbs, significantly reducing waste and energy consumption.” — U.S. Department of Energy

Segmental Market Size

The Solid State Lighting (SSL) segment plays a pivotal role in the overall lighting market, currently experiencing robust growth driven by increasing energy efficiency demands and sustainability initiatives. Key factors propelling this segment include the global shift towards energy-efficient solutions, spurred by regulatory policies such as the Energy Independence and Security Act in the U.S., and advancements in LED technology that enhance performance and reduce costs. Regions like North America and Europe lead in adoption, with companies such as Philips and Cree implementing large-scale SSL projects in commercial and residential sectors. Primary applications of SSL include general illumination in residential, commercial, and industrial settings, as well as specialized uses in horticulture and automotive lighting. Notable examples include the deployment of LED street lighting in cities like Los Angeles, which significantly reduces energy consumption. Current trends such as smart city initiatives and the push for carbon neutrality further accelerate SSL adoption, while technologies like IoT-enabled lighting systems and advanced thermal management methods shape the segment's evolution, ensuring enhanced functionality and user experience.

Future Outlook

The Solid State Lighting (SSL) market is poised for significant growth from 2024 to 2032, with a projected market value increase from $168.9 billion to $250.64 billion, reflecting a compound annual growth rate (CAGR) of 5.06%. This growth trajectory is underpinned by the increasing adoption of energy-efficient lighting solutions across various sectors, including residential, commercial, and industrial applications. As governments worldwide continue to implement stringent energy efficiency regulations and sustainability initiatives, the demand for SSL technologies is expected to rise sharply, with penetration rates potentially reaching over 70% in new construction projects by 2032. Key technological advancements, such as the integration of smart lighting systems and the development of more efficient LED technologies, will further drive market expansion. The emergence of Internet of Things (IoT) capabilities in lighting solutions is expected to enhance user experience and operational efficiency, making SSL an attractive option for both consumers and businesses. Additionally, the growing trend towards smart cities and urbanization will create new opportunities for SSL applications, particularly in outdoor and public lighting. As the market evolves, stakeholders must remain agile to capitalize on these trends and leverage innovations that align with consumer preferences and regulatory frameworks.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 150.9 Billion |

| Market Size Value In 2023 | USD 159.65 Billion |

| Growth Rate | 5.8% (2023-2032) |

Solid State Lighting Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.